Reviewing and Maintaining IR8A and IR8S Forms

This topic discusses how to review and maintain IR8A and IR8S forms.

Note: The system sets the issue status on each of the pages in the component to awaiting (issue to the employee) when it first creates the record. When you print the IR8A, the system changes the status to issued (to the employee). The status should be awaiting whenever you want to print or reprint an Appendix 8A, IR8A/IR8S or IR21 form. If you already issued one of the forms, you need to change the status back to awaiting to reprint it, or you can select the Reprint Forms check box to reprint those that you already issued.

Online maintenance of all user-maintainable fields in this component is only possible for the awaiting status. You cannot maintain a form that you already issued to an employee. However, since you can change the status field from issued to awaiting, you can decide to enable changes to an issued form and then reissue it.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_IR8A_DTLS |

Review an employee's personal details and change the issue status after running the IR8A/IR8S Form creation process. |

|

|

GPSG_IR8A_INCOME |

Review an employee's income details after running the IR8A/IR8S Form creation process. |

|

|

IR8A Gratuity/Comp Details Page |

GPSG_IR8A_GRATDESC |

Enter an employee's gratuity and compensation details when gratuity or compensation is declared, including the circumstances leading to the payment, and the basis of arriving at the figure and whether it is contractual. |

|

Payment for loss at Office Page |

GPSG_PAYMT_DTL_SEC |

Enter any payment for loss at office details when there is any payment for loss at office declared including the circumstances leading to the payment, and the basis of arriving at the figure. |

|

Other's Information Page |

GPSG_OTH_DTL_SEC |

View the reason and basis details for other payments made to an employee. |

|

IR8A Share Option details Page |

GPSG_IR8A_SHR_DESC |

Enter an employee's share option details when gain or profit from share options is declared, including the date of the exercise, assignment or release of the option, number of shares or stocks, name of company, open market value of the shares or stocks at the time of the exercise, assignment or release of the option and the amount that is paid by the employee that is concerned for such shares or stocks under the share option. |

|

GPSG_IR8A_DEDNS |

Review an employee's fund deduction details after running the IR8A/IR8S Form creation process. |

|

|

GPSG_IR8S_DTLS |

Use this page for employees who qualify for IR8S forms. Review and maintain the employee's and employer's monthly contribution details after running the IR8A/IR8S Form creation process. All fields on this page can be maintained. |

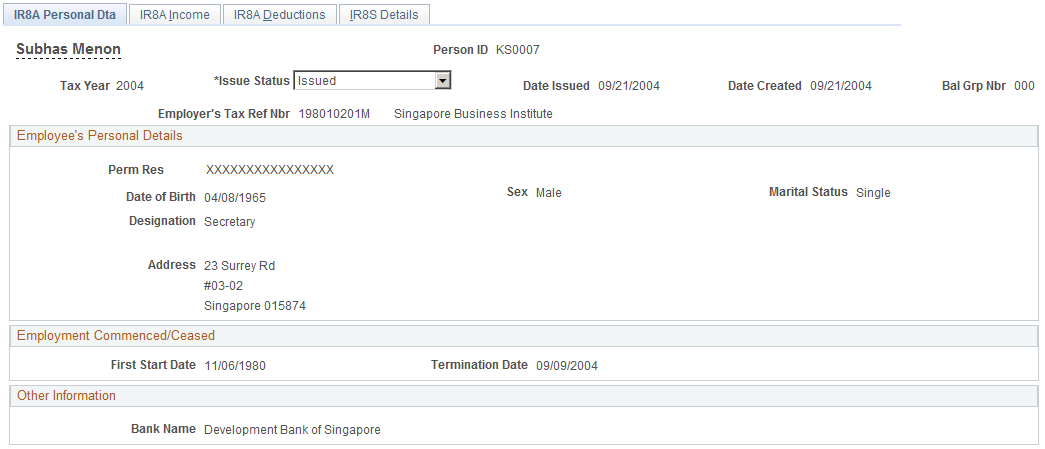

Use the IR8A Personal Dta (IR8A personal data) page (GPSG_IR8A_DTLS) to review an employee's personal details and change the issue status after running the IR8A/IR8S Form creation process.

Navigation:

This example illustrates the fields and controls on the IR8A Personal Dta page.

All fields on this page are display-only, except the Issue Status field, which you can maintain. The details populate from the employee's personal data and job data records. Two job designations may appear in theDesignation field. This caters to the employee with two concurrent jobs. If the employee has more than two concurrent jobs, only the job designations of the two earliest employee record numbers will appear.

