(BRA) Providing Additional Information for Brazilian Employees

These topics discuss providing additional information for Brazilian employees.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PERSONAL_INFO_BRA |

Enter additional information about a person for Brazil. |

|

|

TAX_INFORM_BRA |

Manage tax exemption information for employees. |

|

|

TX_NO_WITHHELD_BRA |

Enter information regarding non-withholding of taxes or judicial deposits for employees. |

|

|

SUSP_DED_TXNW_BRA |

Enter details for deductions with suspended liability. |

|

|

ADDL_INFO_BRA |

Enter additional worker information. |

|

|

PERS_NID_HI_BRA |

Enter the effective dated national ID. This information is used in SEFIP reporting. |

|

|

CONTRCT_DTA_BRA |

Specify the first and second contract periods for the employee who has an active contract. |

|

|

EMPL_SPEC_TRAI_BRA |

List special training completed by employees. |

|

|

APPRENTICE_BRA |

Manage apprentice contract information. |

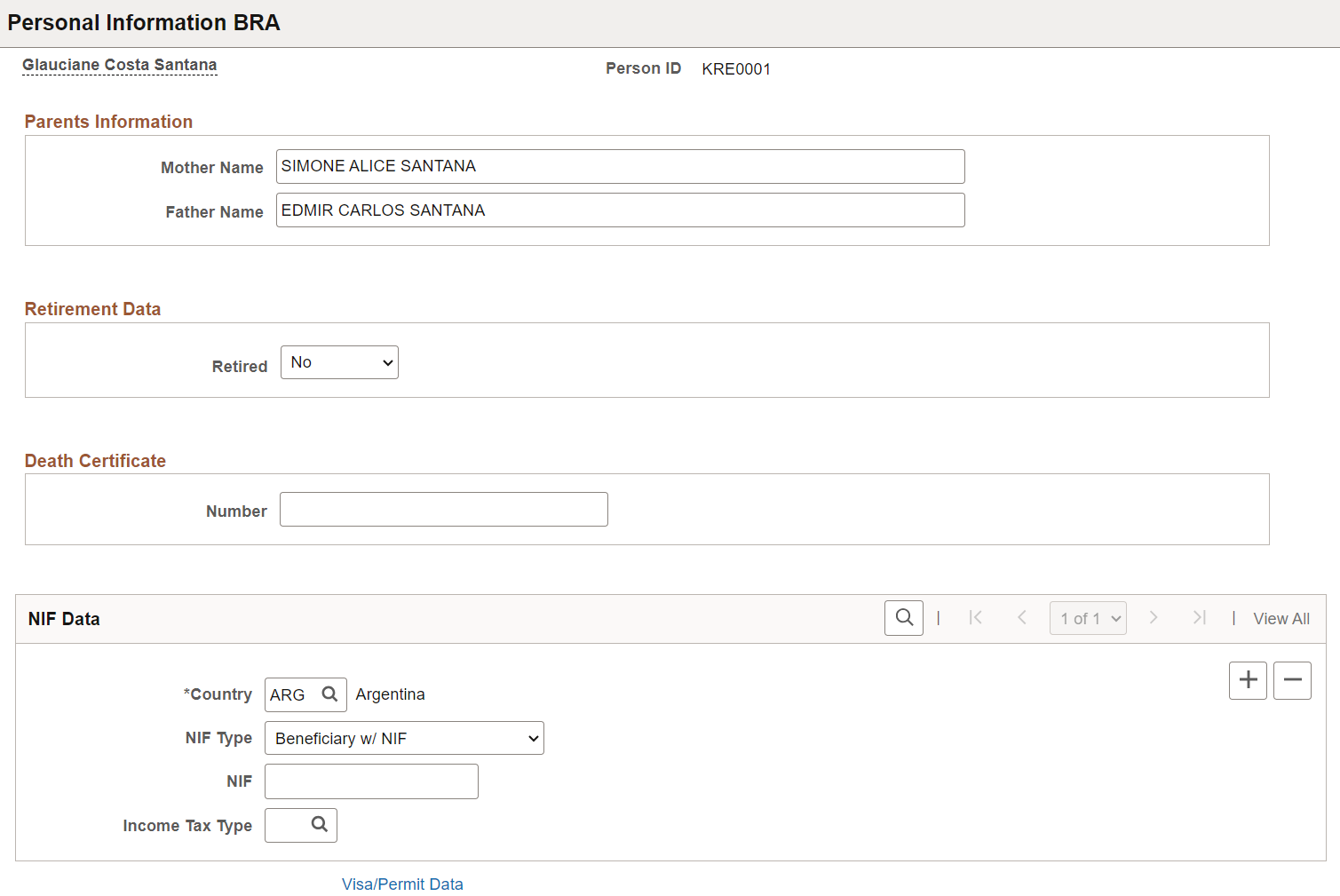

Use the Personal Information BRA page (PERSONAL_INFO_BRA) to enter additional information about a person for Brazil.

Navigation:

This example illustrates the fields and controls on the Personal Information BRA page.

Use this page to enter additional personal information, such as parental information, retirement data, death certificate number, NIF (foreign tax identification) data, and tax exemption information. Information entered in this section is used in eSocial reporting.

Retirement Data

|

Field or Control |

Description |

|---|---|

|

Retired and Date |

Select Yes if

the employee is retired, otherwise select No.

