Understanding Workplace Pension - Auto Enrolment

This topic provides an overview of the auto-enrolment of workplace pension.

Auto-enrolment is a semi-compulsory approach to retirement saving introduced by the UK government. Auto-enrolment includes the automatic enrolment of all qualifying employees into a qualifying pension scheme. An employee’s workplace pension is a way of saving for retirement arranged through the employer. Workplace pension is also known as a ‘company pension’, ‘occupational pension’, or ‘works pension’. The employer and employee together need to make a contribution that adds up to 8% value of the employee’s earnings.

The UK government made it compulsory, from October 2012, for all employers with at least one worker in the UK to automatically enroll certain members of their workforce into a pension scheme. The start date, called the staging date, varies according to the number of employees in each Pay As You Earn (PAYE) scheme. The UK government made is mandatory for all employers with 250 or more employees to comply by February 2014.

Following are the steps to prepare for automatic enrolment:

Identifying the staging date - Staging dates are determined by the number of employers in the employer’s largest Pay As You Earn (PAYE) scheme. Smaller schemes automatically have the same staging dates. It is each employer’s responsibility to identify the staging date by which they must be ready for the new enrollment duties. Employers can advance their staging date in order to align with their other key business dates. However, staging must commence on the 1st of the month. Employers can identify their staging date by entering their PAYE references into a ‘Staging date tool’ offered by the Pension Regulator.

Workforce assessment - Employers need to check if they employ anyone classified as a ‘worker’ and they need to assess their contractual relationships. When an employer has identified a worker, the next step is to ascertain the type of the worker so that they can determine if enrolment is required. There are two main categories of workers - jobholders and entitled workers. Jobholders can be further classified into eligible and non-eligible job holders.

The following are definitions of the different worker categories:

Worker: An employee or individual who has a contract to perform work or services personally, and is not undertaking the work with the employer as part of an own business.

Job holder: A worker aged between 16 and 74, working or ordinarily works in the UK under a contract, and has qualifying earnings.

Eligible jobholder: A jobholder aged between 22 and the state pension age, and has qualifying earnings above the earnings trigger for automatic enrolment.

Non-eligible job holder: A jobholder aged between 16 and 21 or between the state pension age and 74, and has qualifying earnings above the earnings trigger for automatic enrolment; or aged between 16 and 74 and has qualifying earnings below the earnings trigger for automatic enrolment.

Entitled worker: A worker aged between 16 and 74, working or ordinarily works in the UK under a contract, and does not have qualifying earnings.

The workforce assessment includes the following steps:

Assessing the worker’s age: Employers need to identify if the worker meets the age brackets for automatic enrolment.