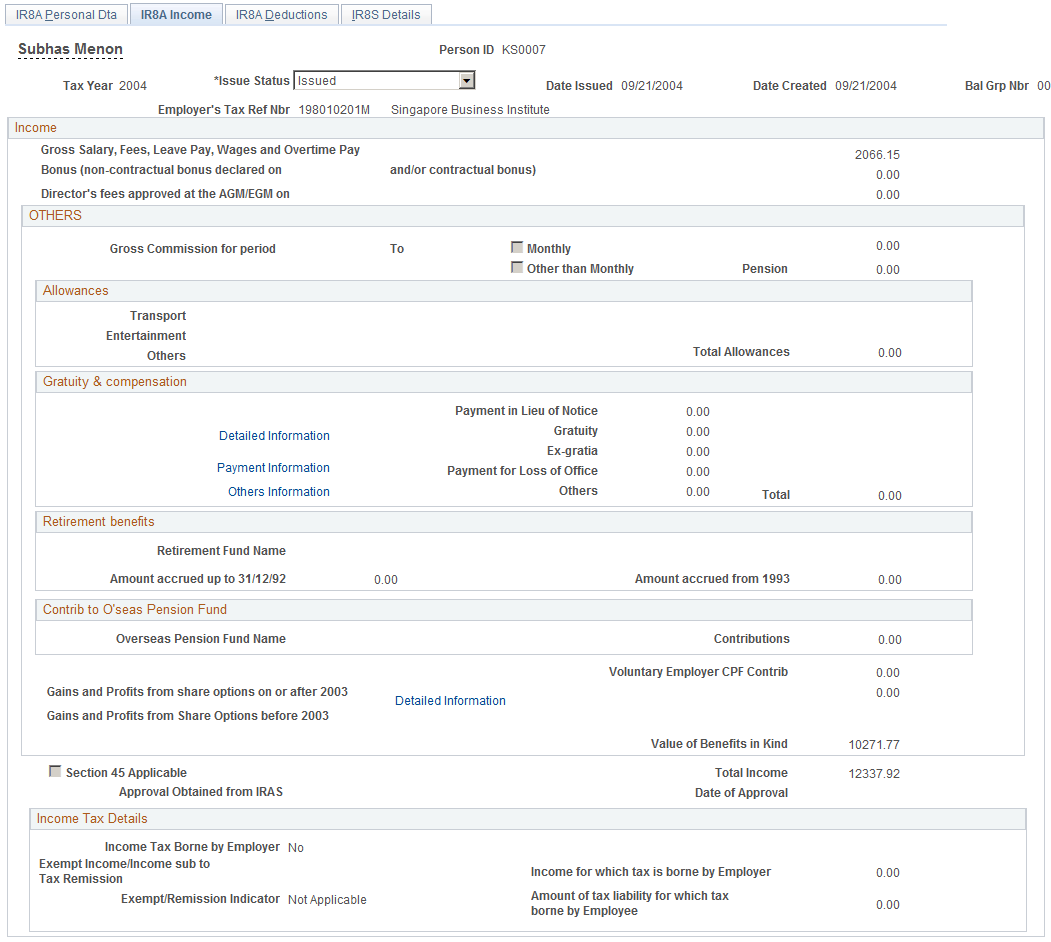

Use the IR8A Income page (GPSG_IR8A_INCOME) to review an employee's income details after running the IR8A/IR8S Form creation process.

Navigation:

This example illustrates the fields and controls on the IR8A Income page.

Income

Field or Control |

Description |

|---|---|

Gross Salary, Fees, Leave Pay, Wages and Overtime Pay |

Displays all earnings elements identified as gross salary, fees, wages, overtime pay, and leave pay. It includes values from accumulators for categories IR8A gross salary and wages and IR8A leave pay. |

Bonus (non-contractual bonus declared on and/or contractual bonus) |

The system tracks two kinds of bonuses: contractual and non-contractual. If the employee has one contractual bonus only and no non-contractual bonuses, the system populates the contractual bonus field. If the employee has one non-contractual bonus only and no contractual bonuses, the system populates the non-contractual bonus field. It includes values from accumulators for categories IR8A contractual bonus and IR8A non-contractual bonus. Enter the date on which the non-contractual bonus is declared payable. Contractual bonuses are due and payable under the terms of a contract of service and are regarded as the employee's income in the year that the contract specifies. This is usually the year in which the employee's services are rendered. For example, you should declare a contractual bonus paid in 2007 for the services rendered in 2006, for the year ending December 31, 2006. Non-Contractual bonuses are due and payable at the discretion of the employer and are regarded as the employee's income on the date that the employer decides the bonuses are payable. |

