Maintaining Consolidated Payroll Data

This topic provides an overview of consolidated payroll data and consolidation overrides. It then lists common elements on the consolidation history pages and discusses how to view and override consolidation data.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CONS_EARNS_HIST |

View and override an employee's consolidated earnings. Depending on your plan rules, the system might use these during calculations for final average earnings, social security, or cash balance accounts. |

|

|

PA_CONS_HOURS_HIST |

View and override an employee's consolidated hours. |

|

|

PA_CONS_DED_HIST |

View and override an employee's consolidated contributions. |

Pension Administration consolidates payroll data (such as earnings, hours, and contributions) into periodic amounts. You run the consolidation process as part of your periodic processing. Each pension plan has its own rules for consolidating, and therefore has its own consolidation results.

Consolidation results are effective-dated. The normal mode for periodic processing is to continue to add segments to the existing effective-dated history, so there is one effective date (the hire date) with rows for each consolidation period.

However, you can create a new effective-dated history. You can either delete the old history or keep it and insert a new effective-dated history to supersede the original history. This occurs when you run consolidation processing in Delete and Rebuild mode, which erases existing results and creates new results, or in Create New Consolidations mode, which creates new results without erasing the old ones.

Normally, the earliest effective date for an employee's consolidation is the first date on which you ran the consolidation process for that employee. Additional consolidation results are added under the same effective date. However, if you build a new history using Delete and Rebuild mode, the new effective date is the employee's hire date.

If you build a new history without deleting the existing history using Create New Consolidations mode, the new effective date is the date on which you ran the process. In this case, you now have multiple effective-dated consolidation histories. When you run a calculation, the system uses the consolidation history effective on the rules as-of date that you specify at calculation time, rather than the history effective on the date on which you actually run the calculation.

You might need to overwrite the calculated earnings or hours consolidation amounts. Use this feature sparingly, because it's best if your consolidation results map cleanly to the source data from payroll.

The pages displaying the consolidated data include display-only fields with the results of consolidation processing and available fields in which you can override these calculated values. You can override amounts for existing periods, but you cannot insert new rows to create new periods.

To override consolidated data:

For each period in a consolidation history, select the Override or Override Indicator check box to substitute your own values for certain fields.

Note: If you enter overrides without selecting one of these check boxes, the system ignores the information that you enter.

Indicate an override type.

If you select Permanent, the system prevents you from rerunning consolidation in Delete and Rebuild or Create New Consolidations mode. This prevents you from losing your manually entered override. To delete this permanent override, return to this page and remove the override or mark it as Temporary.

If you select Temporary, any rebuild of the existing history deletes the override without issuing a warning. For example, if you discover a problem with an employee's data, enter an override so that you can complete your current calculations and sort out the payroll data problem later. When you uncover the data problem, make corrections, reconsolidate in Delete and Rebuild mode, and the Temporary override does not stop the rebuild.

Enter the actual override values.

Each consolidation (including earnings, hours, and contributions) has override fields corresponding to the final results for the period, such as the final adjusted hours for the period. Override fields do not exist for intermediate results, such as the actual hours worked.

Final results fields for each consolidation are calculated as follows:

Consolidated earnings include the earnings amount, the partial period indicator, and the partial period fraction.

Consolidated hours include the hours amount and the partial period indicator.

Consolidated contributions include pretax and posttax amounts.

Note: If the override indicator is selected, you must enter data in all of the override fields. If you fail to enter data, the system enters zero for numeric fields and deselects check boxes.

Field or Control |

Description |

|---|---|

Start Date and End Date |

Identify the individual consolidation periods. The consolidation rules define the type of consolidation period. |

Last Proc Date (last processed date) |

Displays the last date in the period on which you ran the consolidation. Compare this with the end date to determine whether you completed processing for that period. |

Partial Period Flag and Partial Period Indicator |

Display Y (yes) or N (no) to indicate whether this is a partial period. A period is partial if the employee did not work throughout the entire period. Usually, a partial period is a hire period, a termination period, or a period during which an employee was on leave. |

Override |

Select this check box to use the values that you enter on this page instead of the values calculated by the system. Note: If you select the override indicator, you must enter data in all of the override fields. If you fail to enter data, the system enters zero for numeric fields and deselects check boxes. |

Override Type |

Indicate whether an override is temporary (Temp) or permanent (Perm). |

Use the Earnings History page (PA_CONS_EARNS_HIST) to view an employee's consolidated earnings.

Depending on your plan rules, the system might use these during calculations for final average earnings, social security, or cash balance accounts.

Navigation:

This example illustrates the fields and controls on the Earnings History page.

Note: If an employee provides a social security earnings history, such as a document from the Social Security Administration or pay stubs from previous employers, you must use this earnings history for social security calculations. Rather than entering the new information as an override to the consolidated earnings (which might interfere with other calculations based on these earnings), enter the data on the Yearly Soc Sec Earnings page.

Multiple views of this page are available by clicking the tabs in the scroll area.