If the employee is retired, specify the retirement date. These fields are not used in eSocial reporting. |

Death Certificate

|

Field or Control |

Description |

|---|---|

|

Death Certificate Number |

Enter the death certificate number, if the employee is deceased. |

NIF Data

This section applies to employees who live outside of Brazil.

|

Field or Control |

Description |

|---|---|

|

Country |

Select the country where the employee resides, as specified in the home address on the Person Data Page - Contact Information Section. |

|

NIF Type |

Select the NIF (foreign taxpayer identification number) type. Values are: Beneficiary w/ NIF Country Does Not Require Exempt Beneficiary Not Applicable |

|

NIF |

Enter the taxpayer identification number if the selected NIF type is Beneficiary w/ NIF. |

|

Income Tax Type |

Specify the applicable income tax type. This field does not appear if the selected NIF type is Not Applicable. This information is used in S-1210 event reporting. |

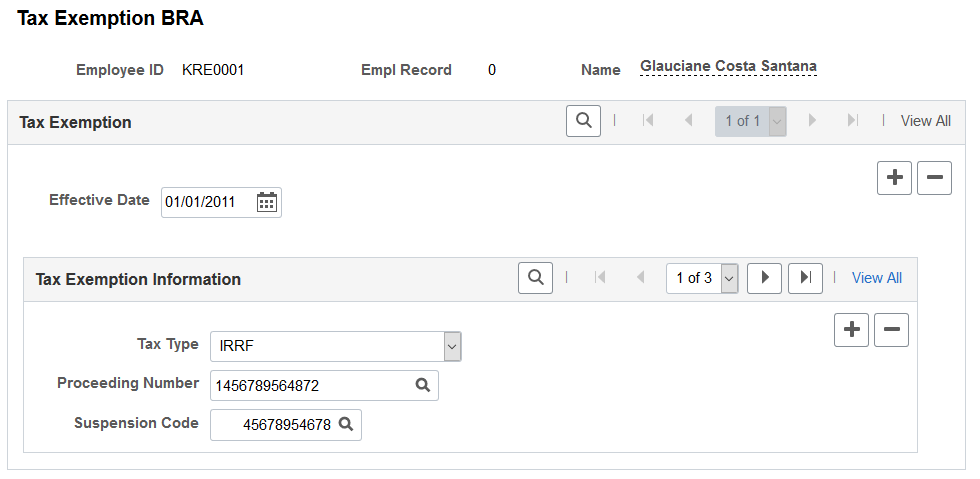

Use the Tax Exemption BRA page (TAX_INFORM_BRA) to manage tax exemption information for employees.

Navigation:

This example illustrates the fields and controls on the Tax Exemption BRA page.

Tax Exemption

|

Field or Control |

Description |

|---|---|

|

Effective Date |

Enter the tax exemption’s effective date. Do not enter a date that is earlier than employee’s hire date. The system uses this date to determine when the information needs to be reported to the Government. If a tax exemption is provisional, for example, an employee is granted an IRRF tax exemption for 4 months, enter a new effective-dated row after 4 months and remove the IRRF tax exemption from it. |

|

Tax Type |

Select the type of the tax exemption that the employee has. Values are: FGTS INSS IRRF Union Contribution Note: Both FGTS and Union Contribution tax types are no longer used in the S-1.0 version. These values are maintained as historical information and do not drive any eSocial processing in the system. If a tax type is specified, fill out the rest of the fields in this section. You can add multiple tax exemptions with the same tax type and proceeding number, as long as they have different suspension codes. |

|

Proceeding Number |

Select the proceeding number of the tax exemption. Proceeding numbers meeting all of these conditions are available for selection:

Note: The field prompt is available for use if the Enabled option is selected on the Adm/Legal Proceedings Parameters BRA Page. Enter the number manually, if the option is not selected. Proceedings are defined on the Administrative/Legal Proceedings BRA Page. |

|

Suspension Code |

Select the tax suspension code for the specified proceeding number. Note: The field prompt is available for use if the Enabled option is selected on the Adm/Legal Proceedings Parameters BRA Page. Enter the code manually, if the option is not selected. |

