Entering Employee Share Scheme Information

This topic discusses how to enter employee share scheme information.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_EE_SS_SVE |

Enrol payees in a share save scheme. If your organization has eligibility rules associated with share schemes you must check that payees meet those criteria before enrolling them. Global Payroll for the UK doesn't perform any eligibility checking. |

|

|

Contribution Holiday Page |

GPGB_EE_SS_HOL_SEC |

Enter the begin and end dates and duration of contribution holidays. These are periods when payees suspend contributions to share schemes. The share save scheme definition defines whether contribution holidays are allowed, the maximum duration of holidays and how contributions that were due during the contribution holiday period are collected. |

|

Contribution Holiday Notes Page |

GPGB_EE_SS_CMT_SEC |

Enter comments about the contribution holiday. |

|

GPGB_EE_SS_BUY |

Enrol payees into a share buy scheme. If your organization has eligibility rules associated with share schemes you must check that payees meet those criteria before enrolling them. Global Payroll for the UK doesn't perform any eligibility checking. |

|

|

GPGB_EE_SS_HOL |

Enter the begin and end dates and duration of contribution holidays. These are periods when payees suspend contributions into share save schemes. The share save scheme definition defines whether contribution holidays are allowed, the maximum duration of holidays and how contributions that were due during the contribution holiday period are collected. |

Use the Save page (GPGB_EE_SS_SVE) to enrol payees in a share save scheme.

Navigation:

This example illustrates the fields and controls on the Save page.

Field or Control |

Description |

|---|---|

Scheme ID |

Select the share save scheme that the payee wants to join. The system displays only those share schemes defined with a share scheme type of share save that are open for enrolment. If the Enrolment Locked check box is selected on the Define Share Schemes GBR page, the share scheme is not available in this field. |

Begin Date and End Date |

Enter the date that the payee joined the share scheme and the date that the scheme will cease. The default end date is the scheme end date. If employee override is allowed and this applies to the payee, enter the revised end date |

Duration |

Displays the duration (in months) of the share save scheme you selected. If the share scheme definition allows employee override, you can modify the default duration. |

Share Save Schemes — Contributions

Access the Contributions tab.

Field or Control |

Description |

|---|---|

Account Number |

Enter the payee's account number issued by the share system administrators. |

Amount |

Enter the payee's contribution to the scheme each pay period. The amount must be within the minimum and maximum contributions defined for the share scheme. If payees are enrolled in more than one share save scheme, their total contributions across all share save schemes must be within the statutory limits defined on the Share Scheme Limits GBR page. |

Holidays |

Displays Yes or No to indicate whether contribution holidays already exist for the payee. If the field displays No and the Holiday link doesn't appear, the scheme doesn't allow contribution holidays. |

Holiday |

Click this link to access the Contribution Holiday page where you can view and add contribution holiday dates. This link is only displayed for schemes that allow contribution holidays. |

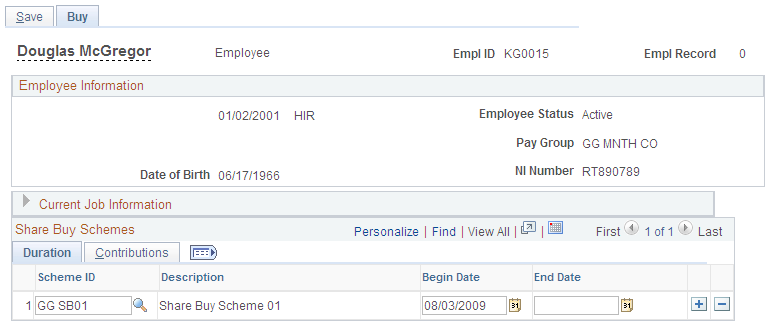

Use the Buy page (GPGB_EE_SS_BUY) to enrol payees into a share buy scheme.

Navigation:

This example illustrates the fields and controls on the Buy page.

Field or Control |

Description |

|---|---|

Scheme ID |

Select the share buy scheme that the payee wants to join. The system displays only those share schemes defined with a share scheme type of share buy. |

Begin Date and End Date |

Enter the date that the payee joined the share scheme. You only enter an end date at such time as the payee withdraws from the scheme. |

Share Buy Schemes — Contributions

Access the Contributions tab.

Field or Control |

Description |

|---|---|

Account Number |

Enter the payee's account number issued by the share system administrators. |

Contribution Basis |

Displays the contribution basis defined for the share scheme: Amount: If contributions are based on a fixed amount. Percent: If contributions are based on a percentage of earnings. |

Contribution Amount |

Enter the payee's contribution to the scheme each pay period. The amount must be within the minimum and maximum amount specified in the share scheme definition. If payees are enrolled in more than one share buy scheme, their total contributions across all share buy schemes must be within the statutory limits defined on the Share Scheme Limits GBR page. This field is available if the Contribution Basis is Amount. |

Percentage Value |

Enter the percentage of earnings that are contributed to the share scheme each pay period. The percentage must be within the minimum and maximum percentage specified in the share scheme definition. If payees are enrolled in more than one share buy scheme, their total contributions across all share buy schemes must be within the statutory limits defined on the Share Scheme Limits GBR page. This field is available if the Contribution Basis is Percent. The earnings on which this percentage is based is defined in the share scheme definition. Rules for share schemes are defined on the Define Share Schemes GBR page. |

Note: You cannot enrol employees in more than one share buy scheme with the same contribution basis (fixed amount or percentage). However, employees can be enrolled in two share buy schemes if one is based on a fixed contribution amount, and the other scheme is based on a percentage of earnings.

Use the Share Save Holidays GBR page (GPGB_EE_SS_HOL) to enter the begin and end dates and duration of contribution holidays.

These are periods when payees suspend contributions into share save schemes. The share save scheme definition defines whether contribution holidays are allowed, the maximum duration of holidays and how contributions that were due during the contribution holiday period are collected.

Navigation:

This example illustrates the fields and controls on the Share Save Holidays GBR page.

Holiday Details

Enter the details of the payee's contribution holidays. Where contribution holidays are permitted, and the share scheme has a maximum total duration for contribution holidays, the system checks that the payee has not exceeded this limit.

See Pages Used to Define Share Schemes.

Field or Control |

Description |

|---|---|

Begin Date and End Date |

Enter the start and end date for the period when the payee's share scheme contributions stopped. |

Duration (months) |

Displays the number of months that the payee is not contributing to the share scheme when you click Save. The duration is rounded to two decimal places, based on an average month of 30.4166 days. |