Understanding the EDI Processes

Global Payroll for the UK EDI functionality provides you with the ability to undertake electronic transactions of statutory data with HM Revenue and Customs (HMRC).

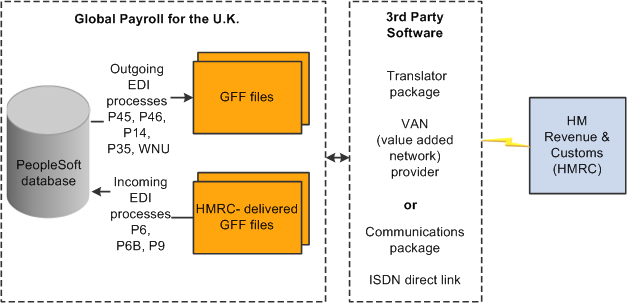

This diagram illustrates the EDI functionality consisting of application engine processes that either generate or load flat files that are exchanged, via third-party software or providers, with HMRC:

The flat files of statutory data typically are a replacement for existing statutory reports and forms.

There are two types of EDI transactions:

Outgoing transactions

In this type of transaction, the application engine process creates a flat file containing information from your PeopleSoft database that you then submit to HMRC via third-party software or provider. The outgoing transactions are: P46, P45 Part 1 (leaver), P45 Part 3 (starter), P14, P35, and works number update (WNU).

Incoming transactions

In this type of transaction, the application engine updates employee data in your PeopleSoft database using information from a flat file that you obtain from HMRC via third-party software or provider. The incoming transactions are: P6 and P9.

All the flat files, whether for outgoing or incoming transactions, are in HMRC-defined Generic Flat File (GFF) format. Global Payroll for the UK does not support any other file format. There are four types of GFF format on which Global Payroll for the UK continuous EDI transactions are based:

Movements and Deductions (MOVDED).

Work Number Update (WNU).

P14 (P14nn, where nn is the tax year. P1405 is the format for the tax year 2004/2005).

P35 (P35nn, where n is the tax year).

Each transaction has a file layout based on the GFF format type. For outgoing transactions, an application engine process extracts data from the system and then uses the file layout associated with the transaction to create the flat file. For more detailed information about these GFF format types and file layouts, consult the EDI EBN range of documents provided by HMRC.

Note: Consult your EDI provider or HMRC for information about how to submit files generated by outgoing transactions to HMRC.