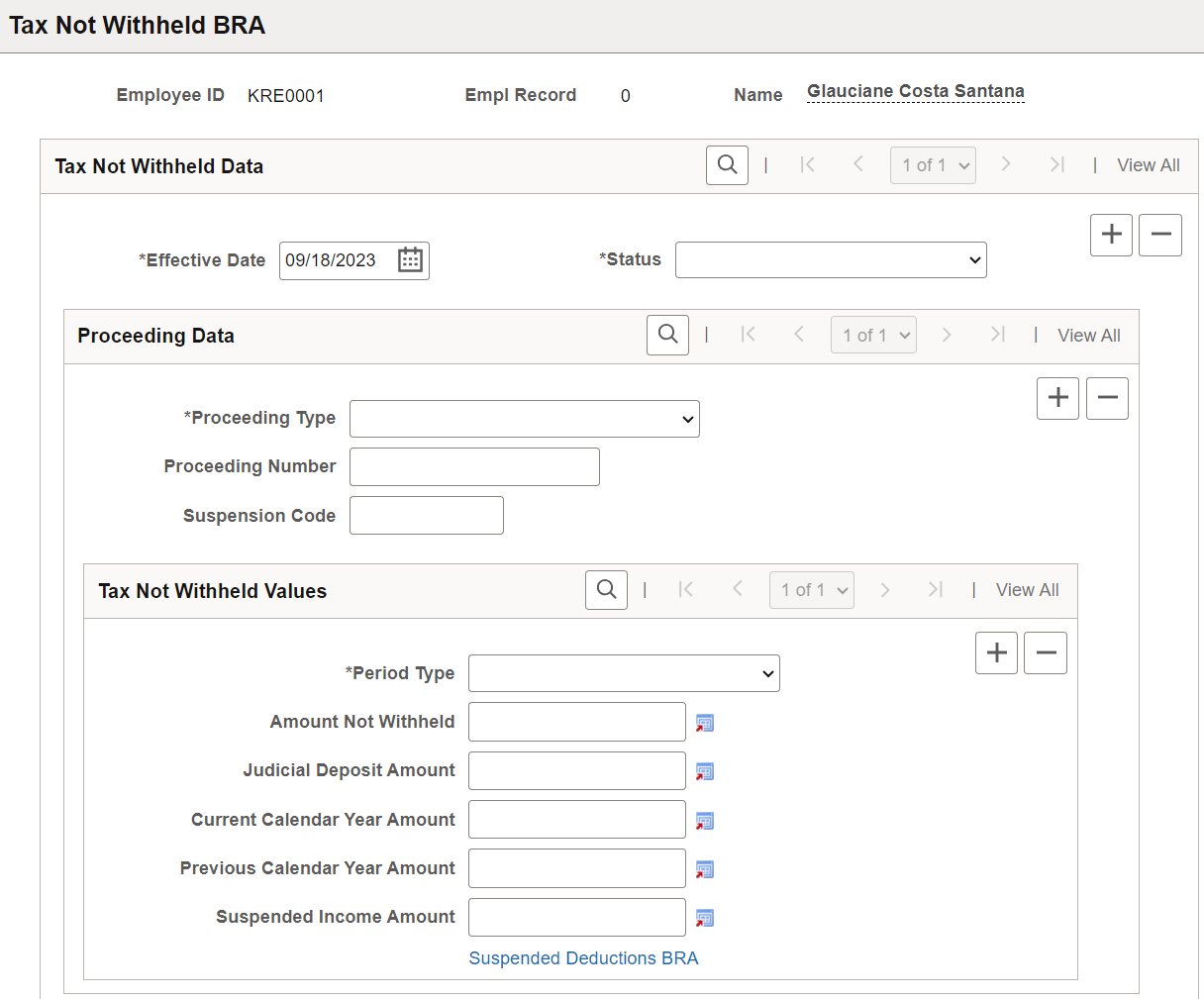

Use the Tax Not Withheld BRA page (TX_NO_WITHHELD_BRA) to enter information regarding non-withholding of taxes or judicial deposits for employees.

Navigation:

This example illustrates the fields and controls on the Tax Not Withheld BRA page.

This information is used in S-1210 event reporting.

Proceeding Data

|

Field or Control |

Description |

|---|---|

|

Proceeding Type |

Enter the government proceeding type. Values are: Administrative Judicial |

|

Proceeding Number |

Enter the proceeding number, or select the proceeding number if the option for proceedings parameters is enabled on the Adm/Legal Proceedings Parameters BRA Page. Proceedings are defined on the Administrative/Legal Proceedings BRA Page. |

|

Suspension Code |

Enter the suspension code, or select the suspension code if the option for proceedings parameters is enabled on the Adm/Legal Proceedings Parameters BRA Page. |

Tax Not Withheld Values

|

Field or Control |

Description |

|---|---|

|

Period Type |

Select the calculation period. Values are: Annual (13th Salary) Monthly |

|

Amount Not Withheld |

Enter the withholding amount that is no longer made to the government due to the specified proceeding. |

|

Judicial Deposit Amount |

Enter the judicial deposit amount for the specified proceeding. |

|

Current Calendar Year Amount |

Enter the compensation amount received in the current calendar year due to the specified proceeding. |

|

Previous Calendar Year Amount |

Enter the compensation amount received in the previous year due to the specified proceeding. |

|

Suspended Income Amount |

Enter the income amount with suspended liability. |

|

Suspended Deductions BRA |

Select to provide more details for the suspended deduction on the (BRA) Suspended Deductions BRA Page. |

