Maintaining Employee Regulatory Data

This topic provides an overview of employee regulatory data and discusses how to enter an employee’s historical 415(e) information and actual social security earnings history.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_DC_FRACTION |

Record historical 415(e) information for your employees. If no information appears here, the system assumes that the employee was not subject to 415(e) limits. Typically, you enter data only for highly compensated employees who participate in a DC plan. |

|

|

Yearly Soc Sec Earnings Page (yearly social security earnings page) |

PA_EMP_SS_EARNS |

Enter an employee's actual social security earnings history. |

Pension calculations often require data for regulatory purposes. Although much of the necessary data exists in the PeopleSoft HCM database, you must track pension-specific information in Pension Administration:

You enter historical 415(e) information about a participant's contributions to defined contribution (DC) plans that you sponsor.

The system does not calculate the DC information. You enter the data directly on the 415(e) Limit page.

You enter an employee's actual social security earnings history.

Social security calculations require that you use the actual earnings history, rather than your plan assumptions, if the employee provides this information. You enter this information on the Yearly Soc Sec Earnings page.

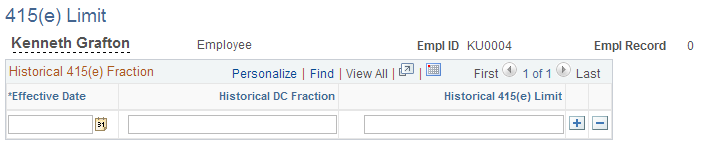

Use the 415(e) Limit page (PA_DC_FRACTION) to record historical 415(e) information for your employees.

If no information appears here, the system assumes that the employee was not subject to 415(e) limits. Typically, you enter data only for highly compensated employees who participate in a DC plan.

Navigation:

This example illustrates the fields and controls on the 415(e) Limit page.

If you sponsor both defined benefit (DB) and defined contribution plans, employees who participated in both were subject to Internal Revenue Code Section 415(e) prior to its repeal. This regulation limited the combined benefit from the two types of plans, and Pension Administration determines the historical 415(e) limit in calculations for which the limit is historically effective.

Under the combined limits, the sponsor designated which plan (DB or DC) was primary. Reductions required by 415(e) were made to the non-primary plan. Typically, the DC plan was primary, so the DB plan was reduced. Because Pension Administration calculates only DB plan benefits, use the system's historical 415(e) limit functionality only if the DC plan was primary and benefits that are greater than the limit resulted in a reduction to the DB plan.

If you set up Pension Administration to calculate historical 415(e) limits, the system needs access to participants' DC information. It needs either the defined contribution fraction, calculated according to historical section 415(e), or the final historical 415(e) limits.

Historical section 415(e) limited the combined benefit from DB and DC plans. The sum of the DB fraction and the DC fraction cannot exceed 1.0.

Pension Administration calculates the DB fraction, but it cannot calculate the DC fraction. You must provide the DC fraction.

To find the DC fraction:

For each year that the employee contributed to DC plans, find the lesser of:

DC dollar limit × 1.25.

Employee's compensation × 1.4 × 0.25.

Add the amounts calculated in step 1. This is the DC fraction denominator.

Divide total contributions to DC plans by the DC fraction denominator.

Because the fraction's numerator and denominator can change annually, enter an effective date for the information that you provide. Enter a defined contribution fraction for that date.

Alternatively, you can calculate and provide the final 415(e) limit—that is, the maximum dollar benefit for the defined benefit plan allowable under historical section 415(e).

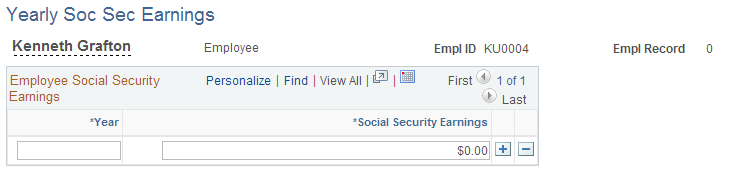

Use the Yearly Soc Sec Earnings (yearly social security earnings) page (PA_EMP_SS_EARNS) to enter an employee's actual social security earnings history.

Navigation:

This example illustrates the fields and controls on the Yearly Soc Sec Earnings page.

Pension plans may incorporate social security calculations in their benefit formulas or when calculating a level income option form of payment. Because you do not normally have access to social security earnings information from other employers, you usually use assumed earnings that are determined using certain assumptions.

Sometimes, however, an employee provides their earnings history—either a document from the Social Security Administration or pay stubs from previous employers. You must use this actual earnings history, rather than the assumed earnings. Entering the actual earnings data on the Yearly Soc Sec Earnings page ensures that all social security calculations use the actual earnings. At the same time, you avoid overwriting the consolidated earnings data that you might use elsewhere for final average earnings or cash balance accounts calculations.

Social security earnings are always based on calendar years. For each year of earnings, enter the year and earnings. Amounts that exceed the maximum taxable wage base are limited to the wage base amount during the social security calculations.

Only social security calculations use these earnings. Other calculations involving earnings use the consolidated earnings that are specified in the plan rules.

Note: The system does not project or regress earnings entered on this page. Be sure to enter information only when you have a complete earnings history.