Director's fees approved at the AGM/EGM on |

Enter the date on which the payment of director's fees is approved. Director's fees are regarded as paid to the director on the date on which the fees are voted for and approved at a company's annual general meeting of that calendar year. Director's fees do not require a CPF contribution. It includes values from accumulators for category IR8A director's fees. |

Others

Field or Control |

Description |

|---|---|

Gross Commission for period andTo |

The commission year-to-date field includes the values from accumulators for category IR8A commission. Enter the commission from and to dates for the period. Select the Monthly check box if the employee receives the commission on a monthly basis. If the employee receives the commission in one lump sum, select theOne Time Payment check box. |

Pension |

Enter the total amount of pension that the employee accrued. It includes values from accumulators for category IR8A Pension Benefits. |

Income Tax Borne by Employer |

Tax paid by the employer on behalf of the employee is a benefit attached to an employment. It could either be in the form of allowance or payment. |

Total Income |

The amount that appears is the total of the individual earnings year-to-date values on this page. It is updated if you change the value of any contributing field. |

Allowances

The fields in this group box include values from accumulators for categories IR8A Transport Allowance, IR8A Entertainment Allowance and IR8A Other Allowance.

Gratuity & compensation

Field or Control |

Description |

|---|---|

Payment in Lieu of Notice |

This field includes any payments that an employee receives as compensation for not working the required employment (notice) period following resignation or termination. When employees are dismissed, it is not uncommon for employers to pay them lump sums in lieu of notice rather than require them to work out their statutory or contractual notice periods. It includes values from accumulators for category IR8A pay in lieu of notice. |

Gratuity and Detailed Information |

Displays gratuity or compensation, including retrenchment benefits. It includes all earnings elements that are identified as gratuity or compensation. It includes values from accumulators for category IR8A gratuity/ex-gratia. Click the Detailed Information link to access the IR8A Gratuity/Comp details page, where you can enter an employee's detailed information on gratuity or ex-gratia compensation payments. You must declare the full amount of gratuity or compensation that the employee receives. This page enables you to provide a separate breakdown of the details relating to the gratuity or compensation. |

Ex-gratia |

Displays ex-gratia payments. |

Payment for Loss of Office andPayment Information |

Enter any payment for loss of office details when there is any payment for loss at office declared, including the circumstances leading to the payment, and the basis of arriving at the figure. The Basis andReason fields are editable and can be entered with comments only if theIssue Status field in the page is set to Awaiting. Click the Payment Information link to access the Payment for loss at Office page, where you can view the reason and basis of payment. |

Others and Others Information |

Enter any lump sum payment details when there is any payments that are not paid by payroll and need to be manually entered. For example, if the staff has the following: Long Service Award = $300, No Sick Leave Incentive = $150 and Compensation for loss of share = $200, then Others would be $650. Reason for payment in this case would be: Long Service Award, No Sick leave incentive, Compensation for loss of share. Basis of arriving at the payment would be: As per policy. The Basis and Reason fields are editable and can be entered with comments only if theIssue Status field in the page is set to Awaiting. Click the Others Information link to access the Other's Information page, where you can view the reason and basis of payment. |

Retirement benefits

Enter the total amount of retirement benefits accrued by the employee, including gratuities, pension, commutation of pension, lump sum payments from a pension, provident fund in the Amount accrued from 1993 field. It is populated from the accumulators for category IR8A retirement benefits. Enter the full name of the retirement fund and the amount accrued up to December 31, 1992.

