Viewing and Adjusting IRD Data

This section discusses how to review and adjust the child support variation.

Four pages enable you to view IRD reporting. In one of them you can change the status of the data. In another you can adjust the Child Support Variation code.

IRD345/6 Deductions and IRD348 Deductions

These two pages are in a single component. On the first page — IRD345/6 Deductions — you can see, for both half-months, the total PAYE deductions & withholding tax, and child support, student loan, and SSCWT deductions.

On the second page — IRD348 Deductions — you can see gross earnings, gross not liable for earner premium, PAYE deductions and withholding tax, and child support and student loan deductions. On this page you can change the status from issued to IRD 348 Ready if you need to recreate the data and if you haven't actually submitted the electronic file. If for some reason you have create the electronic file but do not want it to be submitted, you can also set the status to Not (to be) Issued.

IR348 Details

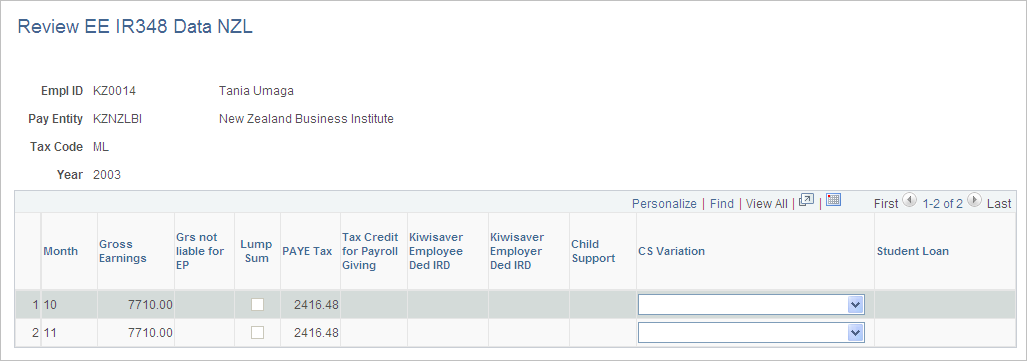

On the Review EE IR348 Data NZL page (navigation), you can view employee level IR 348 data and adjust the Child Support Variation code if required.

IRD Exceptions Inquiry Page

On the IRD Exceptions Inquiry page, you can view current data, which comes from the NZ IRD Exception record and the "as issued" data which is from the NZ IRD Details record. The system displays "as issued" data when there is a valid exception code.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

IRD345/6 Deduction Page |

GPNZ_INQ_IR345_6 |

View total PAYE deductions & withholding tax, and child support, student loan, and SSCWT deductions. |

|

IRD348 Deductions Page |

GPNZ_INQ_IR348 |

View gross earnings, gross not liable for earner premium, PAYE deductions and withholding tax, and child support and student loan deductions. |

|

GPNZ_INQ_IR_EMPLEE |

View employee level IR 348 data and adjust the Child Support Variation code if required. |

|

|

IRD Exceptions Inquiry Page |

GPNZ_IRD_EXCEP |

View current data from the NZ IRD Exception record and "as issued" data from the NZ IRD Details record. |

Use the Review EE IR348 Data NZL page (GPNZ_INQ_IR_EMPLEE) to view employee level IR 348 data and adjust the Child Support Variation code if required.

Navigation:

This example illustrates the fields and controls on the Review EE IR348 Data NZL page. You can find definitions for the fields and controls later on this page.

All the data on this page comes from the NZ IRD Details record.

Field or Control |

Description |

|---|---|

Lump Sum |

The system selects this check box if there is a value in EXTRA EMLMNT FMTDA (Extra Emolument - WA Reporting) accumulator for the month. |

CS Variation (child support variation) |

You can manually override the variation code if there is a value in the Child Support field. If there is no value in that field, the system displays 0 in the CS Variation field.

If the normal amount of the Child Support deduction is not the same as the amount in the month-to-date accumulator, the system determines why, using the IRD specified order of priority, and sets the CS variation code according to the conditions:

|