Setting Up Payday Reporting (PDR) Data

To set up Payday Reporting, use the Pay Entity IRD Details NZL (GPNZ_IRD_DTL) component.

This section discusses how to enter pay entity information for Payday Reporting.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPNZ_PYENT_DET |

Store information about the pay entity that is needed for Payday Reporting. |

Use the Pay Entity IRD Details NZL page (GPNZ_PYENT_DET) to store information about the pay entity that is needed for reporting to the IRD.

Navigation:

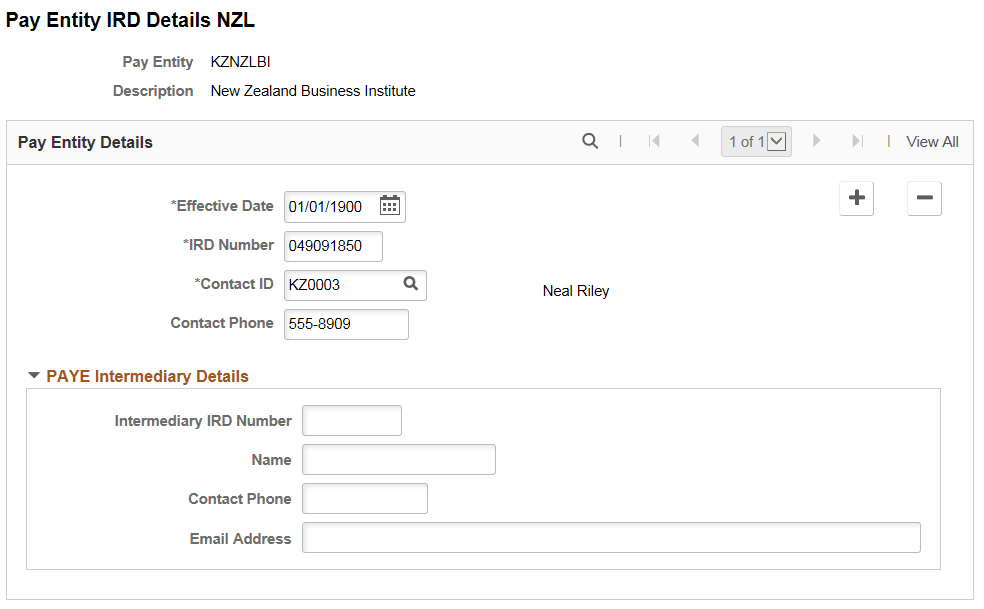

This example illustrates the Pay Entity IRD Details NZL.

Field or Control |

Description |

|---|---|

IRD Number |

Enter the number that the IRD allocates for the pay entity. Your entry is validated in the same way as employee IRD numbers are. |

Contact ID |

This is the employee in the organization that the IRD should contact as required. |

Pay Entity IRD Details NZL page has the provision for entering payroll intermediary details if the employer is using a payroll intermediary to submit the file. Then the intermediary details are captured in ‘PAYE Intermediary Details’ section and these details are picked up in the file for reporting.