Setting Up and Managing Employee and Employer CPF Details

Use the Employer CPF Reference SGP (GPSG_EMPLR_CPF_REF) component to set up and manage employee and employer CPF details.

Before you can administer contributions for employees or report for CPF or any of the other collections it is necessary to determine and record some unique identifiers for the employer and employee.

This topic discusses how to set up and manage employee and employer CPF details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_EMPLR_CPF_REF |

Maintain employer CPF reference numbers. |

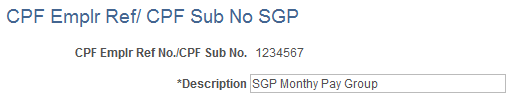

Use the CPF Emplr Ref/ CPF Sub No SGP page (GPSG_EMPLR_CPF_REF) to maintain employer CPF reference numbers.

Navigation:

This example illustrates the CPF Emplr Ref/ CPF Sub No SGP page.

Field or Control |

Description |

|---|---|

CPF Employer Ref Num (central provident fund employer reference number) |

The employer's CPF reference number is a unique ID assigned to each employer by the CPF Board. Reporting to the CPF Board is always processed separately for each employer reference number. So it is important for all the amounts and balances related to CPF to be kept separately for each one. The employer's CPF reference number is therefore recorded in the variable CPF VR EMPLR REF which is used as a user key on all CPF related accumulators. You enter the number on the Singapore Pay Groups SGP. An array is used to load it into the variable. |

To add some more flexibility to the way pay entities are structured, you can define the employer data either at the pay group level, or at a higher level. We also allow for the situation where a single CPF employer is implemented in Global Payroll as a number of pay entities.

The employers sector is also recorded using a Global Payroll variable. The variable CPF VR SECTOR stores the sector which is used to determine the set of CPF rates applicable for an employee. You can override the sector variable at pay entity, pay group or payee level.

You can enter the following values:

1 — Civil Service – Pensionable.

2 — Civil Service – Other.

3 — Private Sector – (the default value).

The variable CPF VR UNIT NUM stores the 3-digit unit number used in reporting to the CPF Board by the MOF/MID. It is not used by other customers. You can override it at pay entity, pay group or payee level.

Two views and arrays are delivered to bring all of the CPF information required for processing—including the citizenship status, worker type, permanent residence date, age, ethnic group and religion—using the arrays to make it available to the Global Payroll CPF rules.

The GPSG_CPF_PERS_VW view enables the employee (personal) data to be extracted from several different tables using a single array — CPF AR PERS DATA. The array is included at the beginning of the DEDUCTIONS – CPF (CPF section) so that the values retrieved are available to all the deductions and related supporting elements. The array is keyed by employee. Only one row is ever retrieved, and an error formula is included to provide a message if no record is found.

A national ID type is delivered to hold the employee's CPF account number (in addition to the national ID types of NRIC and permanent residency (PR) number. When reporting employees CPF accounts, the CPF account number national ID is used, if it exists. If not, it uses the NRIC and if that doesn't exist either, the permanent residency number.

The GPSG_CPF_ETH_VW view enables the employee's ethnic group and religion data to be extracted from several different tables using a single array—CPF AR ETHN/RELIG. The array retrieves the payee's ethnic group and religion to determine if they must contribute to CDAC, MBMF, ECF and SINDA and is included at the beginning of the DEDUCTIONS – CPF (CPF section) so that the values retrieved are available to all the deductions and related supporting elements. The array is keyed by employee.

Note: Ethnic group and religion are loaded using a separate array—CPF AR ETHN/RELIG—as they are not necessarily needed for foreign workers.

The GPSG_CPF_PERS_VW view extracts the following fields:

|

Field |

Variable |

Attribute |

|---|---|---|

|

CITIZENSHIP_STATUS |

CPF VR CITIZENSHIP |

Employee's citizenship status from CITIZENSHIP table. Selected only where DEPENDENT_ID is blank (the employees record), and COUNTRY = 'SGP'. |

|

WORKER TYPE_SGP |

CPF VR WORKER TYPE |

Employee's worker type from the same CITIZENSHIP record as Citizenship Status. |

|

PERM_STATUS_DT_SGP |

CPF VR PERM DATE |

Employee's permanent status date — also from the same CITIZENSHIP record as Citizenship Status. |

The GPSG_CPF_ETH_VW view extracts the following fields:

|

Field |

Variable |

Attribute |

|---|---|---|

|

RELIGION_CD |

CPF VR RELIGION |

Employee's religion from DIVERS_RELIGION table. |

|

ETHNIC_CATEGORY |

CPF VR ETHNIC |

Ethnic Group Code from the DIVERS_ETHNIC table. Ethnic Category from ETHNIC_GRP_TBL table. |

The values for the religion and citizenship status fields are controlled by setup tables.

The employee type is stored in variable CPF VR EMPL TYPE. This is the employee type that is used in reporting to the CPF Board by the MOF/MID. You can override it at pay entity, pay group or payee level. The default value is blank.

Override values are:

'P' - pensionable.

'A' - bonus payment.

'N' - non-pens.

'C' - contract svcmen.

'S' - saver's plan.