Understanding IRAS Reporting

IRAS reporting enables you to capture, generate, and maintain both employee and company identification and biographical data that support the reporting requirements of IRAS. The system meets the IRAS requirement to produce the IR8A, IR8S, Appendix 8A and 8B, IR21, and Appendix 1 forms, which are required for reporting annual payments, benefits, gains or profits from share options, and foreign employees who are terminating their employment.

For IR8A/IR8S and Appendix 8A reporting, the system extracts most of the data from payroll (for Appendix 8B reporting, you enter the details manually). System pages then enable you to review, maintain and enter additional data, and print the forms for distribution to employees in the required format. You can also produce files in the format that IRAS requires, for electronic reporting of employees' payments and benefits, and processes enable you to create the electronic files in the format that the CPF/IRAS Line system requires.

Corporations in Singapore have the option to choose an Auto Inclusion Scheme for reporting employment income to IRAS, a scheme where employers transmit details of employees' employment income to IRAS electronically. Salary, bonus, tax-deductible donations, and CPF contribution information is automatically included in the employees' income tax assessment. The employee does not need to declare or claim the income when filing their income tax returns.

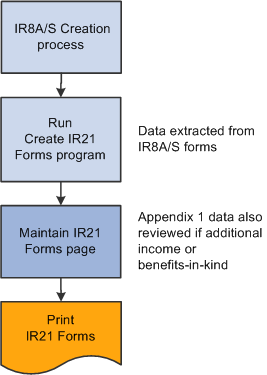

For IR21 and Appendix 1 forms, a process enables you to extract the data from the IR8A/IR8S forms. You can then enter additional data and print the forms in the required IRAS format.

This topic discusses:

Tax reference tracking.

IR8A/IR8S and Appendix 8A and 8B processing management.

IRAS reporting is controlled by the company (tax) reference number. Each pay group is assigned a company tax reference code, which is independent of the company or pay entity. This provides more flexibility in the way that you set up pay entities. Company tax details, such as name and contacts, are stored against the tax reference number.

The array IRS AR TAX REF is included in the initialization section of the Singapore payroll process list to load the value of the company tax reference (GPSG_CPY_TAX_REF) from the pay group extension record into variable IRS VR TAX REF.

The tax reference number and balance group number are included as user keys on all year-to-date accumulators that are used in IRAS reporting. The balance group number enables you to maintain separate balances for separate periods of employment for employees with multiple jobs, or for those that transfer from one company to another. The year-to-date accumulators that PeopleSoft provides with all delivered earnings and deduction elements have the variables IRS VR TAX REF and IRS VR BAL GRP included as user keys 1 and 2. You should also do this for any new elements that you create.

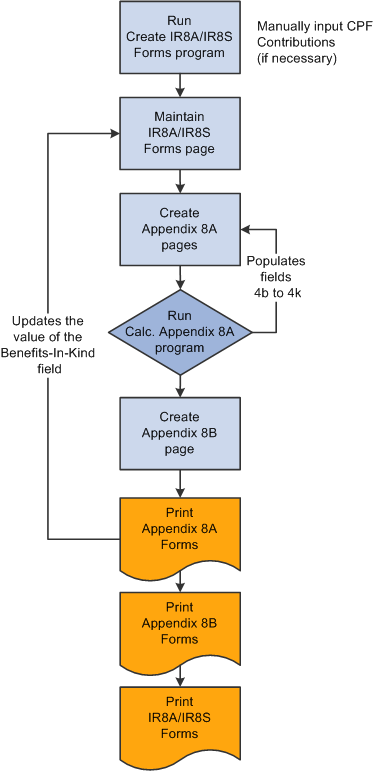

To populate all of the available details that are required for the IR8A/IR8S and Appendix 8A and 8B forms, you must follow the correct processing sequence:

Run the Create IR8A/IR8S Tax Forms process using the Create IR8A/IR8S Form page to create the IR8A and IR8S data from the available payroll data.