Contrib to O'seas Pension Fund (contribution to overseas pension fund)

Field or Control |

Description |

|---|---|

Overseas Pension Fund Name and Contributions |

Enter the full amount of the employer's paid contributions to any pension or provident fund located outside Singapore. Such contributions by the employer are taxable as part of the employee's income. Enter the overseas pension fund name. |

Voluntary Employer CPF Contrib |

Displays employer contributions for all compulsory CPF on ordinary earnings, or CA (voluntary CPF). It includes the values from the accumulators for category IR8A employer voluntary CPF. |

Gains and Profits from share options on or after 2003 and Gains and Profits from Share Options before 2003 |

Enter the total value of gains and profits that is derived by the employee, either directly or indirectly from the exercise, assignment, or release of any share options right or benefit where such right or benefit is obtained through employment. It includes the values from the accumulators for category IR8A gain on share options. To enter separate required detailed information relating to gains and profits from share options, use the IR8A Share Option Details page by clicking the Detailed Information link. |

Detailed Information |

Access the IR8A Share Option details page where you can declare the total value of gains or profits that is derived by the employee, either directly or indirectly from the exercise, assignment, or release of any share option right or benefit through employment. This page enables you to provide a separate breakdown of the details relating to the gains or profit from share options. |

Value of Benefits in Kind |

Displays the total value of benefits in kind that the employee receives. The field populates only when you run the Print Appendix 8A process. The value populates from the Appendix 8A tables. |

Income Tax Details

Field or Control |

Description |

|---|---|

*Income Tax Borne by Employer |

Indicate the income tax that paid by the employer. |

Field or Control |

Description |

|---|---|

Exempt Income/Income sub to tax remission |

Indicate income that is exempt or subject to tax. |

Field or Control |

Description |

|---|---|

Income for which tax is borne by Employer |

Indicate the income tax that paid by the employer. |

Exempt/Remission Indicator |

Indicate . . . |

Field or Control |

Description |

|---|---|

Amount of tax liability for which tax borne by Employee |

Indicate . . . |

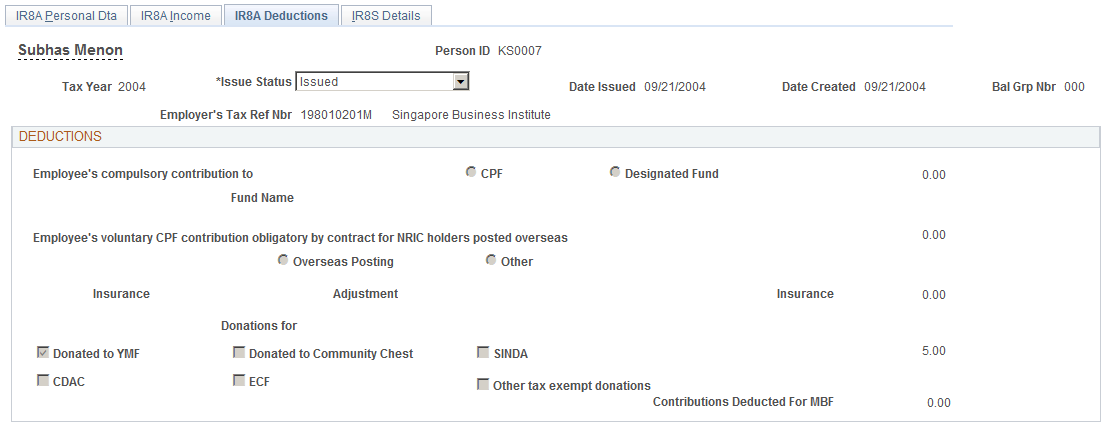

Use the IR8A Deductions page (GPSG_IR8A_DEDNS) to review an employee's fund deduction details after running the IR8A/IR8S Form creation process.

Navigation:

This example illustrates the fields and controls on the IR8A Deductions page.

Deductions

Field or Control |

Description |

|---|---|

Employee's compulsory contribution to and Fund Name |

Select the CPF option if the employee has CPF contributions, and the Fund Name field displays C.P.F. When the employee has no CPF contribution, theDesignated Fund option is available for selection. The year-to-date employee's compulsory CPF contributions (not labeled) include year-to-date contributions for compulsory CPF on ordinary earnings and compulsory CPF on additional earnings, where in either case the deduction is compulsory employee contribution. It includes the values from the accumulators for the category IR8A employee statutory CPF. |

Employee's voluntary CPF contribution obligatory by contract for NRIC holders posted overseas |

This total includes year-to-date contributions of all voluntary CPF (employee voluntary contributions) that are obligatory by contract of employment in respect of NRIC holders who are posted overseas. It includes the values from the accumulators for the category IR8A employee voluntary CPF when the employee has a value of Y set for the variable IRS VR OVERSEAS on the Payee Supporting Elements record (GP_PAYEE_SOVR). |