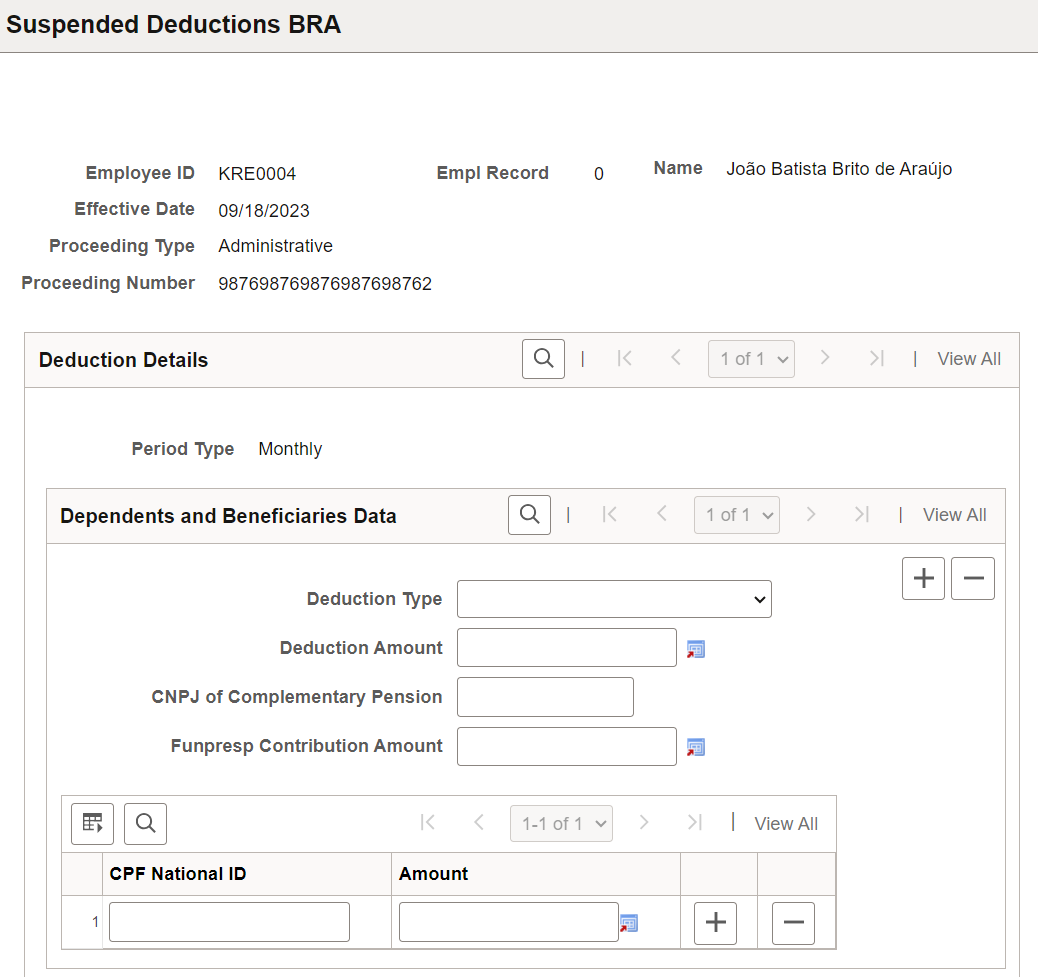

Use the Suspended Deductions BRA page (SUSP_DED_TXNW_BRA) to enter details for deductions with suspended liability.

Navigation:

Select the Suspended Deductions BRA link on the (BRA) Tax Not Withheld BRA Page.

This example illustrates the fields and controls on the Suspended Deductions BRA page.

The header information comes from the associated legal proceeding that was previously entered on the (BRA) Tax Not Withheld BRA Page.

If the key information of the proceeding (such as the effective date, proceeding type, proceeding number, suspension code, or period type) is modified on the (BRA) Tax Not Withheld BRA Page, the system deletes the associated suspended deduction information automatically. You need to reenter the information.

This information is used in S-1210 event reporting.

|

Field or Control |

Description |

|---|---|

|

Deduction Type |

Select an applicable type for the deduction with suspended liability. Values are: Alimony Dependents FAPI Funpresp Private Pension Public Pension |

|

Deduction Amount |

Enter the amount of deduction from the income tax calculation base with suspended liability. |

|

CNPJ of Complementary Pension |

Enter the 14-digit registration number of the supplementary pension entity. |

|

Funpresp Contribution Amount |

Enter the contribution amount from the public entity sponsoring the Complementary Pension Fund for Public Servants (Funpresp), if the selected deduction type is Funresp. |

|

CPF National ID and Amount |

Enter the CPF of the dependent or alimony beneficiary, and their deduction amount with suspended liability. |