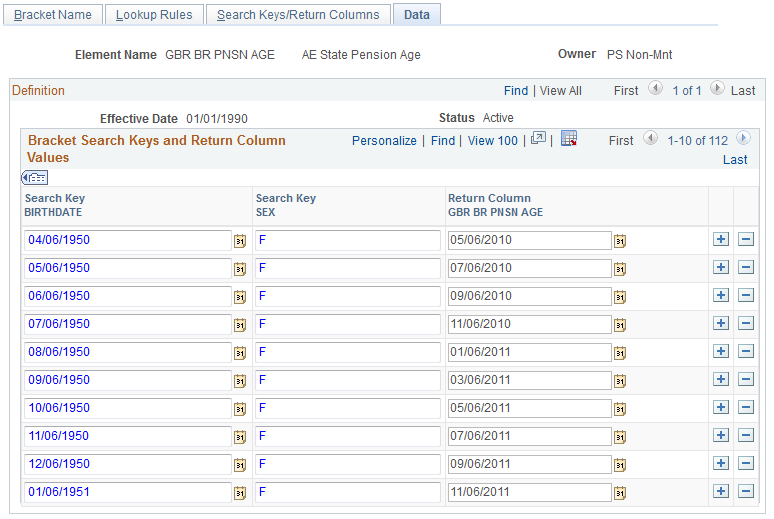

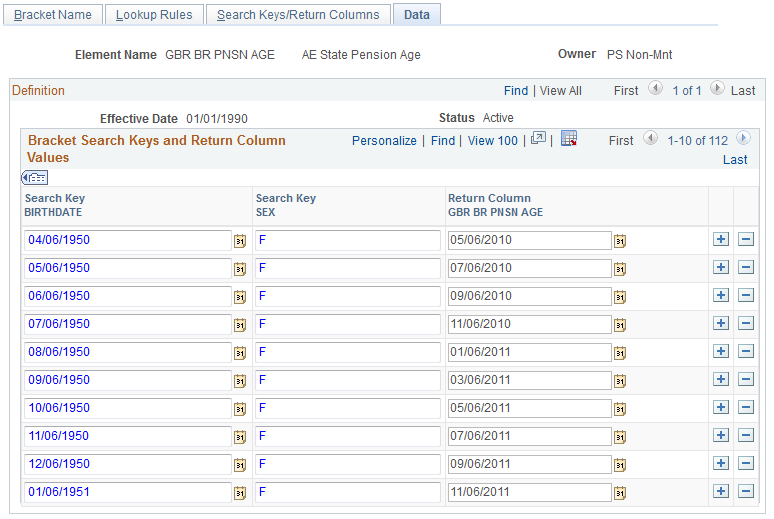

This example illustrates the Brackets - Data page displaying the state pension age for automatic enrolment.

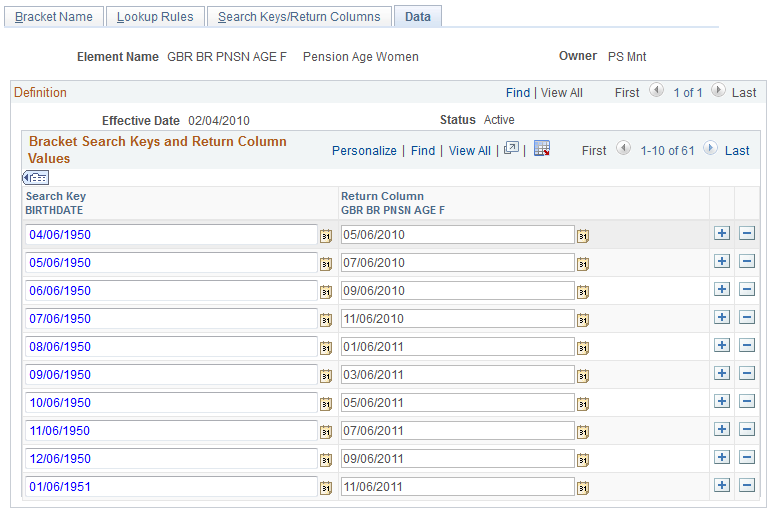

This example illustrates the Brackets - Data page displaying the state pension age for women for automatic enrolment.

Identifying where the worker is based: Employers need to identify if the worker is working or ordinarily works in the UK under their contract.

Assessing the worker’s earnings: Employers need to identify if the worker’s earnings qualify them for automatic enrolment.

This example illustrates the Brackets - Data page displaying the earnings thresholds for 2014 - 2015.

Reviewing pension arrangements: Employers need to identify and understand the type of pension scheme required. Employers can choose an automatic enrolment scheme, a qualifying scheme, or a combination of the two. Employers may have existing pension schemes and they need to check that the minimum requirements are covered in their existing pension related processes.

An employer must automatically enroll any eligible employee, who is not already a member of a qualifying pension scheme with that employer, either from the automatic enrolment date, or from the end of the postponement period, if they chose postponement.

Employers must, on or after the automatic enrolment date, deduct any contributions payable by the eligible employee from any qualifying earnings or pensionable pay due for the eligible employee in each pay reference period.

There is a specific time limit for completing automatic enrolment. One month from the eligible employee’s automatic enrolment date is the ‘joining window’. Before the end of the joining window the employer must:

Provide information about the eligible employee to the pension scheme.

Provide enrolment information to the eligible employee.

Make arrangements to achieve active membership for the eligible employee, effective from their automatic enrolment date.

A key feature of an automatic enrolment scheme is that the eligible employee is not required to provide information in order to either join or remain a member. It is the employer’s responsibility to work with the pension scheme trustees, managers, or pension scheme provider to achieve active membership for the eligible employee. It is also the employer’s responsibility to provide the required personal information about the eligible employee. Employers must complete this activity before the end of the joining window.

The following are some of the opting in rules applicable for the different worker types:

A jobholder can request the employer and make arrangements to become an active member of an automatic enrolment scheme, with effect from the enrolment date by providing an ‘opt-in notice’ to the employer.