Insurance and Adjustment |

The insurance amount appears by default from the IR8A insurance category and its elements that you set up on the IRAS Tax Forms SGP Page for the IR8A/IR8S Form. To manually update the value, enter the additional amount in the Adjustment field. The total insurance amount automatically adds the new amount and is updated. |

Donations For Donated to YMF, Donated to Community Chest, SINDA, CDAC, ECF, and Other tax exempt donations |

The total donations that are deducted through salaries includes year-to-date deductions for all of the following deduction elements; MBMF, SINDA, SHARE (also known as Community Chest), CDAC and ECF. If the check box is selected for these deductions, this indicates that deductions were taken during the year. It includes the values from the accumulators for the categories IR8A MBMF, IR8A Community Chest donations, IR8A SINDA, IR8A CDAC, IR8A ECF and IR8A other tax exempt donation. |

Contributions Deducted for MBF |

The total donations that are deducted for MBF. |

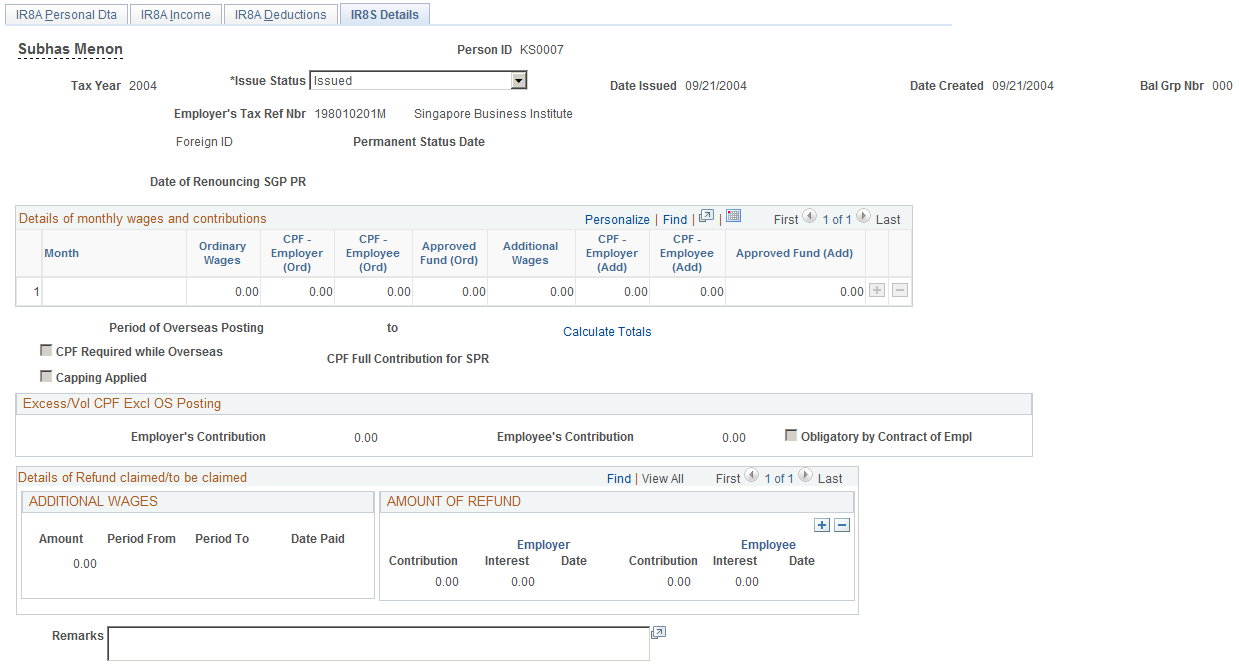

Use the IR8S Details page (GPSG_IR8S_DTLS) to use this page for employees who qualify for IR8S forms.

Review and maintain the employee's and employer's monthly contribution details after running the IR8A/IR8S Form creation process. All fields on this page can be maintained.

Navigation:

This example illustrates the fields and controls on the IR8S Details page.

