(CAN) Setting Up the Canadian Company Tax Table

To set up Canadian company tax information, use the Company Tax Table component (CO_CAN_TAX_TABLE) and the Wage Loss Plan Table component (WAGELS_PLN_TBL).

These topics discuss how to set up the Canadian Company Tax Table.

Note: The tax tables discussed in these topics are required for both the Payroll for North America and Payroll Interface applications. The documentation for each of these applications discusses additional tax data setup that is specific to the application.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CAN_USR_TAX_TABLE1 |

Identify the Prescribed Interest Percent, Province, Provincial Premium Tax Percent, and Health Insurance Rate Override for each company you set up. |

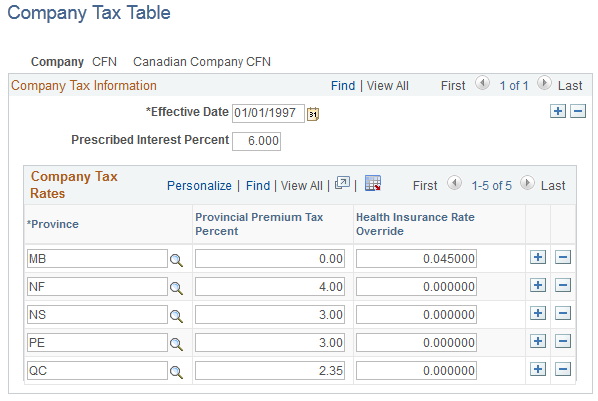

Use the Company Tax Table page (CAN_USR_TAX_TABLE1) to identify the Prescribed Interest Percent, Province, Provincial Premium Tax Percent, and Health Insurance Rate Override for each company you set up.

Navigation:

This example illustrates the fields and controls on the Company Tax Table page. You can find definitions for the fields and controls later on this page.

Note: It is your responsibility to update all rates on the Company Tax Table.

Company Tax Information

Field or Control |

Description |

|---|---|

Prescribed Interest Percent |

If your company processes low interest loans, enter the current prescribed interest percent. This rate is updated quarterly by the Canadian federal government. Warning! It is your responsibility to update the Prescribed Interest Percent field according to the rate set each quarter by the Canadian federal government. PeopleSoft does not update this field in its tax updates; PeopleSoft leaves the field blank. |

Company Tax Rates

Use these fields to enter company-specific overrides to provincial tax rates.

Important! The system ignores override values of zero. If the override value is 0.00, the system calculates taxes using the rates on the provincial tax tables.

Field or Control |

Description |

|---|---|

Province |

Enter all applicable provinces in which the company operates and needs to process PPT tax or override a Health Insurance Rate. |

Provincial Premium Tax Percent |

Enter the provincial premium tax percent applicable to group life and health insurance benefit plan premiums, if your company is responsible for withholding and submitting the tax. |

Health Insurance Rate Override |

Enter the health insurance rate override to specify the premium rate that applies to your company, if that rate is different from the rate defined on the Canadian Tax Table Provincial Rates page. This field applies to companies operating in provinces, such as Ontario and Manitoba, where variable rates apply based upon total gross payroll figures. |