Managing Termination Payments

PeopleSoft delivers a set of predefined rules for processing absences due to termination. PeopleSoft designed these rules in accordance with New Zealand statutory requirements. When an employee's services are terminated, regardless of the reason, the employer is obliged to make certain payments to the employee depending on the circumstances.

This section discusses how to:

Calculate gross total earnings (GTE).

Pay for outstanding leave—with the pay rate dependent on the length of service and leave entitlement.

Pay for any public holiday occurring within a set period of time after termination.

Pay for unused long service leave.

Define offset days for termination triggers.

An accumulator has been delivered to calculate Gross Total Earnings for the pro rata portion of termination payments, LVE AC GTE 6PCT.

It is designed for calculation of the annual leave pay using the 6 percent rule and earnings related to ACC leave are added to it at the ordinary rate rather than rate paid. ACC leave has the amount paid replaced with ordinary pay for this period when adding to the gross taxable earnings accumulator for 6 percent calculation. For earning ACC LVE, addition to the accumulator is performed at the percentage calculated in the formula LVE FM ACC GTE ACM as a ratio of ordinary rate over the calculated 80 percent ACC pay rate. This formula is used on the Earnings Accumulator page.

The Holiday Act provides two ways to calculate payment for annual leave on termination. These are when:

Employment ends within 12 months of service (pro rata leave has accrued only).

Employment ends after 12 months of service (entitlement and prorata leave has accrued).

When an employee is terminated in the first 12 months of service, they are entitled to a payment for annual leave of 6 percent of gross earnings during the employment.

When an employee terminates after 12 months service, the first amount to be calculated is the greater of the ordinary weekly pay or average weekly earnings for the annual leave that the employee is entitled to. The 12 months prior to the end of employment are used to establish average weekly earnings. The second amount to be added is for the period since the employee last became entitled to leave and is calculated at 6 percent of gross earnings since the entitlement arose.

The following is the process flow for the calculation of annual leave payments on termination:

When the payroll is run, Process List NZL PAYROLL calls Section TERMINATION, which will only resolve if formula CMN FM TERM STAT is true.

This formula checks to see if an employee has been terminated, and if this is true, the TERMINATION section will start to resolve.

Annual leave termination payments are processed as follows: formula TER FM CAL AL PAY, decides if the employee has more than 12 months of service, if this is true, it will invoke formula LVE FM ANN ROLAVG, which calculates the average rate for the 12 months prior to the termination date and compares it with the ordinary rate, and will pay the entitlement balance at the greater value.

If prorata annual leave needs to be paid, formula TER FM CAL AL PAY will invoke formula TER FM LEAVE PRORT.

This formula calculates the pro rata leave payment amount as 6 percent of GTE (Gross Taxable Earning) for the current leave year. Since 6 percent represents 3 weeks of leave, any leave taken in advance will decrease it. Formula TER FM LVE PRORT calculates the pro rata leave payment amount as follows:

GTE is retrieved from the pay period that contains the entitlement anniversary date until the end date of the last period before the current period and moved to LVE AC GTE 6PCT.

Leave pay is calculated on the basis of 6 percent of GTE as follows:

LVE AC GTE 6PCT × (ANN PRO DAYS_BAL / ANN PRO DAYS ENT) × 0.06

Lastly, formula TER FM ANN LVE PAY, retrieves the prorata and entitlement values, adds them together and sends them to earnings TER ANN LVE for payment.

Note: In order to process the annual leave upon termination override variable, TER VR HRS/DAY OVR needs to be specified at the pay group level. It should contain the number of hours used to convert daily balance and annual leave to hours.

A public holiday is paid on termination if the holiday has occurred after the termination date but during the period of annual leave entitlement days. The annual leave entitlement days are added to the termination date to project a new date. As part of the Holidays Amendment Act 2010, for sick leave an employee is entitled to be paid either relevant daily pay or average daily pay. So any public holidays are paid either ADP or RDP. Relevant daily pay is the amount the employee would have received had he or she worked on the day concerned.

Average daily pay is the employee's:

The calculation for this earning is unit * rate. Formulas ERB FM PUBHOL UNIT and ERN FM PUB SIC RTE are used respectively into unit and the rate. Formula ERN FM PUB SIC RTE is used to decide the hourly rate at which a particular employee is paid.

Note: ADP or RDP option can be selected for calculation of Sick leave and public leave in the maintain tax data page with effective from 1st April 2011. A field GPNZ_ADV_BUTTON is added in the record GPNZ_EE_TAX_DETAIL in order to store the RDP/ADP selection.

A new variable TAX VR EE OV DPC is created to store the value of the type of calculation that is to be used, ADP or RDP, for the employee. It is referenced in the array TAX AR EE TX DTL and is mapped to the field GPNZ_ADV_BUTTON of the record GPNZ_EE_IRD_DET. It stores a single character value, ‘Y’ or ‘N’.

Formula TER FM PUB HOL, is used to decide if public holidays need to be paid on termination.

The array TER AR PUB HOL retrieves the holiday schedule (HOLIDAY_DATE).