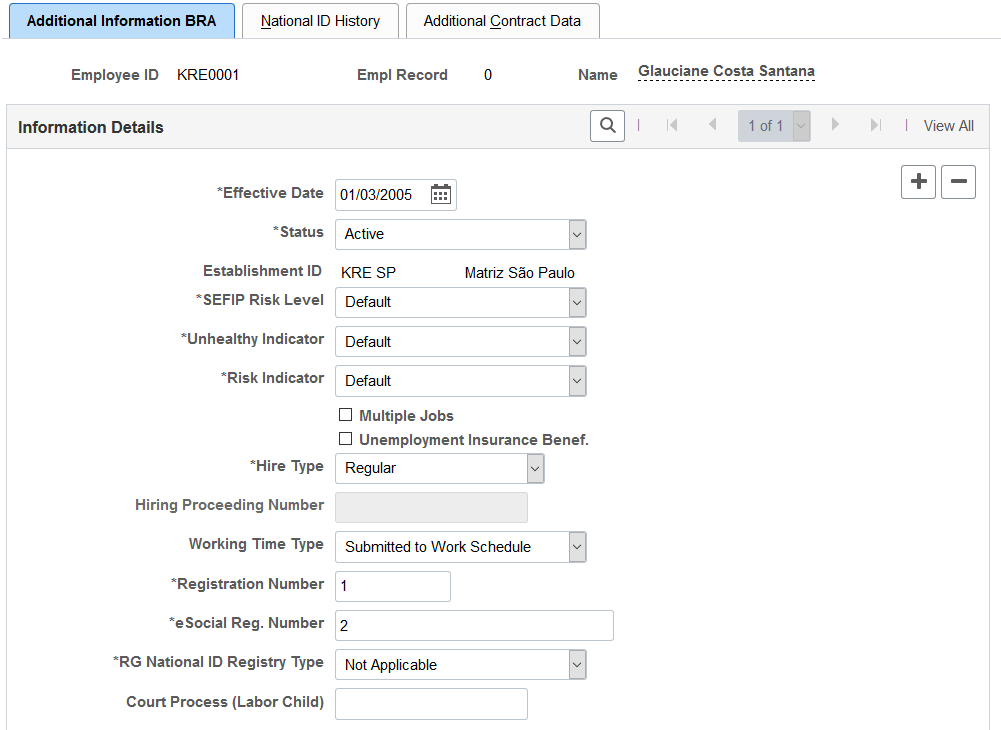

Use the Additional Information BRA page (ADDL_INFO_BRA) to enter additional worker information.

Navigation:

This example illustrates the fields and controls on the Additional Information BRA page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Additional Information BRA page (2 of 2). You can find definitions for the fields and controls later on this page.

Note: If you have Global Payroll for Brazil installed, you can override the values on this page using the Payee Parameters page.

|

Field or Control |

Description |

|---|---|

|

SEFIP Risk Level |

Select the appropriate risk level for the employee's activities. The system uses this information to generate the SEFIP report and to determine the employee's retirement deduction. |

|

Unhealthy Indicator |

Select the appropriate health risk level for the employee's activities. The system uses this indicator to calculate an earning that compensates for this health risk factor. Values are: Default Maximum Grade Middle Grade Minimum Grade Not Applicable |

|

Risk Indicator |

Select the appropriate hazard level for the employee's activities. The system uses this indicator to calculate an earning that compensates for this hazardous factor. Values are Applicable, Default, and Not Applicable. |

|

Multiple Jobs |

Select to specify whether this person has one or more jobs outside of this company. |

|

Unemployment Insurance Benef. (unemployment insurance benefits) |

Select to specify that this person (new employee) receives unemployment benefits. This field is editable if the effective date corresponds to a Hire or Rehire action in this person’s job data. If the newly hired or rehired employee receives unemployment benefits, the company needs to send the CAGED information to the Ministry of Labor and Employment on the same day that the employee begins to work. If the employee does not receive unemployment benefits, the company has until the 7th day of the next month to send out the information, along with other terminated and transferred employment information that occur in the current month. |

|

Hire Type |

This field appears if the employee’s job data action is HIRE and that effective dates of that job data and this additional information record are the same. Values are: Court Decision Fiscal Action Regular |

|

Hiring Proceeding Number |

Enter the processing number of the court decision, if the hiring is the result of a court decision. This field becomes editable if Court Decision is selected as the hire type. |

|

Working Time Type |

Select the applicable working time. Values are: External Activity Functions Specific Not Applicable Submitted to Work Schedule (default) Telecommuting This information is used in eSocial reporting. |

|

Registration Number |

Enter the employee's registration number. This number acts as an alternate employee ID. When an employee is hired, transferred, or rehired through the Job Data component, the system updates this field with the next registration number listed on the Additional Info - Brazil Page of the establishment that is associated with the employee. If an employee was terminated and later rehired with the same establishment, the same registration number is used. |

|

eSocial Reg. Number |

Displays or enter the employee’s 30-digit register number in eSocial. The value in this field is different depending on the eSocial numbering method that is selected for the associated company on the (BRA) Company Details BRA Page. If the method is DRT Number, the field value should be the same as the registration number on this page. If the method is Specific to eSocial, the field values should be the sum of the eSocial Last Reg Number field value (on the (BRA) Company Details BRA Page) plus 1. Note: This number must be present for all employees in companies before they perform initial data loading to the eSocial reporting environment. A new eSocial register number is assigned when the employee is transferred to another company. |

