Defining and Creating Retiree Payments

This topic discusses how to create retiree payments:

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_RT_CALENDAR |

Set up a schedule of pay periods for pension checks for a plan. |

|

|

RUNCTL_PAPPYMNT |

Process payments for pension payees. |

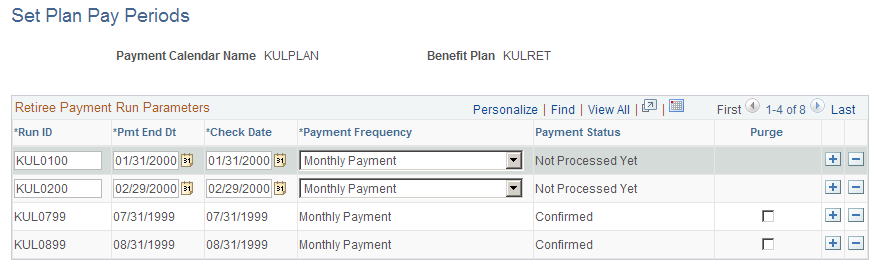

Use the Set Plan Pay Periods page (PA_RT_CALENDAR) to set up a schedule of pay periods for pension checks for a plan.

Navigation:

This example illustrates the fields and controls on the Set Plan Pay Periods page.

When you create a calendar, you assign a payment calendar name and specify the benefit plan that uses this calendar. If you do not specify a plan, all plans are selected by default.

Field or Control |

Description |

|---|---|

Retiree Payment Run Parameters |

Set up the retiree payment run parameters with one row per pay period. |

Run ID |

Assign a run ID to each pay period. You associate a run ID with each pay period and benefit plan, then reference that run ID when you run the Retiree Payments and Trustee Extract processes for that pay period and plan. |

Pmt End Dt (payment end date) |

The payment end date is the last day in a pay period. |

Check Date |

The check date is the date that should appear on the actual pension check. |

Payment Frequency |

The payment frequency indicates how many times per year you make payments under the plan. You can select one of these values: One Time Payment, Annual Payment, Monthly Payment, Semi-Annual Payment, Semi-Monthly Payment, Biweekly Payment, or Quarterly Payment. You typically make 12 payments for regular pension pay runs, so this is value is almost always Monthly Payment. This field is informational only. Payment processing picks up all scheduled payments, regardless of whether the scheduled payment frequency matches the frequency of the pay run ID. |

Payment Status |

The status indicates the processing stage for this pay period: Not Processed Yet, Preliminary, or Confirmed. |

Purge |

After you confirm the retiree payments for a particular pay period, a Purge check box appears for that period. If you select this check box, the system deletes the payment records for the run ID during the next payment processing. The system purges both payment records (created during the payment process) and trustee extract data (created when you run the Trustee Extract process). Purging does not affect the Trustee Extract file, which is saved to disk outside of the PeopleSoft system. |

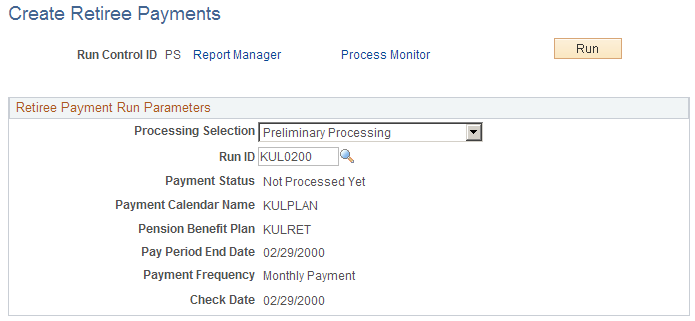

Use the Create Retiree Payments page (RUNCTL_PAPPYMNT) to process payments for pension payees.

Navigation:

This example illustrates the fields and controls on the Create Retiree Payments page.

