Defining State and County Income Tax Rates

To define state and county income tax rates, use the State Tax Rates USA (GPUS_TAX_ST_TBL) and County Tax Rates USA (GPUS_LOCAL_TAX) components.

Important! The PeopleSoft system delivers all existing tax rate information for each state. Do not modify this information. Use pages of this component to view tax rate information and test upcoming changes in tax legislation that affect tax rates.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_TAX_ST_TBL2 |

Define state tax rates. |

|

|

GPUS_TAX_ST_TBL |

Define withholding rates. |

|

|

GPUS_TAX_ST_TBL3 |

Define other tax rates. |

|

|

GPUS_LOCAL_TAX |

Maintain county tax rates. |

Use the State Tax Rates USA page (GPUS_TAX_ST_TBL2) to define state tax rates.

Navigation:

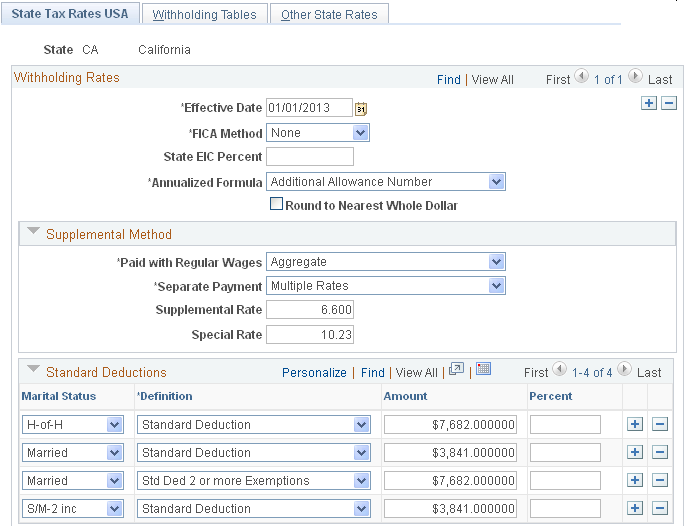

This example illustrates the fields and controls on the State Tax Rates USA page (1 of 2).

This example illustrates the fields and controls on the State Tax Rates USA page (2 of 2).

Note: Many of the fields and field values on this page apply only to specific states.

Field or Control |

Description |

|---|---|

Annualized Formula |

Indicates the formula that the system uses to calculate annualized state income tax. |

FICA Method (Federal Insurance Contributions Act method) |

Indicates the method that the system uses to calculate FICA credits. |

Round to Nearest Whole Dollar |

Selected to specify that the system round calculated state income tax to the nearest whole dollar. |

Standard Deductions

This group box contains the state-specific standard deductions that the system references when calculating state income tax.

Allowances and Exemptions

This group box contains the state-specific allowances, exemptions, and maximum SWT base and limits that the system references when calculating state income tax.

Credits

This group box contains the state-specific credits that the system references when calculating state income tax.

Supplemental Method

Field or Control |

Description |

|---|---|

Paid with Regular Wages and Separate Payment |

Indicates the method by which the system determines the tax for supplemental income. Many states have a supplemental method for the Paid with Regular Wages payment method that differs from the supplemental method specified for the Separate Payment payment method. If either of these fields has a value of Multiple Rates, the Special Rate field becomes available. |

Supplemental Rate |

Indicates the percentage by which the system multiplies the taxable gross when calculating tax for supplemental income. This field applies only to the payment methods with a supplemental method of Aggregate-No Tax else Percent or Percent of Taxable Gross. For example, for the state of Colorado, the supplemental method specified in the Separate Payment field is Percent of Taxable Gross and the supplemental rate is 4.63. That means that for supplemental payments, such as bonuses, that are paid separately from regular wages, the system multiplies the taxable gross of the supplemental payment by 4.63 percent to determine the state tax. |

Special Rate |

Indicates the percentage by which the system multiplies special supplementary income, such as stock. This field applies only to the payment method with a supplemental method of Multiple Rates. |

Use the Withholding Tables page (GPUS_TAX_ST_TBL) to define withholding rates.

Navigation:

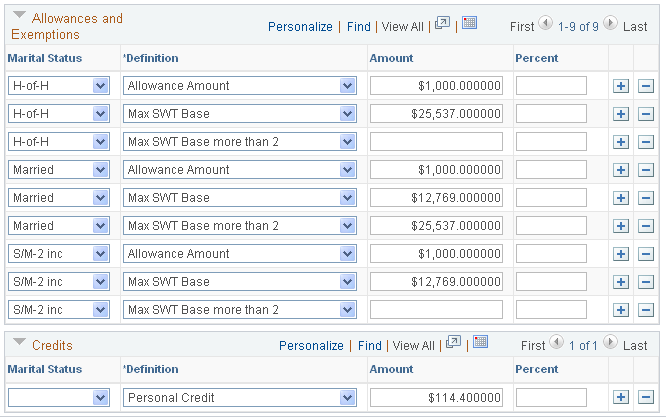

This example illustrates the fields and controls on the Withholding Tables page.

This page lists all of the state-specific wage brackets and withholding rates referenced by the SWT calculation process.

Use the Other State Rates page (GPUS_TAX_ST_TBL3) to define other tax rates.

Navigation:

This example illustrates the fields and controls on the Other State Rates page.

Enter elements here that you want excluded from the calculation of taxable gross. For example, if a deduction is a member of the before tax deduction accumulator for all states, you can exclude the deduction from the calculation for a specific state using this page.

Use the County Tax Rates USA page (GPUS_LOCAL_TAX) to maintain county tax rates.

Navigation:

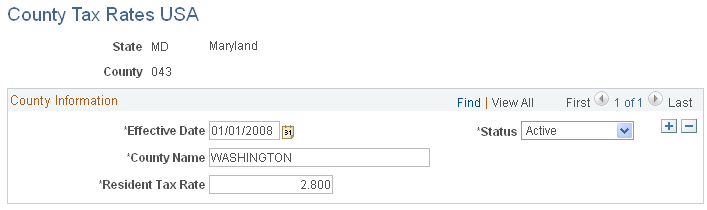

This example illustrates the fields and controls on the County Tax Rates USA page.

Use this page to maintain the resident tax rate for a county within a given state.