|

RG National ID Registry Type |

Select the applicable RG national ID registry type for the employee. |

|

Court Process (Labor Child) |

Enter the judicial process number if the employee is a child labor. |

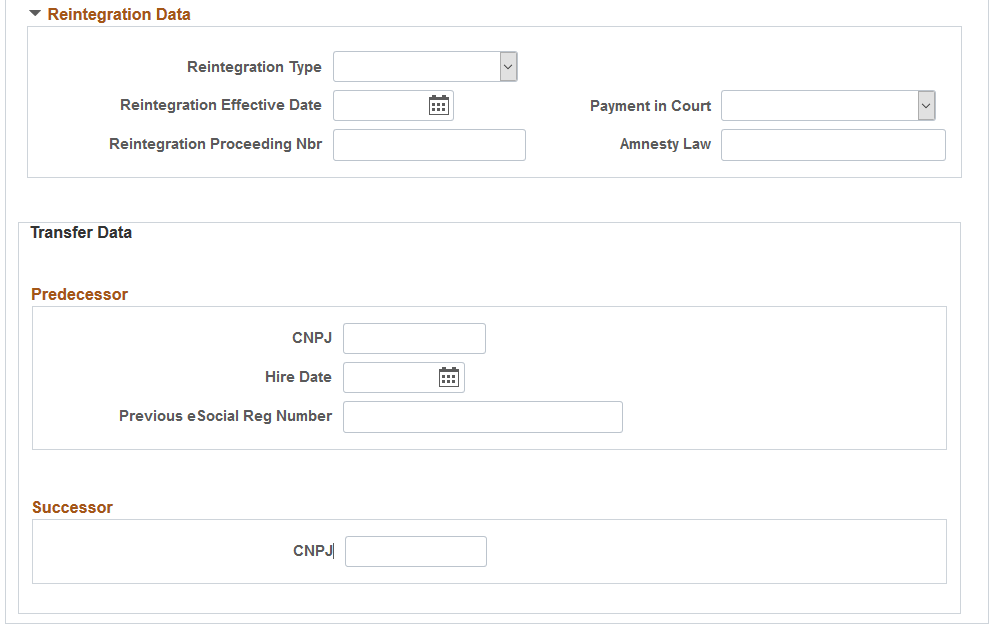

Reintegration Data

Enter reintegration data for the employee. If the Rehire action and a reason is selected in the employee’s Job Data record, and that action and reason combination is set up for eSocial reporting, the information entered in this section will be used in the employee reinstatement event processing.

|

Field or Control |

Description |

|---|---|

|

Reintegration Type |

Select the reintegration type. Reintegration refers to the rehiring of an employee by court decision, which ensures that all the rights of the previous contract stay intact. Values are: Amnesty Judicial Decision Others |

|

Reintegration Effective Date |

Enter the effective date of the reintegration. This value becomes required when you enter information in the Reintegration Data section. |

|

Payment in Court |

Select Yes if court payment was involved. |

|

Reintegration Process Nbr |

Enter the associated judicial proceeding number, if the selected reintegration type is Judicial Decision. |

|

Amnesty Law |

If the reintegration type is Amnesty, specify the applicable amnesty law. |

Transfer Data

Enter employment transfer data for the employee. If the Hire, Termination, or Transfer action and a reason is selected in the employee’s Job Data record, and that action and reason combination is set up for eSocial reporting, information entered in this section will be used in the hiring or termination event processing.

Predecessor

Complete this section if the employee moved from an employer (the predecessor) that does not use PeopleSoft for eSocial reporting to the current employment that does. The information specified here will be reported to the government through the S-2200 event.

|

Field or Control |

Description |

|---|---|

|

CNPJ |

Enter the CNPJ number of the predecessor of the individual’s employment transfer. An establishment’s CNPJ is a 14-digit long number that is displayed in this format: 99999999999999. |

|

Hire Date |

Enter the employee’s hire date with the predecessor. |

|

Previous eSocial Reg Number |

Enter the employee’s 30-digit register number in eSocial with the predecessor. |

Successor

|

Field or Control |

Description |

|---|---|

|

CNPJ |

Enter the CNPJ number of the successor of the individual’s employment transfer. Specify this value if the employee left the current employment to work for an employer (the successor) that does not use PeopleSoft for eSocial reporting. The information will be reported to the government through the S-2299 event. An establishment’s CNPJ is a 14-digit long number that is displayed in this format: 99999999999999. |

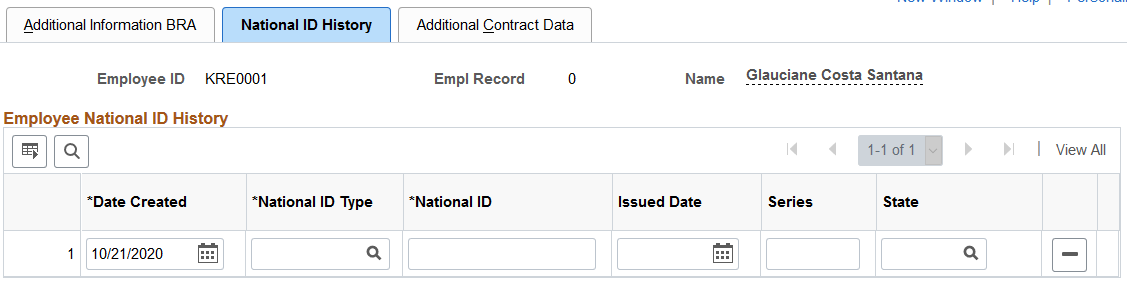

Use the National ID History page (PERS_NID_HI_BRA) to enter the effective dated national ID.

This information is used in SEFIP reporting.

Navigation:

This example illustrates the fields and controls on the National ID History page. You can find definitions for the fields and controls later on this page.

