(GBR) Tracking Company Cars and Vehicle Incidents

This topic discusses how to track company cars and vehicle incidents.

Note: To track company cars and vehicle incidents, use the Calculate P11D Information (CALC_P11D_SEC_A) and Verify P11D Information (VIEW_P11D_SEC_A) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_COMPCAR001 |

To calculate the P11D Information amounts, run the CAR001 process. You can run the report for one worker at a time or for all eligible workers. |

|

|

P11D_SEC_A_UK |

Verify P11D Information calculation results online. |

|

|

Process Notes Page |

P11D_NOTES_UK |

View benefit calculation details. |

To use the PeopleSoft HR Monitor Health and Safety application to track vehicle incidents related to company cars, you must define each car as an item of company property. Do this on the Company Property Table Setup page. Once you define a car as company property, use the Incident Data and Vehicle/Equipment Detail pages to record details of any incidents involving the employee and the car, or use the Monitor Health and Safety menus.

You can allocate a company car, without transfer of property, to a director or worker earning more than the statutory threshold. This car is then also available to the worker or director for private use.

There are various tax implications when you allocate a company car to a worker. Companies pay tax in the form of Class 1A National Insurance Contributions (NICs). Workers pay income tax based on their tax codes, which is adjusted to take into account the taxable benefit of the car. In both cases, the taxable benefit is based on the list price, business mileage, age, and periods of unavailability of the car. To find out more about legal requirements, contact the Inland Revenue.

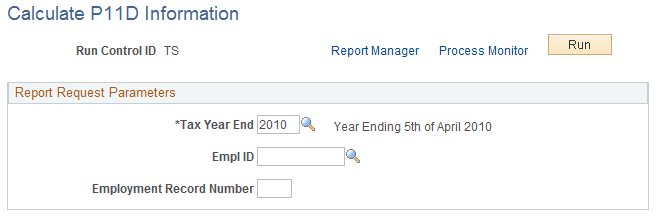

Use the Calculate P11D Information page (RUNCTL_COMPCAR001) to to calculate the P11D Information amounts, run the CAR001 process.

You can run the report for one worker at a time or for all eligible workers.

Navigation:

This example illustrates the fields and controls on the Calculate P11D Information page.

Field or Control |

Description |

|---|---|

Run Control ID |

Displays the run control ID that you entered. |

Tax Year End |

Define values on the Translate table |

Empl ID (employee identification) |

Leave this field blank to run the report for all eligible workers, or enter an ID to run the report for only one worker. |

Employment Record Number |

Leave this field blank to run the report for all worker records, or enter an employment record number to run the report for only one worker record. |

Run |

Click this button to calculate P11D Information. |

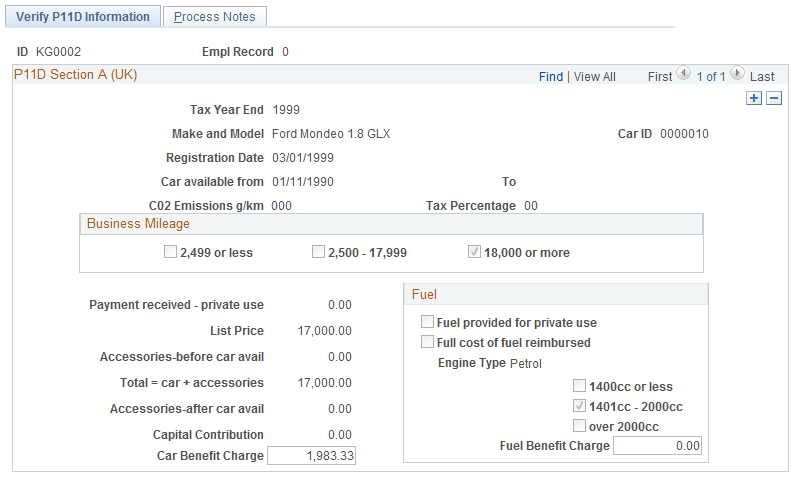

Use the Verify P11D Information page (P11D_SEC_A_UK) to verify P11D Information calculation results online.

Navigation:

This example illustrates the fields and controls on the Verify P11D Information page.

Each data row relates to a car for the worker per tax year. If a worker had two cars during the tax year, there are two data rows for that worker. If a worker had the same car for two tax years, there are also two rows of data. Use the scroll arrows to move between rows.

If you find errors in the display-only fields on the page, update the core data and rerun CAR001.

Field or Control |

Description |

|---|---|

Tax Year End, Car available from andPayment received - private use |

Display values that you defined on the Assign Type of Car/Dates page. |

Make and Model andRegistration Date |

Display values that you defined on the Car Data page. |

CO2 Emissions g/km (carbon dioxide emissions in grams per kilometer) andTax Percentage |

Displays value that you defined on the Emissions Data UK page. |

Business Mileage |

Select from: 2,499 or less, 2,500 − 17,999, or 18,000 or more. |

List Price |

Displays the value that you defined on the Car Model page. |

Accessories-before car avail., Total = car + accessories, andAccessories-after car avail. |

Displays values that you defined on the Car Data page. |

Capital Contribution |

Display values that you defined on the Assign Type of Car/Dates page. |

Car Benefit Charge |

Adjust benefit charge amounts that require complex manual calculations. |

Fuel

Field or Control |

Description |

|---|---|

Fuel provided for private use andFull cost of fuel reimbursed |

Display values that you defined on the Assign Type of Car/Dates page. |

Engine Type andEngine Size |

Displays values that you defined on the Car Model page. Values are: 1400cc or less, 1401cc − 2000cc, and over 2000cc |

Fuel Benefit Charge |

Adjust benefit charge amounts that require complex manual calculations. |