Generating Tax Reports

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_RC_TAXDEPLIAB |

Generate pay period details on federal and state taxes withheld from employees. |

|

|

Tax Summary Reports USA Page |

GPUS_RC_TAXSUMRPT |

Summarize period-to-date income tax, other federal taxes, and state taxes. |

|

Quarterly Tax Reports USA Page |

GPUS_RC_QTRTAXRPT |

Summarize quarterly federal and state withholding tax details for employees. |

|

Federal Tax Data Status USA Page |

GPUS_RC_FEDTAXSTA |

View a list of employees with federal withholding exemption or those with more than 10 allowances. (If the Do Not Maintain Taxable Gross and Do Not Withhold Tax option is selected on the Federal Tax Data page, these employees will appear in the report.) This report summarizes exemptions for the selected employees. |

|

GPUS_RC_W4IRSRPT |

Generate the W-4 IRS report, which lists employees with federal withholding exemption or those with more than 10 allowances. |

|

|

W-4 Exempt Payees Report USA Page |

GPUS_RC_W4EXEMP |

List employees who fail to complete new W-4 forms by the due date. |

|

Identify W-4 Exempt Payees USA Page |

GPUS_RC_SELW4EXEMP |

List employees whose federal tax data includes specified parameters. (If the Maintain Taxable Gross; FWT Zero Unless Specified in FWT Additional Withholding option and the Do Not Maintain Taxable Gross and Do Not Withhold Tax option are selected on the Federal Tax Data page, these employees will appear in the report.) |

|

Reset W-4 Exempt Payees USA Page |

GPUS_RC_W4RSTEXEMP |

Update future-dated records that currently specify W-4 exempt status. |

|

W-4 ePay Audit Report USA Page |

GPUS_RC_W4EPAYRPT |

List employees who enter W-4 information through self-service. This report is available if you purchased ePay. |

Use the Tax Deposit and Liability USA page (GPUS_RC_TAXDEPLIAB) to generate pay period details on federal and state taxes withheld from employees.

Navigation:

This example illustrates the fields and controls on the Tax Deposit and Liability USA page.

Report Request Parameters

Field or Control |

Description |

|---|---|

Report Run By |

Define what you want the report run by. Values are Calendar Group ID, Payment Date Range, and Year and Quarter. |

Tax Year |

Enter the tax year for which you want to run the report. |

Field or Control |

Description |

|---|---|

Tax Quarter |

Select the tax quarter for which to run the report. Values are 1st Quarter, 2nd Quarter, 3rd Quarter, and 4th Quarter. |

Population

Field or Control |

Description |

|---|---|

Selection |

Select the population for which to run the report. Values are Federal EIN and Reporting Company. |

Federal EIN |

Select the Federal EIN. This field appears only if you select Federal EIN in the Selection field. |

Reporting Company |

Select the reporting company. This field appears only if you select Reporting Company in the Selection field. |

Payroll Cycle |

Select the payroll cycle when the report is run. Values are All Cycles, Off-Cycle Only, and On-Cycle Only. |

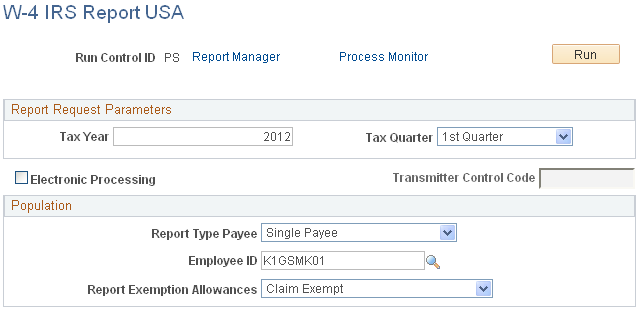

Use the W-4 IRS Report USA page (GPUS_RC_W4IRSRPT) to generate the W-4 IRS report, which lists employees with federal withholding exemption or those with more than 10 allowances.

Navigation:

This example illustrates the fields and controls on the W-4 IRS Report USA page.

Report Request Parameters

Field or Control |

Description |

|---|---|

Tax Year |

Enter the tax year for which you want to run the report. |

Tax Quarter |

Select the quarter for which you want to run the report. Values are 1st Quarter, 2nd Quarter, 3rd Quarter, and 4th Quarter. |

Electronic Processing |

Select if you want to process the report electronically. If you select this check box, the Population group box becomes unavailable for entry. |

Transmitter Control Code |

If you select the Electronic Processing check box, this field becomes available for entry. Enter a code for the electronic processing. |

Population

The Population group box is available for entry if the Electronic Processing check box is deselected.

Field or Control |

Description |

|---|---|

Report Type Payee |

Select the category of payees for which the report is run. Values are All Payees, Payees using ePay, and Single Payee. |

Employee ID |

If you select Single Payee in the Report Type Payee field, enter the employee ID for which the report is run. |

Report Exemption Allowances |

Select the type of exemption allowance for the payee population being defined. Values are All, Claim Exempt, Exempt or > 10 Allowances, and More than 10 Allowances. |