Overriding Employee PHF/SI Deduction Information

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCN_CONT_EE |

Used by Benefit Administrators to override employee PHF/SI deduction information. |

Employee PHF/SI deductions are based on the country, company, contribution area, and contribution types that are set up for the location in which they are employed. This topic discusses how to override employee PHF/SI deduction information.

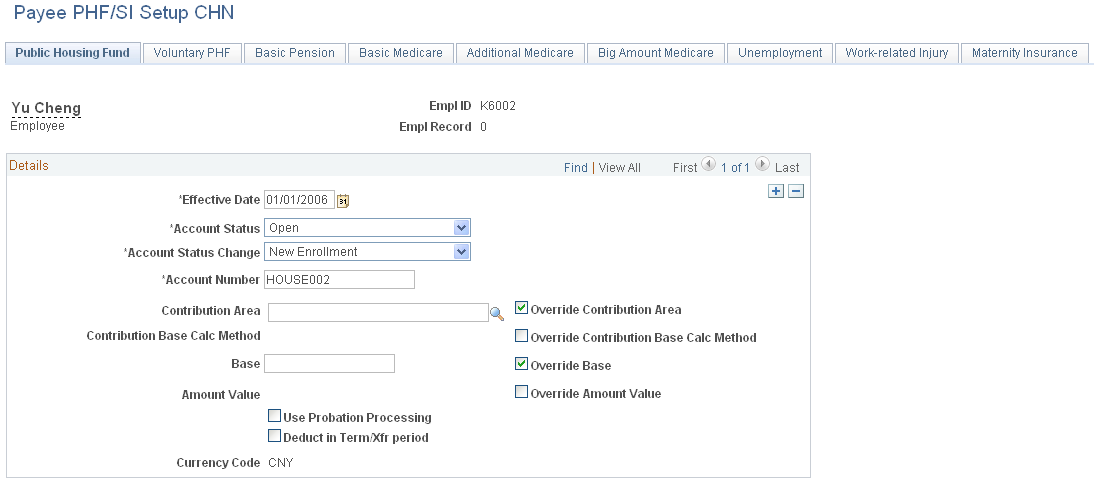

Benefit Administrators use the Payee PHF/SI Setup CHN (GPCN_CONT_EE) page to override employee PHF/SI deduction information..

Navigation:

This example illustrates the fields and controls on the Payee PHF/SI Setup CHN page.

Each tabbed page in this component represents a contribution type. The contribution types for which pages appear here, the order in which they appear, and the tab or page labels, are all based on the values that are selected on the Define PHF/SI Sequence CHN page.

Field or Control |

Description |

|---|---|

Account Status and Account Status Change |

Account Status and Account Status Change fields are translate values. You can override the values for an employee’s account here. Account Status values are:

|

Account Number |

Enter or verify the account number for the contribution. |

Override Contribution Area, Override Contribution Base Calc Method (contribution base calculation method), Override Base, Override Amount Value |

Select the check box of each item whose value you want to override for this employee. With a check box selected, an empty editable field box appears next to the corresponding field label (to the left) where you can enter the value to use in PHF/SI calculations. With a check box selected, you must enter a value for that item to save the page. With a check box deselected, the field label appears, but the editable field box is hidden. Unless you override the value here, the values described below are used:

|

Use Probation Processing |

Select this check box to allow probation processing for this employee. With the check box selected, the system accrues the PHF/SI deduction amount to the CN AC PHFSI PROBN accumulator and sets the deduction amount to zero during a payee's probation period. When the probation period expires, the system adds the amount in the CN AC PHFSI PROBN accumulator to the current period deduction amount and does not accrue further amounts to the accumulator. The system stores the accumulator for a maximum of 12 months after the employee's last hire date. Note: You can also specify this override at the pay group or pay entity level. |

Deduct in Term/Xfr period (Deduct in Term or Transfer period) |

Select this check box to resolve deductions with an Account Status value of Closed or Transfer Out. This enables you to resolve PHF/SI contribution deductions during a termination or transfer out period. |