Enter a Brazilian employee's PIS and CTPS (work card) national IDs and supporting data on the Biographical Details and Regional pages of personal data. When one of these national IDs is updated in personal data, a new history record, containing the national ID as well as the additional related data found on Regional page, are entered on the National ID History page. These values can be modified or deleted on this page.

|

Field or Control |

Description |

|---|---|

|

Date Created |

Displays the date the national ID was entered in the system. This date is used in SEFIP reporting. |

|

National ID Type |

The national ID comes from the Biographical Details page of personal data. The national ID history only allows the CTPS (work card) and PIS values. |

|

National ID |

Displays the historical national ID number. |

|

Issued Date |

Specifies the date this ID was issued. This information comes from the Regional page of personal data. Data entered in the CTPS group box of the Regional page displays for the CTPS (work card) national ID type. The issue date for the PIS national ID type comes from the date entered in the Inscription Date field on the Regional page of personal data. |

|

Series |

Enter the work card number. This value comes from the Regional page of personal data in the CTPS group box. |

|

State |

Enter the political subdivision of the CTPS issuing agency. This value comes from the Regional page of personal data in the CTPS group box. This information is required if a CTPS number is provided. |

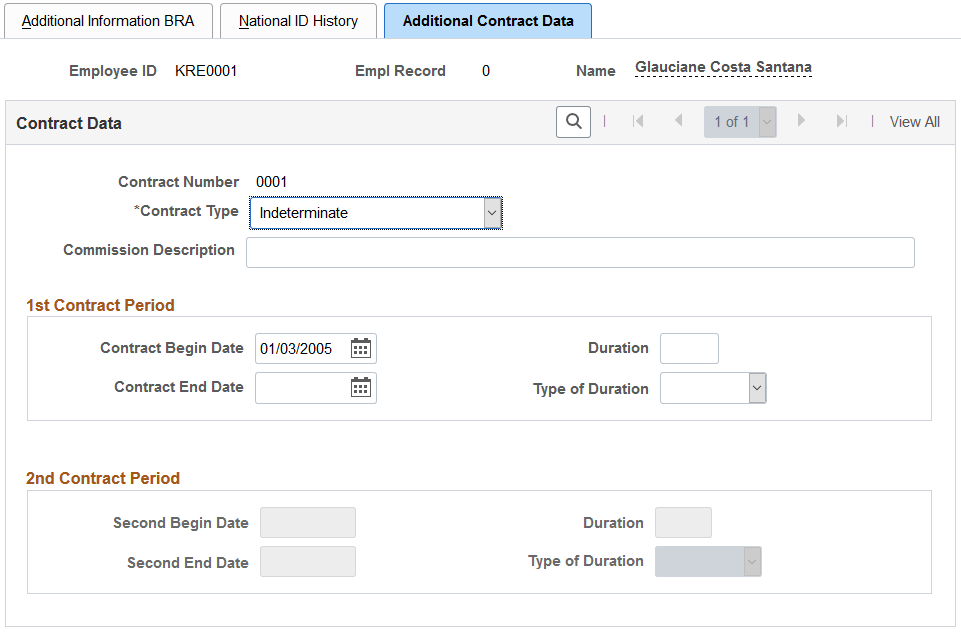

Use the Additional Contract Data page (CONTRCT_DTA_BRA) to specify the first and second contract periods for the employee who has an active contract.

Navigation:

This example illustrates the fields and controls on the Additional Contract Data page. You can find definitions for the fields and controls later on this page.

After you specify the contract dates and save the page, the system updates the expected contract end date on the Contract Status/Content Page with the contract end date listed here (the farthest of the two). The expected contract end date is used in processing payroll rules and reports.

Contract Data

|

Field or Control |

Description |

|---|---|

|

Contract Number |

Displays the number of the contract, if available, that is populated from the Job Information Page. |

|

Contract Type |

Select the legal contract type for the contract. If the value is populated by the system, the value is determined based on the contract information that is defined on the Job Information Page and the contract type setup that is defined on the Legal Contract Type Page or the By Employee Classification Page. Values are: Indeterminate: if selected, you can enter any value as the contract end date or duration. Determinate: if selected, the contract end date you entered must be within the two-year period starting from the contract begin date. Only the 1st contract period is available for edits. To support eSocial reporting, select this option for employees who are apprentices. Indeterminate w/probation prd (indeterminate with probation period): if selected, you can assign both periods a total of 90 days combined. |

|

Clause of Early Termination |

This field appears if the selected contract type is either Indeterminate w/probation prd or Determinate. |

|

Commission Description |

(Optional) Enter the sales commission description. |

1st Contract Period

Specify the first contract period by either entering the contract begin and end dates, or entering the contract begin date and the duration of the contract (for example, 2 months, 30 days, and so on). If the latter method is used, the system calculates and populates the contract end date in this section automatically.

Note: When either the contract begin date or the duration is updated, the contract end date is recalculated accordingly.

An error is displayed if the begin date entered is greater than the end date.

2nd Contract Period

The system populates the second begin date value by adding 1 day to the current contract end date. When the duration is specified, the system calculates and populates the second end date automatically.

Note: If the contract end date is recalculated due to a change in the contract begin date or duration, and the newly adjusted second begin date value is not equal to the current second begin date, the system populates the newly adjusted second begin date and clears the second end date and duration values in this section.

An error is displayed if the begin date entered is greater than the end date, or if the contract end date is removed manually when the second begin date value is present.