This process calculates and generates amounts for the different entities of the IR8A and IR8S forms and stores them in the IR8A/IR8S form tables.

Update additional data by using the IR8A/IR8S Forms component.

You can review, maintain and add information that is not retrieved from the payroll system.

Create Appendix 8A pages by using the Appendix 8A Forms SGP page.

You must provide the Appendix 8A with the IR8A form when an employee receives benefits in kind. Manually add details by using the Appendix 8A Details page before entering any benefit in kind details. Although you fill in most of the data on the form manually, some of the benefits can be extracted from the payroll system. To create an Appendix 8A form, you must first create the Appendix 8A record by using the Appendix 8A pages.

Alternatively, you can create the Appendix 8A record by selecting the Create records check box in the Calculate Appendix 8A run control page (refer to next step).

Run the Calculate Appendix 8A program.

This calculation program captures and stores specific Appendix 8A data - (representing sections 4a to 4k on the Appendix 8A form) and uses the information that you set up in the IRAS Tax Forms SGP page. This process updates those amounts that it can, by using the payroll balances. You can create Appendix 8A records by selecting the Create records check box. You can then print the data or generate an electronic file.

Create Appendix 8B data by using the Appendix 8B Forms SGP page.

You must provide the Appendix 8B form with the IR8A form when the employee has derived gains or profits either directly or indirectly from the exercise, assignment, or release of any share option right or benefit where such right or benefit was obtained by him by reason of any office or employment. You enter all fields here manually—these are not system-populated fields.

Print the Appendix 8A forms by using the Print Appendix 8A Forms SGP page.

Printing the Appendix 8A forms populates the value of benefits in kind field on the IR8A/IR8S Forms - IR8A Income page. A field on the IR8A summarizes the value of benefits in kind that an employee receives. The field becomes populated only when you run the Print Appendix 8A process. The value of benefits in kind is calculated by using the rates that are maintained by using the IRAS Benefit Rates SGP page.

Print the Appendix 8B forms by using the Print Appendix 8B Forms SGP page.

Print the IR8A/IR8S forms. This print program produces the employee's tax year end certificates.

The following diagram illustrates the IR8A/IR8S and Appendix 8A and 8B forms management procedure:

Note: To flag employees that require an IR8S form, enter variable IRS VR IR8S REQD on the standard Payee Supporting Element Override page. Overrides are allowed at payee level only. The variable isn't actually used in Global Payroll processing, but it is checked by the reporting process.

The IR21 form must be completed for all employees who are noncitizens when they terminate their employment with the company. The data that is reported is similar to that which is provided on the IR8A and Appendix 8A forms, and includes amounts for the current and previous year. As with the other IRAS forms, not all of the data can be extracted from the payroll system. Therefore, you should create as much of the data as possible first. You can then enter the other required information by using online pages and print the IR21 report.

The IR21 is a compilation of two years of some IR8A and Appendix 8A data that is compiled into four pages of a single notification report. (IR8A and Appendix 8A are statutory reports that employees complete each tax year). You create IR21 report details by using the Create IR21 Details Page and review and maintain the details online by using the IR21 Details component. After you create an IR21, you can enter prior years of data for all the necessary variables. You can create and maintain IR21 details for a specific employee or pay group.

Two other forms may need to accompany an IR21 under certain circumstances. The first is Appendix 1, which documents received benefit in kind. The system generates this Appendix with the IR21 form, and there is a field on the IR21 that summarizes the value of benefits in kind received by an employee. This field populates when you run the print program for IR21. You can review and maintain Appendix 1 details by using the IR21 Appendix 1 component. The second is IR8S, which documents CPF contributions that the employer and employee make. The system doesn't generate IR8S forms to accompany the IR21, although IR8S forms to accompany IR8A forms are supported as noted previously. You should ensure that an IR8S form is manually completed if it is required to accompany the IR21 form.

The following diagram illustrates the IR21 and Appendix 1 forms management procedure: