Overriding Tax and Payment Methods

PeopleSoft Global Payroll for United States supports three tax calculation methods: annualized, cumulative, and supplemental. For taxes calculated using the supplemental method, the two supported payment methods that affect tax calculation are Paid with Regular Wages and Separate Payment. The tax calculation method and payment method are controlled by the variables TAX VR METHOD and TAX VR PMT, respectively. All of the earnings and deductions delivered with PeopleSoft Global Payroll for United States are associated with a default tax method and payment method. To make one-time or recurring changes to these values, you must use supporting element overrides (SOVRs).

The variable TAX VR METHOD, which controls the tax calculation method used by the system for each earning and deduction, has three possible values: A (annualized), C (cumulative), and S (supplemental). Most of the earnings delivered with PeopleSoft Global Payroll for United States have a default tax method of A. Exceptions exist, such as the BONUS earning, which has a tax method of S. You can change the tax method for an earning at the payee level on the Element Detail page of the Element Assignment By Payee component (GP_ED_PYE) for a recurring modification, and on the positive input component (GP_PI_MNL_ERNDED) for a one-time modification.

This example illustrates the fields and controls for tax method override on Element Detail page.

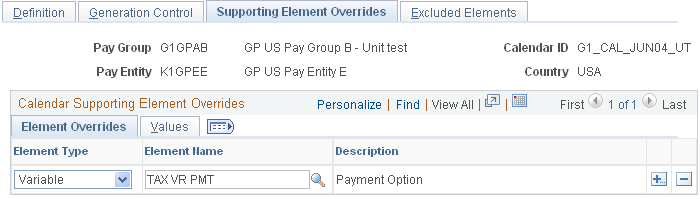

The variable TAX VR PMT, which controls the payment method that the system uses when calculating taxes on supplemental income, has two possible values: R (Paid with Regular Wages) and S (Separate Payment). This variable has a default value of R for all supplemental tax calculations, but you can override the payment method at the calendar level. You must create a separate calendar with a unique run type using the Calendars component (GP_CALENDAR).

This example illustrates the fields and controls on the Example of a payment method override on the Supporting Element Overrides page (GP_CALENDAR2) of the Calendars component.

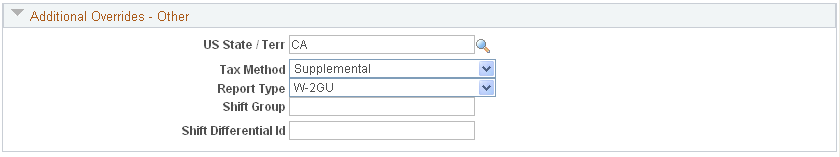

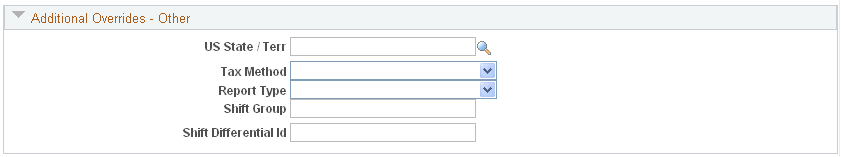

The variables TAX VR STATE (U.S. state and territory code) and TAX VR RPT TYPE (report type) control how the system processes and reports tax data at the state level. You can override the state and territory code and report type for a payee on the Element Detail page of the Element Assignment By Payee component (GP_ED_PYE) for a recurring modification, and on the positive input component (GP_PI_MNL_ERNDED) for a one-time modification.

This example illustrates the fields and controls on the Example of state code and report type override on the Element Detail page.