Setting Up Package Components

To set up package components, use the Package Components (PKG_CMPNT_TBL) component.

Package components identify the different forms of remuneration that can be included in salary packages in your organization. When defining components, identify different attributes that determine the value of the component and any associated liabilities (additional components), the information to be enrolled to payroll, and the detail required to track expenditures against this component.

Note: Package components are reusable—you can include them in any number of packages or templates, so you don't need to define components more than once.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PKG_BSE_CMP_TBL |

Set up basic information about the salary package component. |

|

|

PKG_BSE_CMP_ADD |

Associate additional components with a salary package component. |

|

|

PKG_BSE_CMP_CAL |

Define contributing components. To assist in the accurate calculation of components dependent on the value of other components, define the calculation starting point and the other components that affect the value on the Expense Data page. |

|

|

PKG_BSE_CMP_EXP |

If you are planning to track expenditure (the package expense calculation) and you have Global Payroll installed, specify package component expenses information for each component. Enter the details and identify the payroll types and related data to track expenditures against package components. |

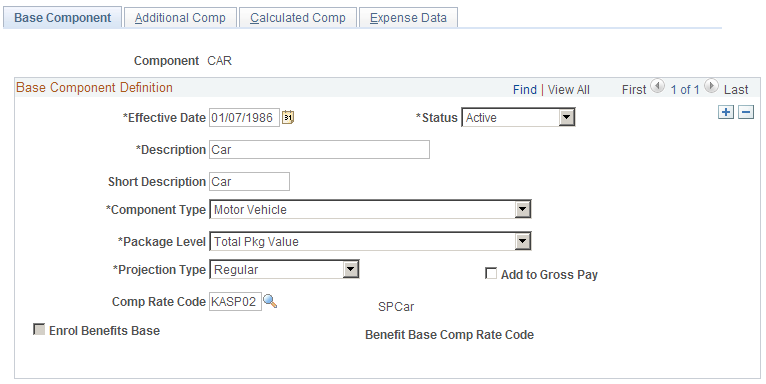

Use the Package Components - Base Component page (PKG_BSE_CMP_TBL) to set up basic information about the salary package component.

Navigation:

This example illustrates the Package Components - Base Component page.

Base Component Definition

Field or Control |

Description |

|---|---|

Component Type |

Determines the data the system needs when you are modelling your packages. The component definition drives more than the Fringe Benefits Tax calculation. It drives the enrolment, expense, and component calculations for all components — regardless of whether they are subject to FBT. Component definition is essential to the accurate calculation and administration of each package component. |

Package Level |

PeopleSoft can represent the value of remuneration at several different levels—Total Empl (total employment),Cost (TEC),Total Pkg (total package), andValue (TPV). By selecting the level for each component, you identify the level of remuneration of the component value that should be included. |

Projection Type |

Used during package expense calculation. It's possible to project the expenditure to the end of the package based on the actual expenditure of the component to date. The method of projection can differ for different types of components. Select: Ad Hoc: This does no calculation. The value of projected expenditure at period end reflects the actual expenditure of the component. Regular: Projection is based on the actual expenditure to date. The rate of expenditure is assumed to be the same for the remainder of the effective period of the component. Calculation of the projected period end expenditure looks at the actual expenditure against the period to date and calculates for the remaining effective period expenditure at the same rate. Budget: During modelling you can identify an expenditure budget. This gives you the ability to identify known expenditure expectations for components spent on an irregular basis. The information entered during modelling is used to reflect the projected expenditure at period end. Note: Regardless of which option you select, if the component start date is in the future, the system uses the budgeted component amount when calculating the impact of the component on an employee salary package. |

Comp Rate Code (compensation rate code) |

Enables you to use the multiple components of pay functionality for your salary packaging. If you are using Global Payroll, link salary package components and additional components to different types of rate codes to facilitate the payment of earnings and deductions through your payroll system. |

Add to Gross Pay |

Enables you to identify components to include in the notional calculation of PAYG tax liabilities. Select this check box for components that represent cash payments. At the time of modelling, the value of components with this check box selected are aggregated and the PAYG tax liability is calculated on the total (such as salary and allowances). |

Enrol Benefits Base / Benefit Base Comp Rate Code (enrolment benefits base/benefit base compensation rate code) |

Select this check box and a specific rate code to update the annual benefits base rate at the time of package enrolment. This field is available only when you have selected a component type of Percentage of Benefits Base orPct of Contributing Components on the Base Component page. Some of your benefits, such as superannuation, might be calculated using the Annual Benefits Base Rate. When this is the case, it is possible to also maintain the value of the annual benefits base rate from within Salary Packaging. |

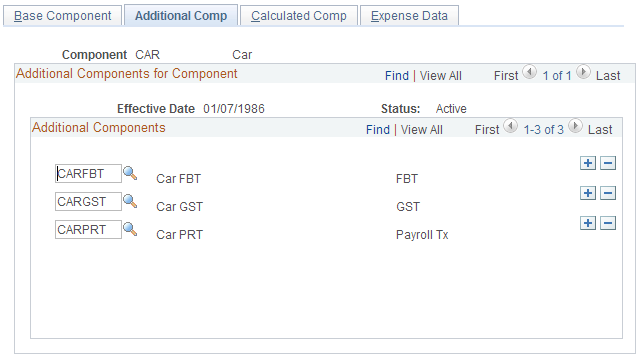

Use the Package Components - Additional Comp page (PKG_BSE_CMP_ADD) to associate additional components with a salary package component.

Navigation:

This example illustrates the Package Components - Additional Comp page.

