Understanding Retroactive Distribution of Funding Sources

You can make mass changes to the distribution of funding sources at the department, job code, position pool, position, or job data (appointment) level for data that has been posted to PeopleSoft General Ledger. Create retroactive transactions directly by using the Direct Retro Distributions (direct retroactive distributions) process to search the database for records that meet search criteria and replace selected data in those records with new information. Or create retroactive transactions by modifying department budgets. When you start the Budget Retro Distribution process, the system will create retroactive transactions for all records affected by the changes, either using the Direct Retro Distribution process or in the Department Budget Table component (DEPT_BUDGET).

After you create the transactions, using either method, view them in the Review Retro Distribution (review retroactive distribution) component (HP_RDIST_TRANS_USA or HP_RDIST_TRANS_CAN) to ensure that they are correct and make changes if necessary. From there, start the online transaction process to apply the new transactions to the actuals data.

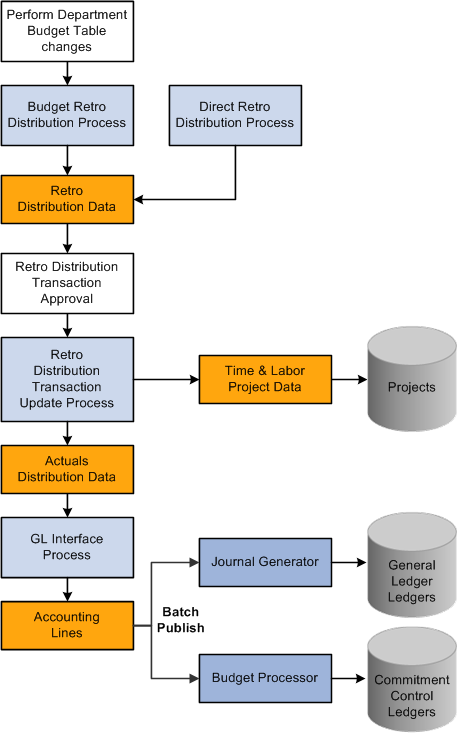

The following diagram illustrates the two methods of creating retroactive transactions, applying transactions, and the flow of data through the Commitment Accounting business process and to other PeopleSoft applications:

This diagram illustrates the two methods of creating retroactive transactions, applying transactions, and the flow of data through the Commitment Accounting business process and to other PeopleSoft applications

Field or Control |

Description |

|---|---|

Combination Code |

Combination code funding the associated portions of the check. Note: Select the Edit ChartFields link to search for an existing combination code or select a unique combination of ChartFields on the ChartField Detail page. |

Benefit Plan |

Displays the benefit plan covered by the paycheck. |

Canadian Tax Class |

Displays the Canadian tax class for Canadian taxes. |

Check #(check number) |

Paycheck number. |

Company |

Name of company that issued check. |

Current Deduction |

Displays the deduction amount distributed to the associated combination code. |

Current Tax |

Displays the total amount of tax deduction distributed to the associated combination code. |

Deduction Classification |

Displays the deduction classification of the deduction covered by the paycheck. |

Deduction Code |

Displays the deduction code of the deduction covered by the paycheck. |

Department |

Displays the department to which the earnings, deductions, or taxes are distributed. |

Earnings |

Displays the amount of earnings distributed to the associated combination code. |

Earnings Code |

Displays the earnings code describing the earnings, such as Regular or Vacation. |

Job Code |

Displays the job code to which the earnings, deductions, and taxes are distributed. |

Line |

Paycheck line number. |

Locality |

Displays the locality that regulates and collects the associated tax. |

Message ID |

The message ID of the message generated by the associated process. The system displays the text of the message in the text box below this field. |

Off Cycle |

Indicates if the check is off-cycle. |

Page |

Paycheck page number. |

Pay End Date |

Pay end date of the pay cycle. |

Pay Group |

Pay group that the check was processed with. |

Plan Type |

Displays the type of benefit plan covered by the paycheck. |

Position Number |

Displays the position number to which the earnings, deductions, and taxes are distributed. |

Position Pool ID |

Displays the position pool ID to which the earnings, deductions, and taxes are distributed. |

Province |

Displays the province that regulates and collects the tax. |

Selected |

Check to include the paycheck in retroactive processing. |

State |

Displays the state (or federal marker, if a federal tax) that regulates and collects the tax. |

Tax Balance Class |

Displays the tax balance class for US taxes. |