Defining Covered Compensation Rules

To define compensation rules, use the Covered Compensation (COVERED_COMP) component.

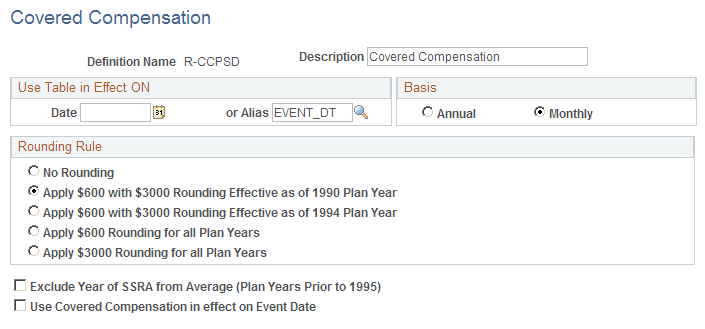

The covered compensation rules definition comprises taxable wage base (TWB) table selection, period basis, and rounding rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_COVERED_COMP |

Set up the covered compensation rules. |

Use the Covered Compensation page (PA_COVERED_COMP) to set up covered compensation rules.

Navigation:

This example illustrates the fields and controls on the Covered Compensation page.

Use Table in Effect On

Field or Control |

Description |

|---|---|

Date and Alias |

Enter a constant date or an alias. You typically use the event date. When calculating covered compensation, the system uses the table you indicate here. |

Basis

Field or Control |

Description |

|---|---|

Annual or Monthly |

The normal covered compensation amount is an annual average. You can express this as a monthly amount. |

Rounding Rule

Depending on when and if your plan adopted the various IRS rounding options, select one of the following as your rounding rule:

No Rounding.

Apply $600 Rounding with $3,000 Rounding Effective as of 1990 Plan Year.

Apply $600 Rounding with $3,000 Rounding Effective as of 1994 Plan Year.

Apply $600 Rounding for all Plan Years.

Apply $3,000 Rounding for all Plan Years.

When you use one of the $600 or $3,000 mixed options, the system uses 600 USD rounding for all years up to the threshold year and 3,000 USD rounding for the threshold year and beyond.

To change the rounding rule as of any other date, create multiple definitions and create separate effective-dated rows in the covered compensation function result.

If all 35 years in the covered compensation calculation are later than the last year in the Taxable Wage Base table, the unrounded value for the last year is used as the final covered compensation.

Field or Control |

Description |

|---|---|

Exclude Year of SSRA from Average (Plan Years Prior to 1995) (exclude year of social security retirement age from average) |

For plan years beginning before January 1, 1995, a plan may define covered compensation as the taxable wage base average over the 35 years up to but excluding the year in which the employee reaches social security retirement age. Select this option to use that definition for those years. This option only affects historical calculations. |

Use Covered Compensation in Effect on Event Date |

A plan may define covered compensation such that all employees who have not yet attained SSRA, regardless of actual age, are assumed to reach SSRA on the event date. Thus all employees terminating in the same year have the same covered compensation, regardless of year of birth. Select this option to use this definition. This option doesn't effect employees who are older than SSRA on the event date. |