Field or Control |

Description |

|---|---|

Run Control ID |

The run control ID is your link to Process Scheduler, the tool that manages your processing requests. |

Processing Selection |

Choose whether to run the processing in Preliminary Processing or Confirmation Processing mode. You cannot run confirmation processing unless you first run preliminary processing. In both modes, the Retiree Payment process creates payment data in the table PA_RT_PAY_DETL. Payments are based on scheduled payments and adjustments. Payments are identified by the run ID that you assign. If you have previously run a preliminary payment process for the same run ID, the previous payment data is deleted and the new data takes its place. |

Run ID |

The run ID identifies the pay period that you want to process. You can click the Table Lookup button to see a list of the run IDs that you created on the Retiree Set Plan Pay Periods page. |

Payment Calendar Name, Pension Benefit Plan, Pay Period End Date, Payment Frequency , and Check Date |

When you enter the run ID, the system displays the associated payment calendar name, pension benefit plan, pay period end date, payment frequency, and check date. Note: The payment frequency does not actually affect processing. For example, the monthly pay run picks up any scheduled lump sum payments. |

Running Preliminary and Confirmation Processing

In Confirmation Processing mode, the Retiree Payment process:

Updates the run ID status to Confirmed.

This is important because the Trustee Extract process only processes confirmed run IDs. To review the run ID status, access the Set Plan Pay Periods page.

Marks as complete any one-time payments that were picked up during the current run.

This prevents a payment from being picked up again during the next pay cycle. The system does not display this information.

Updates summary payment data, such as the running total of payments.

To review these totals, access the Review Balances and Totals page.

Updates the employee's pension status code for all newly started, newly deferred, or newly stopped payments.

To review pension statuses, access the Identify Pension Status page.

Creates the Trustee Extract file.

Note: The Retiree Payment process does not actually pay retirees. Rather, it translates general payment instructions, such as "pay 1,500 USD every month," into pay period-specific information. You use a separate process, the Trustee Extract, to transmit all payments and deductions for the pay period to a third-party trustee, who is responsible for creating the pension checks.

Updating Pension Status Codes

The pension status code is a three-character code:

The first character indicates the payee type (for example, R is a retired employee).

The Retiree Payment process does not change the payee type.

The second and third characters indicate the payment status:

DF: Deferred payments.

PY: Active payments (the payee is currently receiving payments).

ST: Stopped payments.

In Confirmation Processing mode, the Retiree Payment process updates the payment status, based on activity during the pay period.

The payment process changes the payment status:

From deferred to active the first time that it pays an employee.

From active to deferred if payments are suspended during a pay period.

From active to stopped when payments are stopped.

Note: The process only stops payment for a plan if all the payment streams for that plan are stopped. If you have manually set the status to deceased, the payment process does not change the status to stopped.

The effective date of a pension status is the same as the effective date on the payment schedule that starts, stops, or suspends the payment.

The following table summarizes the codes that the payment process sets:

|

Payee Type |

Deferred Payments |

Active Payments |

Stopped Payments |

|---|---|---|---|

|

Terminated employee |

TDF |

TPY |

TST |

|

Retired employee |

RDF |

RPY |

RST |

|

Employee retired on disability |

DDF |

DPY |

DST |

|

Beneficiary |

BDF |

BPY |

BST |

|

QDRO alternate payee |

QDF |

QPY |

QST |

If the payment process detects an initial payment and the current payment status is DF, it assumes that the person is a retiree and changes the status to RPY. Similarly, if the process detects a deferred or stopped payment and the current payment status is not PY, it assumes that the person is a retiree and changes the status to RDF or RST. In both cases, it issues a warning message.

Note: The warning message is issued when you set up a payee and you do not manually change the payment status to DF.

Running the Process

Click Run to run the Retiree Payment process. The Process Scheduler runs this process at user-defined intervals.

Payment process messages do not appear in the message log. Instead, you review messages by viewing the log file for a particular process. PeopleTools creates the log files in your temp directory.

Note: After you click Run, select a Process Scheduler Server, and click OK, you can see the process instance number, which you can use to access the Review Processing Messages page for information about the process.

Payment processing typically runs on the Process Scheduler server. Select a Process Scheduler server in the Server Name field and click OK to put the job into the Process Scheduler queue.