This array retrieves holidays where the date is greater than the termination date (TERMINATION DT) and less than or equal to the termination date plus the annual leave entitlement in days. Every row retrieved through the array has formula TER FM PUB HOL attached to it. This formula performs the following processing if the holiday date falls after the original termination date but before the termination date plus the annual leave entitlement (using duration TER DR PUB HOL AFT):

The start date for the period is calculated using date TER DT PUB HOL STR.

The new termination date, including annual leave, is calculated using date TER DT TERM +ANN.

The number of working days between the start date calculated in the previous step and the termination date using the work schedule is retrieved by array TER AR WRK SCH.

Formula TER FM WRK SCH accumulates the number of work days in the specified period and is executed for every row retrieved by the array.

The pay for the public holiday is calculated as follows:

Number Of Hours in Public Holiday × Ordinary Rate × Number of Public Holidays .

Holiday pay is accumulated into variable TER VR PUB HOL PAY, attached to the earning TER PUB HOL.

Array TER AR PUB HOL is included in the TERMINATION section of the payroll run.

Global Payroll for New Zealand enables you to pay an employee their unused long service leave when they are terminated. The termination process caters for unused long service leave payments as follows:

Absence entitlement LSL PRO DYS, using formula LVE FM LSL ENT, determines the pro rata values of the leave.

On the anniversary date specified in bracket LVE BR LSL ENT DYS, the current balance for the LSL PRO DYS entitlement (stored in accumulator LSL PRO DYS_BAL is moved to entitlement LSL ENT DYS.

Formula TER FM LSL TERM retrieves the balance and converts it to hours.

The outstanding hours in the LSL ENT DYS_BAL accumulator are paid at the ordinary rate.

The unused long service leave is calculated in formula TER FM LSL TER as:

LSL ENT DYS_BAL (Long Service Leave – Entitlement) × TER VR HRS/DAY OVR (Hours per Day of Leave to Pay)

The variable TER VR HRS/DAY OVR stores number of hours paid for every day of leave entitlement to be paid upon termination.

When you define retro triggers on the Trigger Definitions-Field Values page, you can enter a positive or negative number in the Offset Days field to increase or decrease the retro trigger effective date in relation to the date of a field value change. For example, if you enter -1 in the Offset Days field for one of the values listed in the Field Values group box, and you retroactively enter that value into the database with an effective date of January 1, 2000, the system automatically adjusts the trigger effective date to December 31, 1999 (one day earlier). The system then processes pay periods going back to December 1999 rather than January 2000.

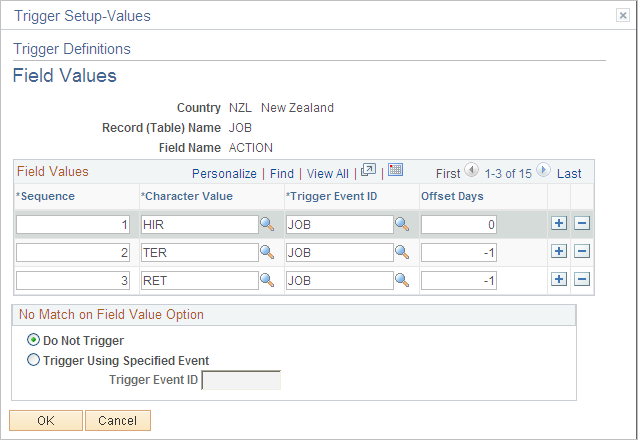

Global Payroll for New Zealand uses the offset days feature to define the triggers for retroactive terminations entered in the JOB record using the Action field. Access the Trigger Definitions Field Values page (Set Up HCM, Product Related, Global Payroll and Absence Mgmt, Triggers, Trigger Definitions, Trigger Definitions). Click the List Field Values link on the Trigger Definitions page:

This example illustrates the fields and controls on the Trigger Definitions-Field Values page showing New Zealand JOB actions that trigger retroactive termination processing page. You can find definitions for the fields and controls later on this page.

The offset for the termination actions TER, RET, RWP, TWP, and TWB is -1.

The reason for this offset is that the PeopleSoft system considers the effective date of a termination entered in the Action field in JOB to be the first day that a payee is no longer working (in other words, the day before the termination is the last day the payee is considered active); however, the effective date of the trigger generated in response to this termination is identical to the termination date. This can create problems when the termination date in the JOB record is equal to the pay period begin date (meaning, the last day worked is the last day of the prior pay period). For example, assume that you enter a termination in JOB on February 1 after processing and closing the January calendar. In this situation, the system generates a trigger with an effective date of February 1, which is within the current period—a period in which the payee is "inactive" and is not picked up for processing. Because there is no trigger in the prior, closed period (January), this period will not be recalculated and any rules set up to generate termination payments will not be processed. To avoid this problem, Global Payroll for New Zealand sets the offset days for the TER (termination), RET (retirement), RWP (Retirement with Pay), TWP (termination with pay), and TWB (termination with benefits) action values in the JOB record equal to -1.

Important! If you define additional action values to trigger retroactive termination payments, you should set the offset days to -1.