Understanding IRD Reporting

This Global Payroll country extension enables you to meet the New Zealand IRD requirement to produce the IR 345/6 Employer Deductions Remittance certificate twice a month and the IR 348 Employer Monthly Schedule.

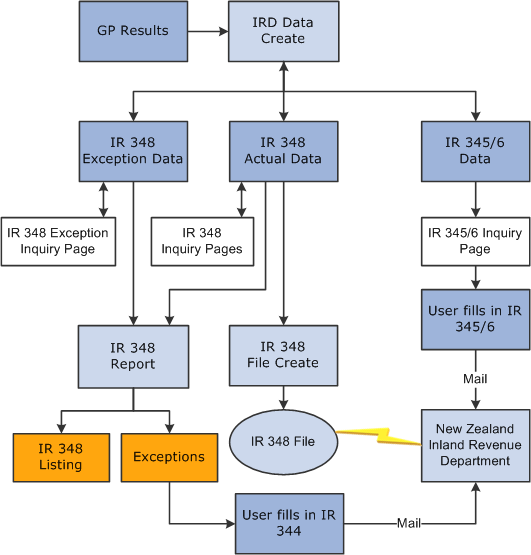

A single application engine process populates three types of IRD data tables:

The pay entity totals that are required for reporting on the IR 345/6 forms

For IR 345/6 employer deduction reporting, the system extracts payroll data, which you view on an inquiry page and copy to the IRD's preprinted forms.

The detailed, employee amounts required for reporting in the IR 348 file.

The system firsts calculates and stores the required data by employee so that you can review it and print it. When you are satisfied with the data, you can create the electronic file for submission to the IRD.

A table containing exceptions to the IR 384 data.

An exception report shows you if any payments that should have been reported, weren't reported.

The following diagram illustrates the IRD reporting process flow.