Adjusting Payday Reporting (PDR) Data

This section discusses adjusting of Payday Reporting data which includes:

Override: If you had run Payday reporting file in the production mode ( finalized payroll) and needs to correct certain values in the reporting file for some employees before submitting the file in myIR, use the Override option.

Amendment: If you want to correct the employment file that was submitted earlier, use the Amendment option.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_PDR_AO_DTL |

To amend or override the PDR data. |

Use the Amendment/Override PDR page (GPNZ_PDR_AO_DTL) to override or amend the PDR data.

Navigation:

Search and select the record for override/amendment based on Pay Entity, Tax Year, Payment Date, Employee ID or Name. Once you select the record, click “+” to add a new row and to select Override/Amendment as the Run Type.

Note: If the file is already submitted, system displays an error message if you try to select override option. Amendment can only be performed for a previously submitted file where as override is performed before the file is submitted.

Override

Use Override option if you had run Payday reporting file in the production mode and needs to correct earnings and deduction values for some employees before submitting the file in myIR. This is not to add delta value; it is to enter the expected value, which is required to report in the file. The new values will override the existing earnings and deductions details.

Note: Override can only be performed for a finalized calendar. In case of multiple calendars in a payment date then all calendars that corresponds to a payment date should be finalized.

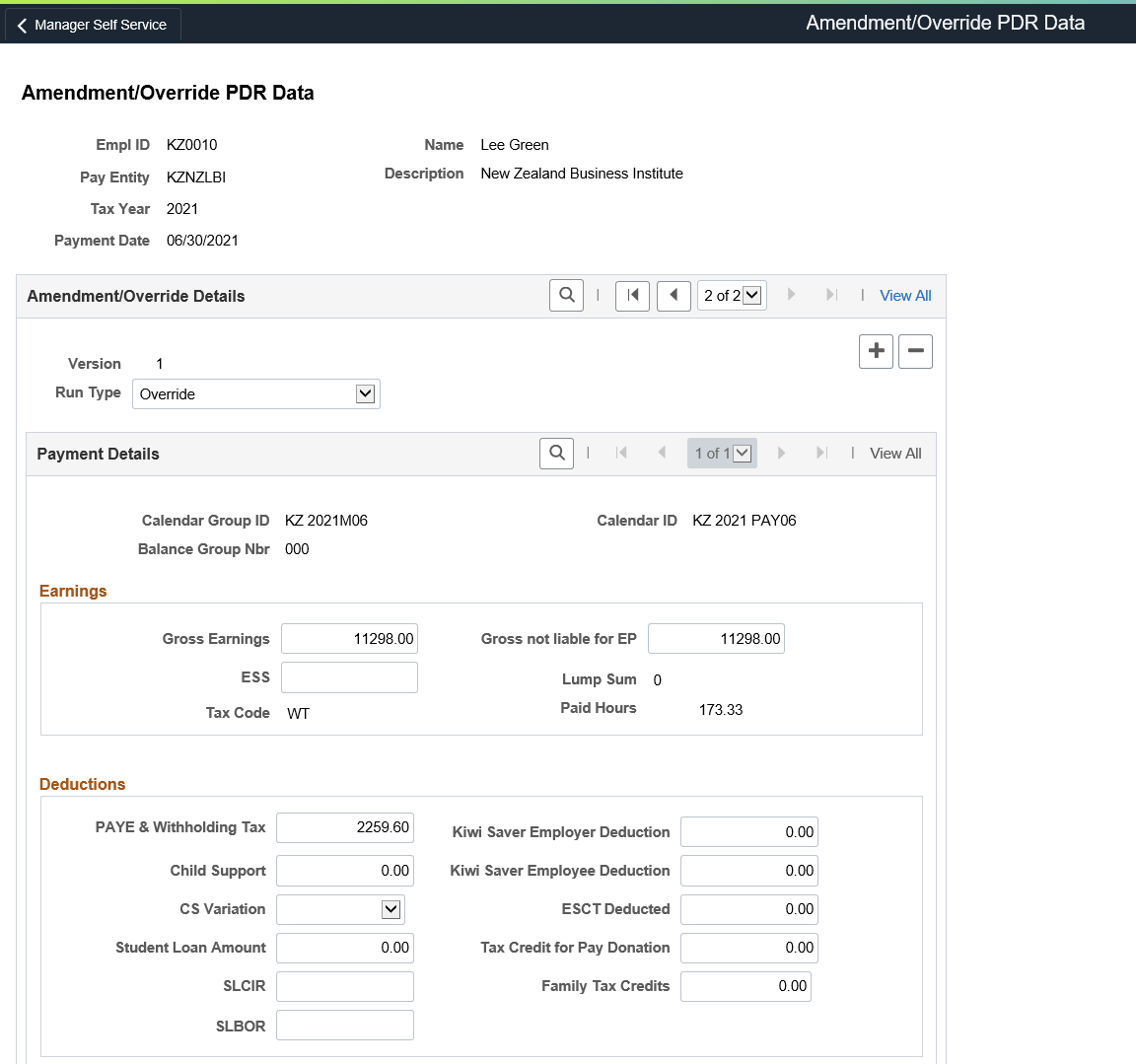

This example illustrates the Amendment/Override PDR page when Override is selected as the Run Type.

