Defining Offset Groups

To define offset groups, use the Department Offset Groups component (DEPT_OFFSET).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEPT_OFFSET_GRP |

Establish offset groups to use as part of your department budgets. |

When encumbrance transactions are created in PeopleSoft HCM for PeopleSoft General Ledger, the system enforces balancing by creating an offsetting entry for each entry written (that is, for each debit transaction written by the system, the system creates an offsetting credit transaction). Unlike PeopleSoft Financials, where revenues offset expenses, PeopleSoft HCM has only expenses. PeopleSoft HCM uses the Department Offset Groups (DEPT_OFFSET_GRP) to create offsetting entries so that the transactions are balanced when they are sent to general ledger.

The accounts you select on the Department Offset Groups page must be valid in general ledger. For example, if your general ledger has been set up so that salary expenses are offset by a liability account, then that account should be the value appearing in the Account field associated with the payroll activity ERN, Payroll Earnings. If you did not load the GL Account Table with values from PeopleSoft General Ledger, it is recommended that you set up this table with the help of someone from general ledger.

If you are not using commitment control, then for each encumbrances/pre-encumbrances debit transaction written, the system writes an equal/offsetting credit entry. With the exception of the account ChartField (which is looked up on the Department Offset Groups component), the credit transaction contains the same ChartFields as the debit transactions and is balanced on all ChartFields except for the account ChartField.

If the Prorate Liability Indicator on the ChartField Transaction Table page (ACCT_CD_TABLE) is selected (which is the default), then all journals passed from PeopleSoft HCM to the general ledger during actuals transactions are balanced by fund (and any other ChartField you might select with the exception of account), as long as no insufficient funds available errors are generated. In other words, the total debits charged toward a fund equal the credits charged toward that fund.

Expense transactions for earnings, employer deductions, and employer-paid taxes are created based on funding information (namely, the combination code) as established on the Department Budget component (DEPT_BUDGET_CN or DEPT_BUDGET) or as overridden at the Job Earnings Distribution or Paysheet level. Assuming that the Prorate Liability Indicator on the ChartField Transaction Table page is selected, all combination codes associated with earnings expenses, liability amounts for employee-paid deductions, employee-paid taxes, and employee net pay are allocated to the combination codes used for earnings in the same ratio as earnings are allocated. Only the account ChartField is replaced with the value on the corresponding Department Offset Group entry.

Similarly, the liability amounts for employer-paid taxes and employer-paid deductions are allocated against the combination codes used for tax and deduction expenses and in the same proportion as the expenses (the account ChartField is replaced with the value on the corresponding Department Offset Group entry).

Because Earnings = Net Pay + EE Deductions + EE Taxes, ER Deduction Expense = ER Deduction Liability, and ER Tax Expense = ER Tax Liability, the net result of this process is that the journals should balance on all ChartFields except for the account ChartField.

Deselecting a combination code's Prorate Liability Indicator may impact this balancing at the ChartField level because it prevents employee deduction, employee tax, or net pay liability from being allocated against that combination code. In other words, the employee liability is only allocated across the combination codes where the Prorate Liability Indicator is selected (in proportion with those earnings amounts).

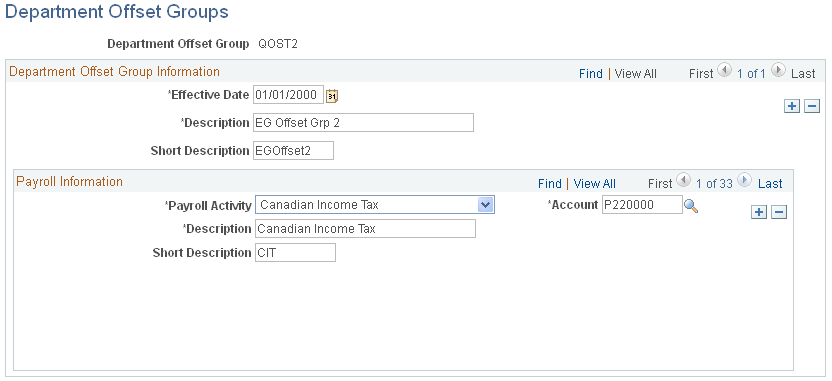

Use the Department Offset Groups page (DEPT_OFFSET_GRP) to establish offset groups to use as part of your department budgets.

Navigation:

This example illustrates the fields and controls on the Department Offset Groups page.

Field or Control |

Description |

|---|---|

Payroll Activity |

Select a valid payroll activity. You can associate more than one activity with a Department Offset Group.Add a new row to add more activities. |

Account |

Enter a valid account code. The code you select is the funding source for all plan types in the selected Payroll Activity, unless otherwise specified. |

Plan Information

This group box appears when you select a Payroll Activity of Deduction.

Field or Control |

Description |

|---|---|

Plan Type |

Select a deduction plan type. You can associate more than one plan type with a payroll activity. Add a new row to add more plan types. |

Deduction Code |

Select a deduction code. The list of available options depends on the Plan Type you specified. |

Deduction Classification |

Select a deduction class, such as Before Tax or After-Tax |

Account |

Select a deduction plan type account to be used instead of the account specified for the Payroll Activity. |