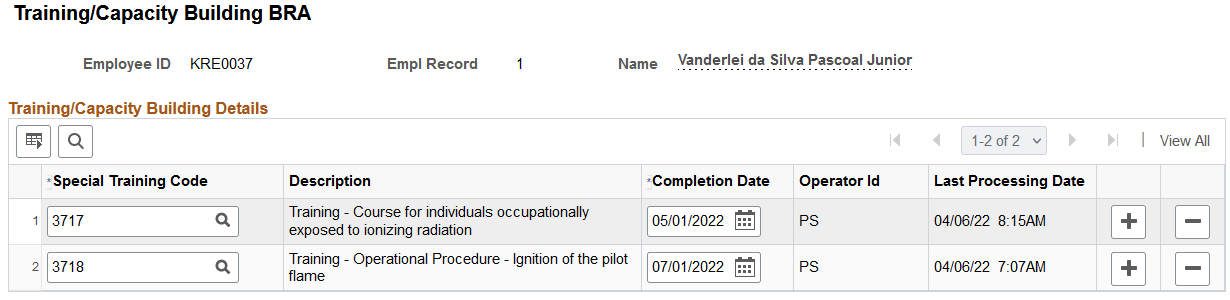

Use the Training/Capacity Building BRA page (EMPL_SPEC_TRAI_BRA) to list special training completed by employees.

Navigation:

This example illustrates the fields and controls on the Training/Capacity Building BRA page. You can find definitions for the fields and controls later on this page.

The system reports this training information for employees to the Brazilian Government using S-2200 and S-2206 events in eSocial. For employees with multiple jobs, training information needs to be added to all applicable employee records.

It doesn't apply to employees who are associated with 721, 722, or 901 (not employed) labor categories through their employee classification.

If the training data exists in another PeopleSoft module or a legacy system, a component interface (CI_EMPL_TRAINING_BRA) is available to load this data to the Training/Capacity Building BRA page for employees.

|

Field or Control |

Description |

|---|---|

|

Special Training Code |

Specify the code of the training taken by the employee. |

|

Completion Date |

Specify the date the training was completed. |

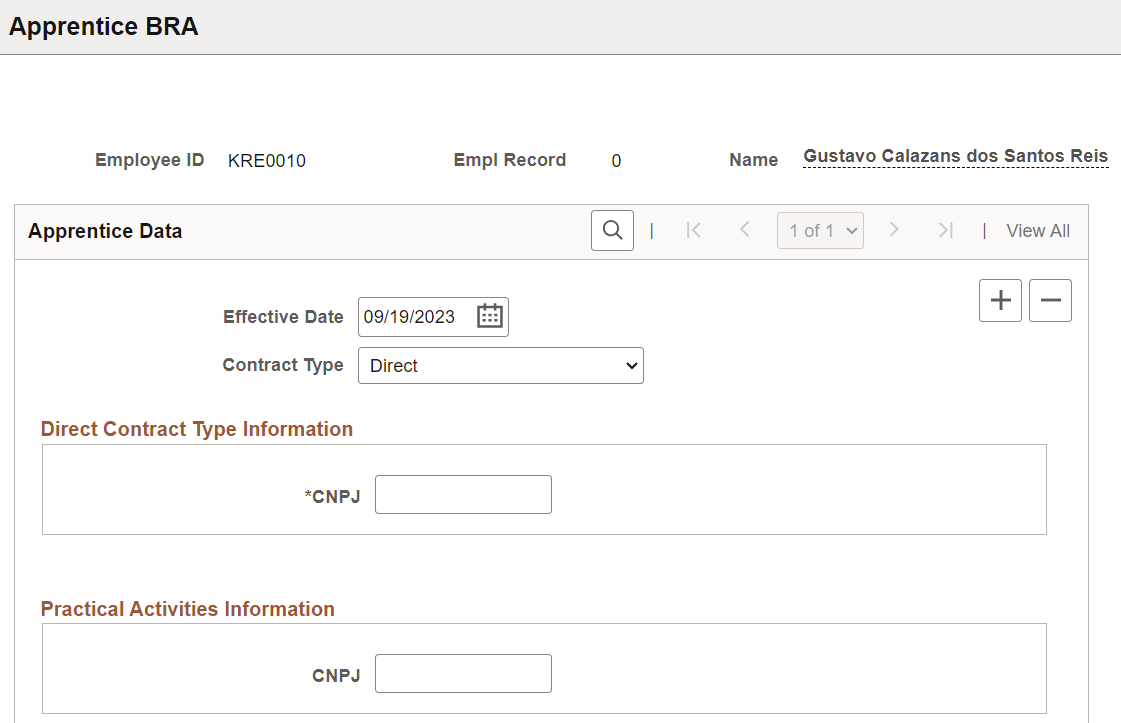

Use the Apprentice BRA page (APPRENTICE_BRA) to manage apprentice contract information.

Navigation:

This example illustrates the fields and controls on the Apprentice BRA page.

You can enter apprentice contract information for individuals with the Trainee employee class in Job Data.

This information is used in S-2200, S-2205, and S-2206 event reporting.

|

Field or Control |

Description |

|---|---|

|

Contract Type |

Specify whether the apprentice contract is a Direct or Indirect one. |

Direct Contract Type Information

This section appears if the selected contract type is Direct.

|

Field or Control |

Description |

|---|---|

|

CNPJ |

Enter the CNPJ number of the establishment for which the apprentice was hired. |

Indirect Contract Type Information

This section appears if the selected contract type is Indirect.

|

Field or Control |

Description |

|---|---|

|

Inscription Type and Inscription Number |

Select the registration type (CNPJ or CPF) of the establishment for which the apprentice was hired, and enter the corresponding registration number. |

Practical Activities Information

|

Field or Control |

Description |

|---|---|

|

CNPJ |

Enter the CNPJ number of the establishment where the practical activities are being carried out, when occurred. |