Creating Function Result and Actuarial Factor Aliases

To create function result actuarial factor aliases, use the Function Result Aliases (FNC_RSLT_ALIASES) and Factor Aliases (FACTOR_DEFINITIONS) components.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_ALIAS_AUTO_ASGN |

Create a function result alias. |

|

|

PA_FACTOR_SETUP |

Set up the factor parameters. |

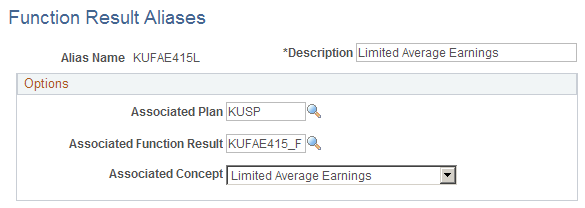

Use the Function Result Aliases page (PA_ALIAS_AUTO_ASGN) to create a function result alias.

Navigation:

This example illustrates the fields and controls on the Function Result Aliases page.

Field or Control |

Description |

|---|---|

Associated Function Result |

Select the function result that produces the extra value. |

Associated Concept |

Select the results you want to reference:

|

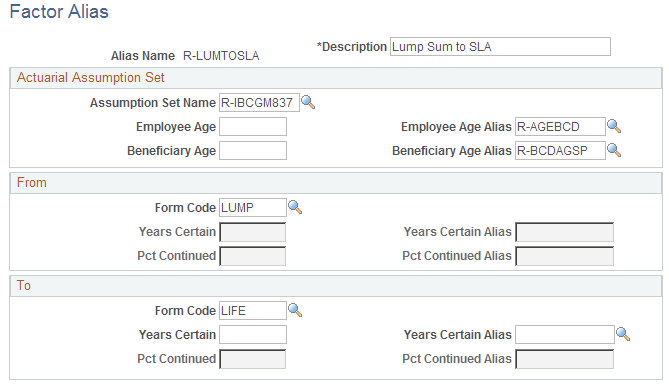

Use the Factor Alias page (PA_FACTOR_SETUP) to set up the factor parameters.

The factor utility calculates actuarial factors that convert payment amounts from one optional form of payment to another. You use the Factor Alias page to specify the information that the factor utility uses in this conversion.

Navigation:

This example illustrates the fields and controls on the Factor Alias page.

Actuarial Assumption Set

Field or Control |

Description |

|---|---|

Assumption Set Name |

An actuarial assumption set incorporates assumptions about mortality, interest, and payment frequency. For example, if you want to convert from a lump sum to a monthly annuity, the actuarial assumptions should specify a monthly payment frequency. |

Employee Age |

Enter the annuitant's age. |

Beneficiary Age |

Enter the beneficiary's age. |

You can enter constant ages or aliases for these fields.

From and To

A factor is used to convert payments from one form to another—for example, from a lump sum to a single life annuity, or from a single life annuity to a 50 percent joint and survivor annuity. You define the two payment forms in the From and To group boxes.

Field or Control |

Description |

|---|---|

Form Code |

Describe each form by entering a form code. Select from these options: Certain Only Installment, Joint and Survivor Annuity, Life Annuity, Level Income Option, Last to Survive Annuity, Lump Sum, Pop Up Annuity, Reversionary Annuity. There is also a Spouse J&S Demonstration option. This is used on the optional forms pages when a plan provides an automatic benefit to a spouse. Do not select this option on the Factor Alias page; instead, use Joint and Survivor Annuity. Certain forms incorporate additional parameters, which are specified in Years Certain and Pct Continued fields. |

Field or Control |

Description |

|---|---|

Years Certain |

Enter the number of years certain if:

For example, to enter a 5-year certain and continuous form, select Life Annuity in the Form Code field, and enter 5 in the Years Certain field. |

Pct Continued (percent continued) |

If the option includes a survivor benefit, enter the percent continued to indicate the survivor's continuing percentage of the original annuity. For example, joint and survivor and last to survive annuities include survivor benefits. For example, to enter a 50 percent joint and survivor form, select Joint and Survivor Annuity in the Form Code field, and enter 50 in the Pct Continued field. |