Additional Components for Component

Field or Control |

Description |

|---|---|

Additional Components |

Many components attract additional liabilities, such as FBT, payroll tax, or GST. PeopleSoft defines these liabilities as additional components. Select additional components to include in the Package Component Table for this component. You can attach multiple additional components. Additional components vary from component to component. For example, a car component might attract FBT, payroll tax, and GST. A salary component only payroll tax and some components such as superannuation might be exempt from all tax. Note: You must first define your additional components on the Additional Component page. |

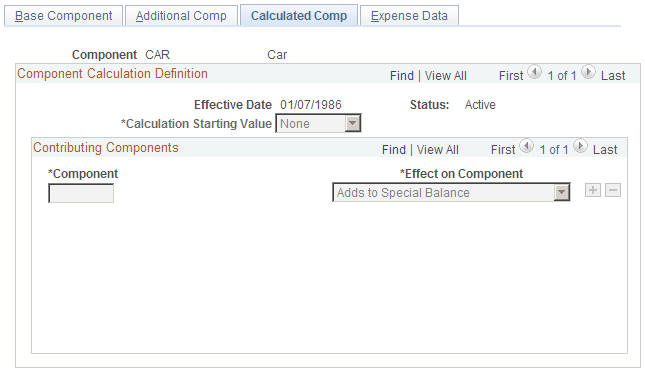

Use the Package Components - Calculated Comp page (PKG_BSE_CMP_CAL) to define contributing components.

To assist in the accurate calculation of components dependent on the value of other components, define the calculation starting point and the other components that affect the value on the Expense Data page.

Navigation:

This example illustrates the Package Components - Calculated Comp page.

Component Calculation Definition

Field or Control |

Description |

|---|---|

Calculation Starting Value |

If you select a component type of Pct of Contributing Components and a Package Level of Total Empl Cost on the Base Component page, determine the calculation starting value for this component. Select: None or TPV (total package value). None: If you accept this default value, the system calculates the value of the component as a percentage of the specified contributing components. Total Pkg Value: If you use this value, the system uses this value as the starting point for the value of this component in the package that you are modelling. Any components that are then specified as contributing components add or subtract from the total package value before the component is calculated. Note: If you don't enter any contributing components, and the value is Total Pkg Value, the system calculates the value of the component to be a percentage of the total package value. Enter the percentage value during modelling. If you indicate a component type of Pct of Contributing Components, indicate a value of Total Pkg Value or enter at least one contributing component. If you do not do either (or both) of these, an error message appears and you must modify the component definition before saving. |

Contributing Components

Field or Control |

Description |

|---|---|

Component |

Select components you have also set up using the Package Component Table pages. These components are dependent on the value of the component you are setting up. |

Effect on Component |

Specify whether the contributing component Adds to or Subtracts From the total value of the contributing components (if there is a special effect on the component). |

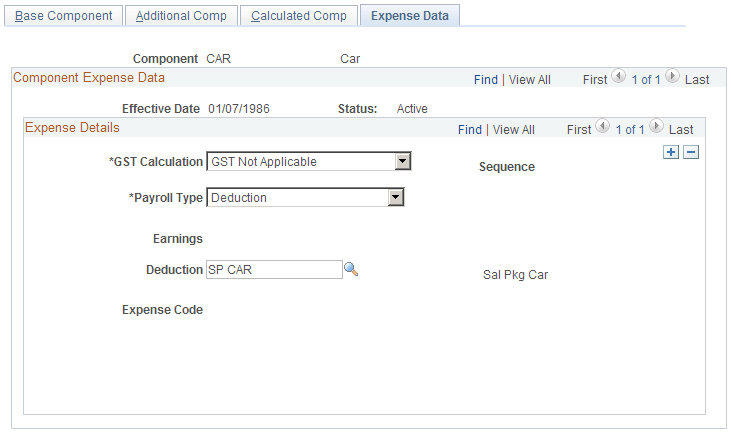

Use the Package Components - Expense Data page (PKG_BSE_CMP_EXP) to if you are planning to track expenditure (the package expense calculation) and you have Global Payroll installed, specify package component expenses information for each component.

Enter the details and identify the payroll types and related data to track expenditures against package components.

Navigation:

This example illustrates the Package Components - Expense Data page.

Field or Control |

Description |

|---|---|

GST Calculation |

Defines how GST is tracked as an expense. Select: GST Included: Indicates that the component has GST included in the value of the component. For example, if the expense amount picked up is 100 AUD, this option treats it as 91 AUD base and 9 AUD GST. GST Excluded: Indicates that the expense calculation will include the GST on top of the component value. For example, if the expense amount picked up is 100 AUD, this option treats it as 100 AUD base and 10 AUD GST. GST Only: Indicates that the expense calculation should calculate only the GST. For example, if the expense amount picked up is 100 AUD, this option treats it as 0 AUD base and 100 AUD GST. The GST is calculated using the GST rate from the Review FBT/GST Rate Table page. |

Payroll Type, Earnings, Deduction, and Expense Code |

The Payroll Type field identifies which payroll (GP) or expense (HR) type to reference to track expenditure against this component for the employee during the package expense calculation. Select Deduction, Earning, or Expenses. Your selection enables or disables the Earnings, Deductions, andBusiness Expenses fields. During the expense calculation process, the actual amounts used are the values recorded against the earnings and deductions through payroll. However, if using the Expense Code field, the values entered on the Employee business expenses page in Administer Workforce are used as the actual amounts. This enables you to track expenditure through both earnings and deductions, or deductions and expense accounts, or even multiple earnings elements. This gives you the flexibility to administer payments in any way you prefer, but still have the expenditure accurately reflected against the employee's package. It is possible to enter more than one Payroll Type when tracking expenditure, which is necessary for some components where the expenditure is not always made against a consistent payroll entity. For example, the salary component might have multiple entries to reflect the different earnings elements that are used to make payments that should be reflected as salary. |

Note: If you are not using Global Payroll, you do not need to complete the Expense Data page.