Understanding Taxation Calculation

This section discusses:

Tax accumulators.

Pay as you Earn (PAYE) tax and extra emolument tax.

Withholding tax.

Student loans.

Specified Superannuation Contribution Withholding Tax (SSCWT).

Child support deductions.

Superannuation and SSCWT.

The tax calculation process.

Calculation of correct tax related deductions is based on three accumulators:

Taxable Gross: All regular earnings are taxed as PAYE.

Extra Emolument: Bonus, back pay, and other irregular payments.

Retire\Redund: For payments that are made on retirement or redundancy.

The system calculates PAYE tax by using the Taxable Gross accumulator; tax on extra emoluments by using the extra emolument and retire\redund accumulators; and withholding tax, student loan repayments and child support payments on all three accumulators. You need to ensure that all taxable earnings and pretax deductions add to the appropriate accumulator.

Like payee tax details, the accumulators are keyed by employee ID, pay entity, and balance group.

PAYE tax is calculated by the formula TAX FM PAYE TAX, and extra emolument tax by formula TAX FM XE TAX. The formulas are the amounts that are in the calculation rule for the deductions PAYE TAX and EXTRA EMLMNT. The deductions both have generation control TAX GC PAYE & XE that uses formula TAX FM DET TAX TYP to return a value that determines whether to calculate tax for PAYE and extra emolument tax or withholding tax.

Withholding tax is calculated by the formula TAX FM WITHOLD TAX. The formula is the amount that is in the calculation rule for the deduction WITHHOLDING. The deduction has generation control TAX GC WT that uses formula TAX FM DET TAX TYP to return a value that determines whether to calculate tax for PAYE and extra emolument tax or withholding tax

There is a page in which you can view the various withholding tax percentages, including the No Declaration (ND) tax percentages, for the various nature of payment codes. You can change the status of the individual nature of payment codes.

Tax on student loans is calculated by the formula TAX FM SL TAX. The formula is the amount that is in the calculation rule for the deduction STUDENT LOAN. The deduction has generation control TAX GC SL that uses formula TAX FM DET SL TAX to return a value that determines whether to calculate tax student loan tax.

The SUP GRSUP ER deduction demonstrates the correct use of the SSCWT gross-up tax calculation. The calculation rule is an amount where the amount, set at payee level, is initially entered as a grossed-up amount. The deduction's postprocess formula, TAX FM SS GRS UP, calculates the SSCWT. It also adjusts the grossed-up amount to the value that's correct for the net amount.

No tax calculations are associated with child support deductions; you enter the dates and amounts by using the standard Payee Deduction Assignment page.

The child support deduction's calculation rule is an amount that is set at payee level. The post process formula TAX FM CS PROTECT ensures that the deduction does not reduce the employee's pay below the protected net as determined by the IRD.

The formula uses the value, set by the IRD, that you enter for the variable TAX VR CS PRT NET.

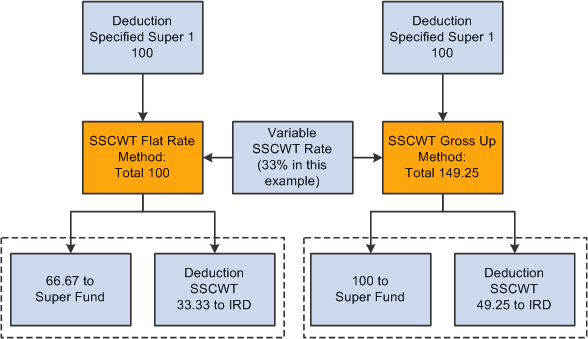

Superannuation deductions can have the SSCWT amount calculated by the flat rate method or the gross up method. For either method the rate can be the normal amount rate or the alternative rate. The employee can elect to have either calculation method use the higher rate.

For example, for an employer contribution of 100 at the normal rate of 33 percent:

The flat rate calculation results in 66.67 to super fund, 33.33 to IRD.

The gross-up calculation results in 100 to super fund, 49.25 to IRD (grossed-up amount = 149.25).

The following diagram illustrates this example and shows how the deduction amounts and super fund amounts are different for the two different calculations methods: