Defining Death Coverage Reductions

To define death coverage reductions, use the Death Coverage (DEATH_COVERAGE) component.

This topic provides an overview of death coverage definitions and discusses how to define death coverage reductions.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_DEATH_ADJ_GEN |

Establish the method for calculating death coverage reduction factors. |

|

|

PA_DEATH_ADJ_GEN2 |

Indicate what time period to evaluate when determining the reduction factor. |

|

|

PA_DEATH_ADJ_COV |

Set up an arithmetic rule. |

If an employee changes jobs and moves in and out of plan eligibility, you don't want to treat the period of ineligibility as a covered period. Rather than having to always record coverage changes due to plan eligibility changes, you can set up separate death coverage definitions to be used during eligible and ineligible periods where the definition for ineligible periods produces no reduction. You set this up on the Function Result page using the Definition Applies to parameters.

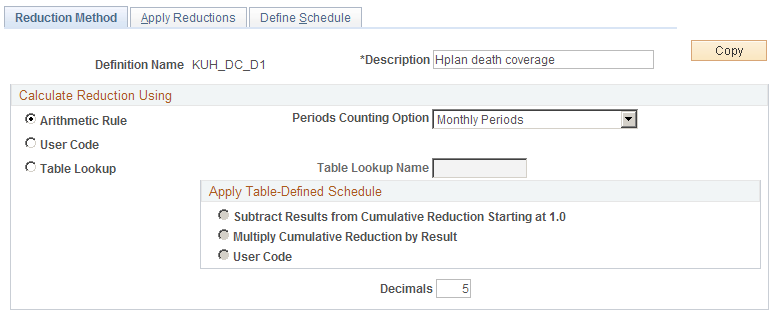

Use the Reduction Method page (PA_DEATH_ADJ_GEN) to establish the method for calculating death coverage reduction factors.

Navigation:

This example illustrates the fields and controls on the Reduction Method page.

Calculate Reduction Using

Field or Control |

Description |

|---|---|

Arithmetic Rule |

An arithmetic method involves counting the covered periods from the election history and applying a specific factor (a percentage or fraction) for each period. For example, you could reduce a benefit by .05 percent for each year of coverage or by .05 percent per year for the first five years of coverage and .04 percent per year thereafter. Select an option in the Periods Counting Option field. There are parameters for setting the reduction rate on the Define Schedule page. Here, you only specify units for measuring the covered period of time. Select from monthly or yearly periods. |

Table Lookup |

If you use a table lookup, you create a custom table for your reduction factor. Reference your custom table in the Table Lookup Name field. The table lookup returns a single factor based on the criteria you specify. |

Apply Table-Defined Schedule

Field or Control |

Description |

|---|---|

Subtract Result From Cumulative Reduction (Starts at 1.0) |

Select this if the table returns the reduction amount—for example, .02 for a 2 percent reduction. This option starts with a factor of 1.0 and reduces it by the factor provided by the table lookup. So if the table lookup returns a .02 reduction, the system converts that to a reduction factor of .98. |

Multiply Cumulative Reduction By Result |

Select this if the table returns the reduction factor—for example, .98 for a 2 percent reduction. |

Decimals |

Select the number of decimal places for the final reduction factor. The system rounds the final result to the specified number of decimal places. |

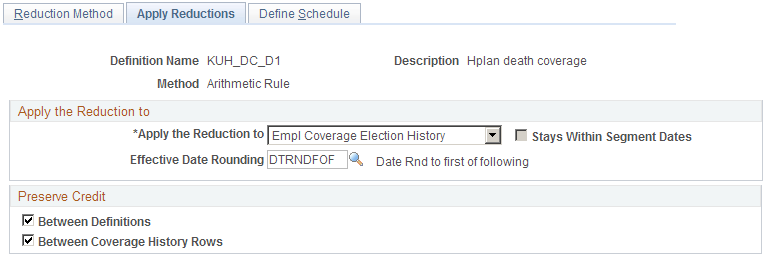

Use the Apply Reductions page (PA_DEATH_ADJ_GEN2) to indicate what time period to evaluate when determining the reduction factor.

Navigation:

This example illustrates the fields and controls on the Apply Reductions page.

Apply the Reduction to

In this group box, you can indicate how to apply arithmetic reductions. You can:

Evaluate the employee's history of covered and non-covered time periods.

Ignore the coverage history and base the factor on a fixed time span, such as date of hire to event date, age 40 to event date, or event date to benefit commencement date.

Field or Control |

Description |

|---|---|

Apply the Reduction To andEffective Date Rounding |

Select from the these options:

|

Effective Date Rounding |

If you apply the reduction to Empl Coverage Election History, you can round the coverage change dates by entering a rounding option here. For example, you might always round to the first of the preceding month so that you always deal in full months. |

Stays Within Segment Dates. |

If you apply the reduction to Some Fixed Period, you can select this check box to modify the fixed period by constraining it to the segments dates. For example, if you define the fixed period as the time starting when the employee reaches age 50 and ending at the event date, the function looks at the coverage history and adjusts the period to begin whenever coverage begins within the period. In this case, if coverage were active when the employee reached age 50, the period would begin immediately, but if the coverage commenced at age 52, the period would not start until that point. |

Determine Fixed Period Length

This group box appears only if you are applying the reduction to a fixed period.