Note: The fields ESS, SLCR, and SLBOR are incorporated in the employee file with effect from April 2021.

Edit the earnings and deductions fields corresponding to each Payment date or Calendar Group and save the record. Adjusted values are considered only for Payday Reporting and the same will not cascade to payroll results automatically.

Once the changes are saved, create file from Create PDR Employment File page by selecting ‘Original’ in the report type. File will be generated with the new values.

Amendment

Use Amendment option to correct the employment file that was submitted earlier. This option is not to add delta values. The new values will be considered as a correction to the original entry.

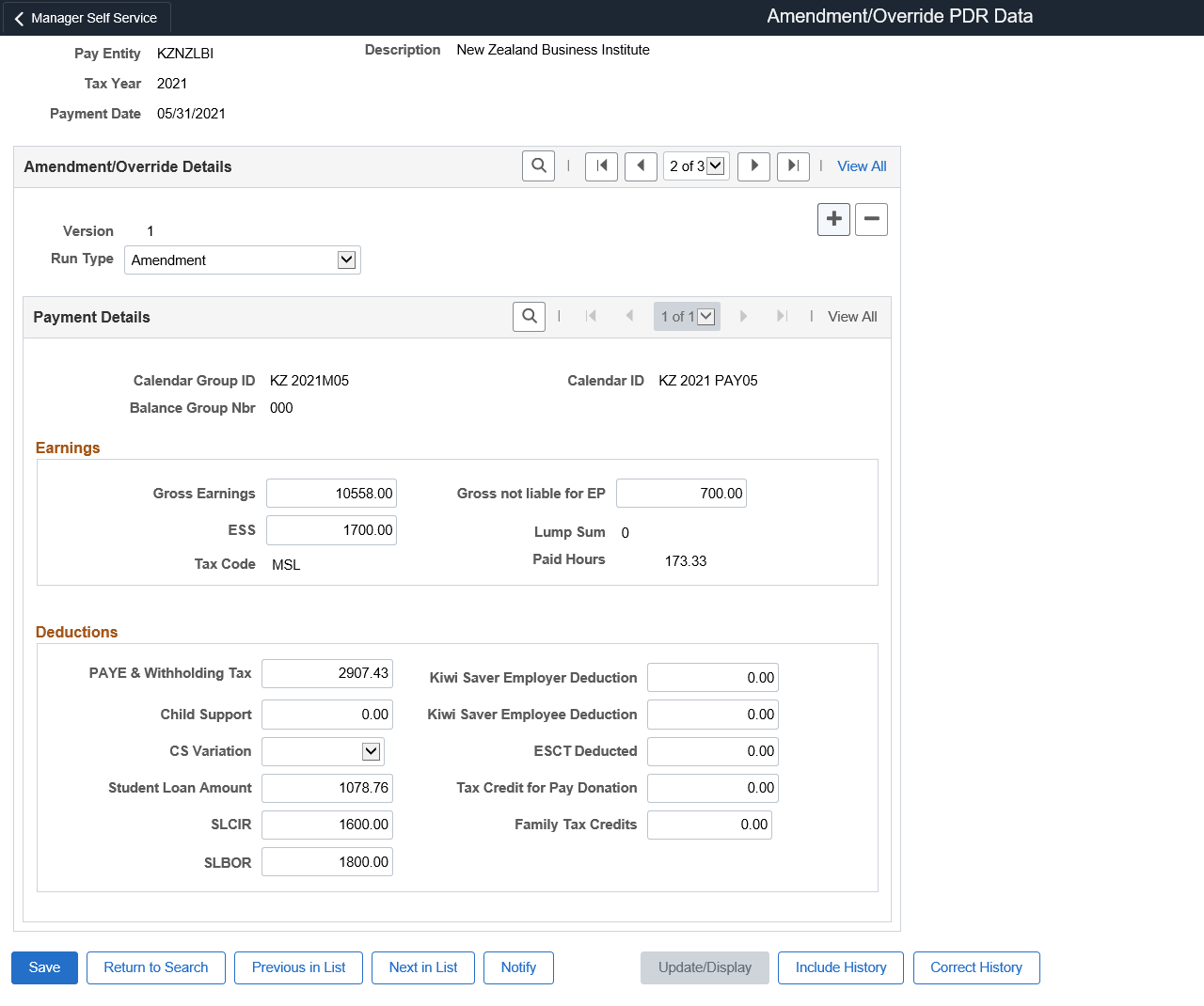

This example illustrates the Amendment/Override PDR page when Amendment is selected as the Run Type.

Note: The fields ESS, SLCR, and SLBOR are amended in the employee file with effect from April 2021.

Edit the earnings and deductions fields and save the record.

Once the changes are saved, create file from Create PDR Employment File page by selecting ‘Amendment’ in the report type. Amendment file with revised header and two rows for an employee depicting original and amended row is generated. Original line will have DTI as an indicator whereas the amendment line will have DAI as an indicator.