Creating Payday Reporting (PDR) Data

This section discusses how to run the create PDR data process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_PDR_RC_CR |

To update the Payroll data that is required for generating the Employment file. |

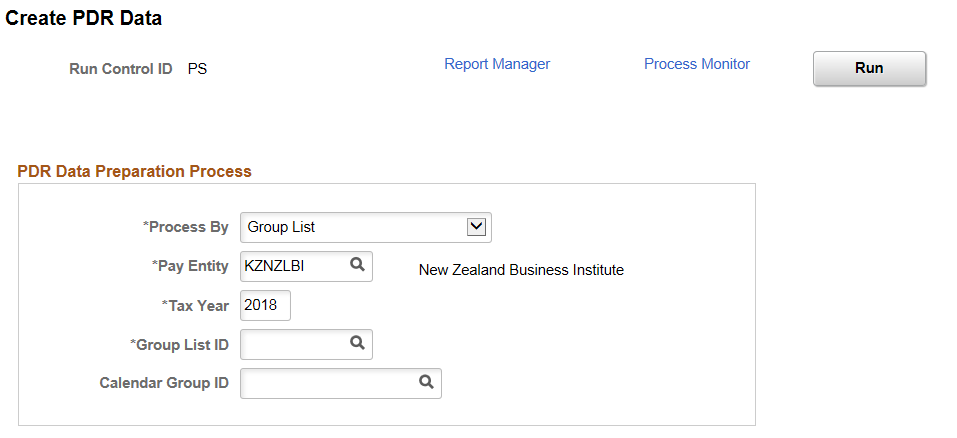

Use the Create PDR Data page (GPNZ_PDR_RC_CR) to update the Payroll data that is required for generating the Employment file. You can run this process before/after finalization of payroll for the respective pay period.

Navigation:

This example illustrates the fields and controls on the Create PDR Data Page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Process By |

Select the required processing option. Available values are:

|

Pay Entity |

Select the Pay Entity for which data is extracted. Details of the pay entity would be used as defined in the pay Entity IRD Details NZL component. |

Tax Year |

Select the tax year for which the PDR data needs to be processed. 1 April to 31 March is considered as a tax year. For example, if the reporting month is May 2017 then the tax year should be selected as 2018. |

Group List ID |

Enter the Group List ID, if you have selected the processing option as ‘Group List’. Note: This field is displayed only if you select ‘Group List’ in ‘Process By’ field. |

Calendar Group ID |

Enter the Calendar Group ID for which the employer would like to consider the payroll results for Payday Reporting data. |

Run |

Select the Run button, to run the PDR data preparation process. This process extracts the payroll data required for PDR reporting. |

Note: A log file is generated along with data preparation process to identify any missing mandatory fields and data format errors that has been prescribed by Inland Revenue. The log file consist of two parts, first part will pick the errors from the employer header data whereas the other one will show errors for the employee details.