Field or Control |

Description |

|---|---|

Method |

Select Count Periods Between Ages or Count Periods Between Dates to determine whether to express the fixed period in terms of either ages or dates. Alternatively, you can select User Code. |

Start Age and Stop Age |

If your method is Count Periods Between Ages, enter the start and stop ages here. You can enter constants or aliases. |

Start Date and Stop Date |

If your method is Count Periods Between Dates enter the start and stop dates here. You can enter constants or aliases. |

Fixed Period is Subject to

This group box appears only if you are applying the reduction to a fixed period.

Use this group box to indicate a maximum or minimum number of periods within the fixed period. For example, even you count the years between age 40 and the age at benefit commencement, you might always charge for a minimum of 60 months.

Field or Control |

Description |

|---|---|

Not Applicable |

Select this if you don't want to impose limits. |

Minimum, Maximum, and Number of Periods |

Otherwise, indicate whether the limit is a minimum or maximum, and enter the limit in the Number of Periods field. |

Preserve Credit

Often the cost of coverage for an employee decreases the longer the employee maintains coverage. For example, the reduction could be .05 percent per period for the first 60 months of coverage and .04 percent per period for all subsequent periods. When an employee starts using a new reduction definition, whether because of a change in group affiliation, a new coverage election, or a change in plan rules, you can either start counting periods from zero, or you can preserve the previous history.

Field or Control |

Description |

|---|---|

Between Definitions |

Select this to preserve credit when the definition changes, either because of a group change or a plan rule change. |

Between Coverage History Rows |

Select this to preserve credit when an employee drops and then reelects coverage. As the system counts coverage periods, it keeps separate accumulators based on each of these options. When you don't preserve coverage, the relevant accumulator is set to zero when there is a definition or coverage history break. In the end, the larger accumulator is used. Note: If you preserve coverage between definitions, all definitions must have this option selected. |

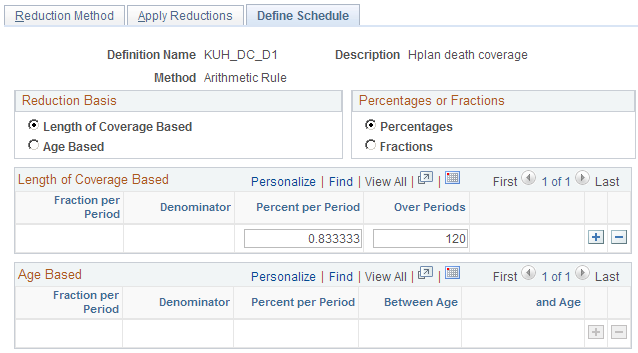

Use the Define Schedule page (PA_DEATH_ADJ_COV) to set up an arithmetic rule for death coverage.

Navigation:

This example illustrates the fields and controls on the Define Schedule page.

Reduction Basis

An arithmetic reduction can be based on either employees' ages or their lengths of coverage. To give an age-based example, you could reduce a benefit by .04 percent per period from age 40 to 54, then by .03 percent per period from age 55 and up. A reduction based on length of coverage would follow a pattern such as a .04 percent per period reduction for the first 30 periods and a .03 percent per period reduction for additional periods. The period is determined by the Periods Counting Option on the Reduction Method page.

Field or Control |

Description |

|---|---|

Length of Coverage Based or Age Based |

Select Length of Coverage Based or Age. Then complete either the Length of Coverage Based or Age Based group box. |

Percentages or Fractions

Field or Control |

Description |

|---|---|

Percentages or Fractions |

Select one of these options to choose whether to express the reductions as fractions, such as a 1/600 reduction per period, or as percentages, such as .16% per period. |

Reduction Details

Use the Length of Coverage Based group box or the Age Based group box to provide reduction details.

Note: For reductions based on length of coverage, the system applies adjustments in the order in which they appear on the page. So if you adjust by .05 percent per year for the first two years and .04 percent per year for the next three years, the .05 percent row must be before the .04 percent year. The order shown on the page is the order the function uses.

Field or Control |

Description |

|---|---|

Fraction per Period and Denominator |

If the reduction uses a fraction, enter the fraction numerator in the Fraction per Period field, and enter the fraction denominator in the Denominator field. |

Percent per Period |

If the reduction uses percentages, enter a percentage. |

Over Periods |

If your reduction is based on the length of coverage, indicate how many periods use each factor. The first row in the sequence applies to the first group of periods, the second to subsequent periods, and so on. |

Between Age and And Age |

Specify the age range to which each factor applies. |