Creating IRD Data

This section discusses how to run the create IRD data process.

A single application engine process populates all the IRD data tables. The process creates data in the IRD Header Data table (GPNZ_IRD_HEADER).

When you run the program for the first half of the month, the process only creates IR 345/6 summary data.

When you run the program for the second half of the month, the process creates both IR 345/6 and IR 348 data. The process also creates exception rows where there are negative amounts in the data and for employees with a Child Support variation or incomplete IRD details.

If you run the program for a month that's already been issued (you have already sent the IR 348 file to the IRD) the process creates exception data for employees where their current data differs from that already reported.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_IRD_RC_CR8 |

Set the parameters to control the date output from the AE process. |

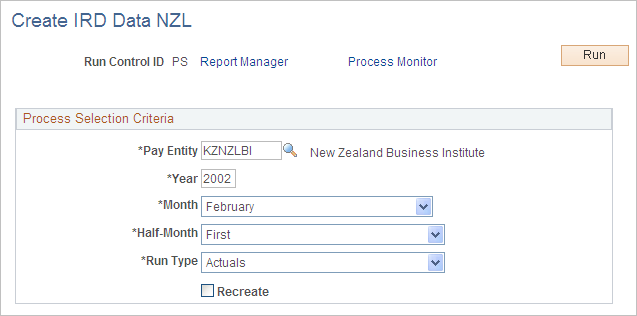

Use the Create IRD Data NZL page (GPNZ_IRD_RC_CR8) to set the parameters to control the date output from the AE process.

Navigation:

This example illustrates the fields and controls on the Create IRD Data NZL page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Half-Month |

Select First or Second. The selection that you make here interacts with your selections in the Run Type field and the Recreate check box. |

Run Type |

Accept the default Actual or select Exceptions. You can only select Exceptions if the half-month is two. When you select Exceptions, the process checks that the status of the IR 348 in the data table for the pay entity, year, and month is IR 348 Issued. |

Recreate |

If you select this check box for an actuals run, the process checks:

If you do not select this check box, the process checks:

|

Note: The Recreate check box has no effect on an exception run, so you should not select it.

Processing - General

If you select Recreate, the process deletes existing data from the IRD Header and Detail tables for the pay entity, year, and month.

If you selected a run type of Exception, the process deletes any existing data from the Temporary IRD Detail table for the pay entity, year, and month.

Processing for the First Half-Month

For the first half-month, the process retrieves the following amounts from the NZ IRD Results table:

PAYE tax amount: the total of the PAYE Tax, Extra Emolument Tax and Withholding Tax accumulators.

Child support amount.

Student loan amount.

SSCWT amount.

Processing for the Second Half-Month

For the second half-month, the process creates details for each employee that are paid during the whole month as well as the pay entity totals.

If the run type is Exception, the process writes the detail to the temporary table for comparison with the actual details at the end of the process.

Note: For employees with concurrent jobs who have different tax codes for each job, the process creates a separate row for each of their tax codes.