Common Page Information

Field or Control |

Description |

|---|---|

Function Result |

Displays the system name for the earnings consolidation rule. |

Consolidations Tab

Field or Control |

Description |

|---|---|

Accumulated Earnings |

Displays the earnings that were actually paid to the employee during a consolidation period. This is not the final earnings for the period, because the rules might require that you generate or otherwise adjust these earnings. |

Generated Earnings |

Displays the period total after any earnings generation. The generated earnings amount is not added to paid earnings—it replaces the paid earnings. If no earnings were generated, this field displays 0. |

Adjusted Accum Amounts (adjusted accumulated amounts) |

Displays the final earnings actually used in the calculation. In addition to including the generated earnings, this reflects minimums, maximums, and other adjustments specified in the plan rules. |

Fraction |

Indicates the portion of the period that the employee worked. For whole periods, this is 1.000, indicating that an employee worked for 100 percent of the period. If the employee worked for 75 percent of the period, the fraction is 0.750. Depending on your plan rules, the system might use the partial period indicator and partial period fraction during final average earnings and cash balance accounts calculations. |

Consolidations Overrides Tab

Field or Control |

Description |

|---|---|

Override Earnings Amount |

Enter the new earnings data. This overrides the data in the Adjusted Accum Amounts field. |

Partial Override |

Indicate whether this is a partial period. This overrides data in the Partial field. When you deselect this check box, the Partial field value is N. When you select this check box, the value is Y. |

Fraction Override |

Enter the partial period fraction. Enter 1.000 for periods that are not partial periods. For periods that are partial periods, enter a decimal corresponding to the percentage of the period worked. For example, if an employee worked for 80 percent of the period, enter .8. |

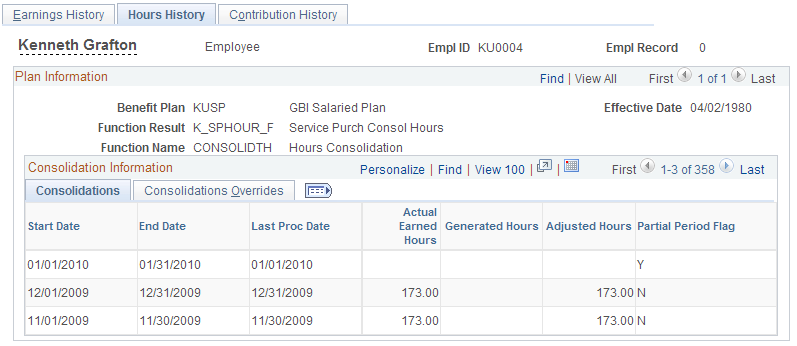

Use the Hours History page (PA_CONS_HOURS_HIST) to view an employee's consolidated hours.

Navigation:

This example illustrates the fields and controls on the Hours History page.

Common Page Information

Field or Control |

Description |

|---|---|

Function Result |

Displays the system name for the hours consolidation rule. |

Consolidations Tab

Field or Control |

Description |

|---|---|

Actual Earned Hours |

Displays the hours that the employee actually worked during a consolidation period. This is not the final hours for the period, because the rules might require that you generate or otherwise adjust these hours. |

Generated Hours |

Displays the period total after any hours generation. The generated hours amount is not added to the actual hours—it replaces the actual hours. If no earnings were generated, this field is blank. |

Adjusted Hours |

Displays the final hours that are actually used in the calculation. In addition to including the generated hours, this reflects minimums, maximums, and other adjustments specified in the plan rules. |

Consolidations Overrides Tab

Field or Control |

Description |

|---|---|

Override Final Cons Hours (override final consolidated hours) |

Enter the new hours data. This overrides the data in the Adjusted Hours field. |

Partial Override |

Indicate whether this is a partial period. This overrides data in the Partial Period Flag field. When you deselect this check box, the Partial Period Flag field value is N. When you select this check box, the value is Y. |

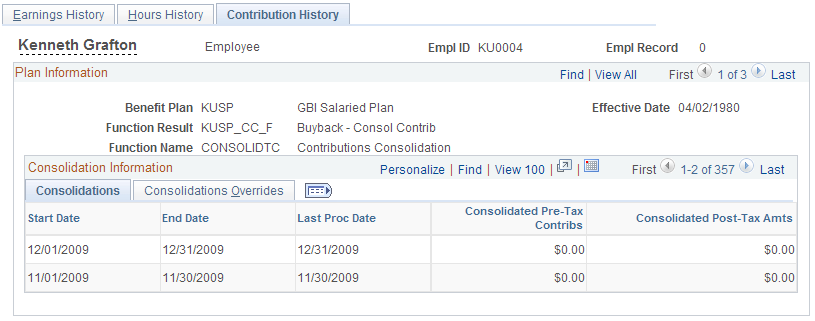

Use the Contribution History page (PA_CONS_DED_HIST) to view an employee's consolidated contributions.

Navigation:

This example illustrates the fields and controls on the Contribution History page.

Common Page Information

Field or Control |

Description |

|---|---|

Function Result |

Displays the system name for the contribution consolidation rule. |

Consolidations Tab

Field or Control |

Description |

|---|---|

Consolidated Pre-Tax Contribs (consolidated pretax contributions) and Consolidated Post-Tax Amts (consolidated posttax amounts) |

Display the employee's pretax and posttax contributions during the period. |

Consolidations Overrides Tab

Field or Control |

Description |

|---|---|

Override Pre Tax and Override Post Tax |

Enter the pretax and posttax amounts. |