An entitled worker can request the employer and make arrangements to become an active member of a pension scheme by providing a ‘joining notice’ to the employer.

A non-eligible jobholder can opt in by providing a notice to the employer. They can request the employer to arrange for an active membership of an automatic enrolment scheme.

An eligible jobholder who has been automatically enrolled, but subsequently opted out or ceased membership also can opt back into an automatic enrolment pension scheme.

An eligible jobholder who was not automatically enrolled because they were a member of another qualifying scheme on their automatic enrolment date, but subsequently ceased membership of that scheme can also opt into an automatic enrolment scheme.

An entitled worker can join a pension scheme by providing a notice to the employer. They can request the employer to arrange for an active membership of a pension scheme. The scheme that the employer chooses does not have to be an automatic enrolment scheme or even a qualifying scheme.

A jobholder can opt into an automatic enrolment scheme, unless they are an:

Active member of another qualifying scheme with the employer,

Eligible jobholder for whom the employer has an automatic enrolment duty, or

Eligible jobholder for whom the employer has a re-enrolment duty.

Note: If the opt-in notice is submitted within 12 months of a previous opt-in notice and the employee has subsequently stopped membership of the automatic enrolment scheme into which they were enrolled, the employee will not be considered for auto enrolment but will be considered for the voluntary opt-in.

Ongoing membership of the scheme is not compulsory for a jobholder. When a jobholder has been automatically enrolled, or enrolled as a result of an opt-in request, they can choose to opt out of a pension scheme.

‘Opt out’ refers to the provision under the law which allows an employee to undo an active membership. It will be considered that the worker had never been a member of a scheme. Opting out can be done only within a specific time period, known as the ‘opt-out period’. The opt-out period varies between the different pension schemes.

Eligible jobholders may choose to opt out after they have been automatically enrolled. Non-eligible jobholders who have opted in may choose to opt out after they have been enrolled.

Workers who have been enrolled under contractual enrolment and entitled workers who requested to be opted in do not have the right to choose to opt out. If they want to leave the scheme, they must cease membership in accordance with the scheme’s rules.

When an employer receives a valid opt-out notice, they must refund to the employee any contributions that have been deducted from the employee’s pay, less any tax due, by the refund date. The refund date can be within one month of receiving the valid opt-out notice. If the payroll arrangements closed before the employer received the notice then the last day of the second applicable pay reference period can be the refund date.

Jobholders who cease their active membership after the opt-out period has ended may also be entitled to receive a refund of contributions. This depends on the length of the employee’s pensionable service and the pension scheme’s rules.

A jobholder can opt out only till the end of the opt-out period. However, if they want to leave the scheme after the opt-out period, they can cease the active membership as per the scheme rules.

Entitled workers who volunteered to join the scheme cannot opt out. They can cease the active membership in accordance with the scheme rules.

A worker enrolled into a qualifying scheme by the employer under a contractual agreement rather than under the employer duties cannot opt out. They can cease active membership in accordance with the scheme rules.

When an employer receives a valid cease notice, a deduction will happen for that notice period. From the subsequent month, deduction will not happen.

Note: Refund is not applicable if the employee uses the cease option.

This table lists accumulators related to Pension - Auto Enrolment.

|

Accumulator Name |

Type |

|---|---|

|

GBR AC APNEED SEG |

Segment |

|

GBR AC APNEED PTD |

Calendar Period |

|

GBR AC APNEED YTD |

Year To date |

|

GBR AC APNEER PTD |

Calendar Period |

|

GBR AC APNEER SEG |

Segment |

|

GBR AC APNEER YTD |

Year To date |

|

GBR AC APNERD PTD |

Calendar Period |

|

GBR AC APNERD SEG |

Segment |

|

GBR AC APNERD YTD |

Year To date |

|

GBR AC APNERR PTD |

Calendar Period |

|

GBR AC APNERR SEG |

Segment |

|

GBR AC APNERR YTD |

Year To date |

|

GBR APN AC EE |

Custom Period |

|

GBR APN AC ER |

Custom Period |

|

GBR AC APN DR |

Segment |

|

GBR AC APN EER DR |

Segment |

|

GBR AC APN ER DR |

Segment |

|

GBR AC APN ERR DR |

Segment |