Details of monthly wages and contributions

Field or Control |

Description |

|---|---|

Month |

The month in which both the employer and employee contributions for both ordinary wages and additional wages (when applicable) were made. Enter a new row for each month that is applicable. |

Ordinary Wages and Additional Wages |

Enter the amount of earnings according to the special accumulator that is defined for the employee's CPF schedule. Ordinary wages are normal wages including allowances that the employee earns in the month, and payable before the due date for payment of contributions for that month (for example, annual bonus, leave pay, commissions and incentive payments). Additional wages are wage supplements that are not paid wholly and exclusively for the month and includes any payment other than ordinary wages (for example, annual bonus, leave pay). |

CPF - Employer (Ord) (ordinary) and CPF -Employee (Ord) (ordinary) |

Includes all of the MTD contributions for all compulsory CPF on ordinary earnings or voluntary CPF where the deduction indicates that it is an employer or employee contribution. |

Approved Fund (Ord) (ordinary) andApproved Fund (Add) |

Includes all of the MTD contributions for all compulsory CPF on ordinary earnings or voluntary CPF where the deduction indicates that it is an employer or employee contribution. |

CPF - Employer (Add) and CPF - Employee (Add) |

Includes all of the MTD contributions for all compulsory CPF on additional earnings where the deduction indicates that it is an employer or employee contribution. |

Period of Overseas Posting and to |

These are specific to the IR8S form and indicate the start and end dates of an overseas posting respectively. |

Calculate Totals |

Click to display the total of all of the amounts for each of the fields in the Details of Monthly Wages group box. |

CPF Required while Overseas |

Select the check box to indicate if contributions are obligatory during a period of overseas posting according to the employment contract. This is specific to the IR8S form. |

Capping Applied |

Select the check box to indicate whether capping is applied. Y (yes) indicates that statutory upper limits to CPF contributions on ordinary and additional earnings are applied, N (no) indicates that upper limits are not applied. If no, it is possible that CPF contributions that were made for the employee are too high (make a refund claim). This is specific to the IR8S form. |

CPF Full Contribution for SPR (Singapore permanent resident) |

Select the check box to indicate whether an employee who has attained the status of Singapore Permanent Resident (SPR) is eligible for CPF full contribution. Singapore Permanent Residents contribute at reduced rates in the first 2 years of obtaining the SPR status. Thereafter, they contribute at the full rates. Y (yes) indicates that the employee is eligible for CPF Full Contribution, N (no) indicates that the employee has not attained. |

Excess/Vol CPF Excl OS Posting

Field or Control |

Description |

|---|---|

Employer's Contribution andEmployee's Contribution |

You must complete these fields if you and your employee's CPF contribution on ordinary wages or additional wages are more than the compulsory amount that is required under the CPF Act. The excess amount of the CPF contribution must be declared. The field amount appears by default from the category IR8A employer voluntary CPF and IR8A employee voluntary CPF when the employee has no variable IRS VR OVERSEAS set on the Payee Supporting Elements record (GP_PAYEE_SOVR). |

Obligatory by Contract of Empl |

Select this check box if Voluntary CPF contributions are obligatory according to the employment contract. By default the field is blank. |

Details of Refund claimed/to be claimed

You must complete this group box if you or your employee paid excess contribution to CPF and you or your employee claimed or will claim a refund of the excess contributions from the CPF Board. You must enter all details of the refund.

Additional Wages and Amount of Refund

Field or Control |

Description |

|---|---|

Amount, Period From, Period To, Date Paid, (Employer and Employee) Contribution, and Interest Date |

The system calculates additional wages contributions during normal, monthly payroll calculations. However, the correct total annual contribution is dependent on annual earnings, so it must be reconciled at year end. During the calculation of the last pay of the year in December, the system runs a year-end adjustment calculation that recalculates all contributions that are made on additional wages. Any shortfall or excess in contributions is identified. An adjustment is necessary when the employee's annual ordinary wages in the current calendar year differ from those that are in the previous calendar year. The adjustment is in the form of either a refund that can be claimed by using Section C of IR8S or an additional contribution payment to the board. Complete the page by entering the details of the additional wages, against which the refund is claimed or to be claimed, and the details of the refund itself. Note: Adjustments are only required if there are sufficient additional wages to be over the limit. If an additional contribution is required, it is automatically taken from the employee's December pay. If a refund is due, a message is created from the December pay, and the employee can claim the refund here. |

Remarks |

Enter any additional remarks regarding the information that is required on the IR8A/IR8S form. Remarks can include further explanations, details, or clarification that is relevant to the submission of the IR8A/IR8S forms. If the Singapore permanent resident status is approved on or after January 01, 2003, indicate in the Remarks field if approval is obtained from the CPF Board to make full contributions. Note: You should enter additional details relating specifically to gratuity and compensation or gains and profit from share options on the IR8A Gratuity and Comp Details and IR8A Share Option Details pages. |