Tax Reports

PeopleSoft Global Payroll for China delivers two tax reports:

The Individual Income Tax Withholding Report is a summary monthly report of income, deductions, and taxes for all payees that must be submitted to the tax authorities within seven days after the end of the current month.

The Tax Withholding Detail Report is a detailed monthly report of income, deductions, and taxes for all payees. It is a supplement to the Individual Income Tax Withholding Report.

The reports are designed in accordance with Article 9 of the Individual Income Tax Law of the People's Republic of China. The State Administration of Taxation (SAT) issues general formats for these tax return reports, but each province or city directly under the central government can design their own format based on the regulations issued by the SAT. PeopleSoft Global Payroll for China provides the general formats as issued by the SAT.

The system extracts data for both of these reports using the Report Data feature.

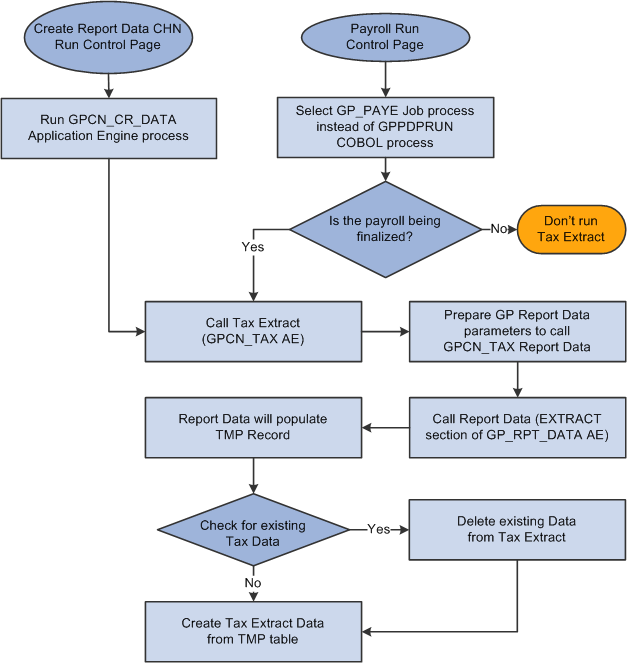

Process Flow

This diagram illustrates the flow of the tax report data extract process:

This diagram illustrates the flow of the tax report data extract process.