Scheduling Payments

This topic provides overviews of scheduled payments and of payments for terminated deferred-vested employees. It then discusses how to schedule payments.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_RT_PAY_SCHED |

|

|

|

PA_RT_PAY_SCHED3 |

Enter descriptive information about a payment. |

|

|

PA_RT_PAY_SCHED4 |

Set up the schedule when you schedule payments for payees who do not have payment amounts already in the system, either in a system calculation or, for beneficiaries, in a retiree's payment schedule. |

|

|

PA_RT_ADJ_SCHED |

Schedule one-time payments. Occasionally, you need to make payments that are not based on the payee's regular pension benefit. |

In order to pay retirees with Pension Administration, you set up scheduled payments. If the system already has a record of the payment amount, you schedule payments in the Request Payment Schedule (PAY_SCHED) component.

For retirees, terminated deferred-vested employees, and QDRO alternate payees, you can use these pages when the payment is based on a system calculation, and you have recorded the payee's form of payment selection on the Identify Optional Form page.

For beneficiaries, you use these pages when there is already a payment schedule for the original employee and that schedule includes information about the beneficiary amount.

If the payment amount comes from a manual calculation, or if you are setting up a beneficiary for a retiree who was never in the PeopleSoft system, use the Payee Manual Schedule page to set up payments.

Both pages display the same information. If you set up a payment automatically, you can use the Payee Manual Schedule page to override the automatic entries, or to add effective-dated changes to the payment information. Conversely, payment information entered on the Payee Manual Schedule page is accessible, though not editable, on the Payee Payment Schedule page. When you apply cost of living adjustments, either manually or though the system's automated process, those adjustments appear on both pages.

You should set up a schedule for a terminated deferred-vested employee at the time of the termination, even though final payment information (form or payment selection and benefit commencement date) are not yet available. This schedule includes a "deferred" status marker to ensure that the system does not actually process the payments.

Pension benefits for a terminated deferred-vested employee are determined at the time the employee terminates. This means that the plan's liability with regard to this person is frozen. By scheduling the payments at this time, you make this information available for the actuarial valuation extract.

Non-employee payees do not require advance scheduling because, until payments commence, the original employee's benefit encompasses the amounts that will eventually be paid to the beneficiary or QDRO alternate payee.

Because a terminated deferred-vested employee's actual commencement date and optional form of payment selection are unknown at this time, schedule payments using a default form of payment and the benefit commencement date specified in the calculation. The deferred status on the schedule ensures that you do not start automatically paying the person on that date.

If a deferred benefit is based on a system-calculated amount, use the Identify Optional Form page to select the default form of payment. This ensures that when you schedule the payments, you schedule the appropriate amount.

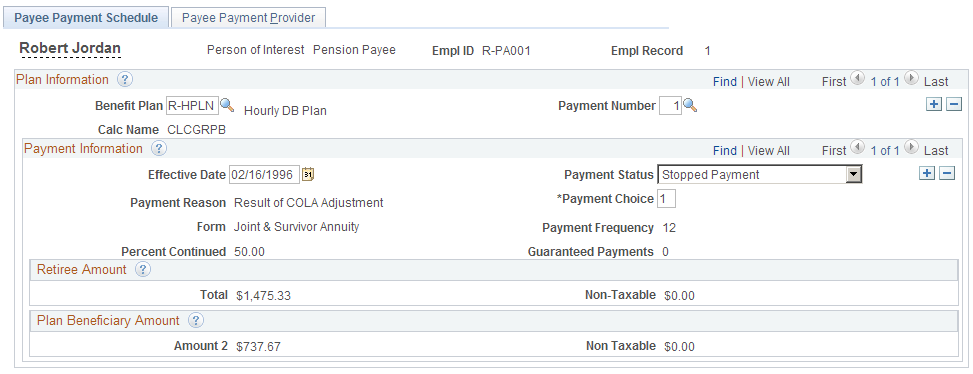

Use the Payee Payment Schedule page (PA_RT_PAY_SCHED) to:

Set up payments if you use a system calculation as the basis for your payments or if you set up beneficiary payments based on an existing retiree schedule.

Stop payments in the event of a retiree's death.

Navigation:

This example illustrates the fields and controls on the Payee Payment Schedule page.

Plan Information

For employees and QDRO alternate payees, the system automatically transfers the information from the Identify Optional Form page onto the Payee Payment Schedule page. The Benefit Plan, Calc Name and Payment Number fields automatically appear, along with information about the form of payment, and a list of the payment options available for that form. If you set up multiple payment streams in the same plan (for example, multiple payment numbers), the system picks up the first one; insert additional rows so you can set up the additional payment streams. If you have not entered an optional form selection, you need to go back and do that first, or use the Payee Manual Schedule page.

For beneficiaries, the system automatically transfers the information from the payment schedule of the original employee. For example, if Roger retires with a 50 percent joint and survivor payment option, his payment schedule shows both the amount of his retiree payments, 1,000 USD, and the amount of the beneficiary payments for his wife Liz: 500 USD. The system maintains this information through the life of Roger's payments. If Roger receives a 5 percent cost of living adjustment, his payment record shows the increased amounts for both Roger and Liz: 1,050 USD and 525 USD respectively. When you set up Liz's payments, the system gets the current beneficiary amount from Roger's payment schedule.

If Roger receives benefits from multiple plans, he has multiple record numbers (Empl Record number). You have set up two records for Liz, one under each record number. The system matches Liz's record to the appropriate one of Roger's records in order to get the appropriate information.

Payment Information

Field or Control |

Description |

|---|---|

Effective Date and Payment Status |

The Effective Date and Payment Status fields control the actual payments. When you run the payment process, the system compares the effective date to the pay period end date to determine the current row. Possible Payment Status values include:

The payment status also impacts the payee's pension status. When the payment process discovers an initial payment, it puts the payee into the in pay pension status. When the system discovers that payments have been suspended or deferred, it sets the pension status to deferred, and when it discovers that payments have been stopped, it sets the pension status to payment complete. As the system switches the pension status, it retains the prefix that identifies the payee type: retiree (or disability retiree), terminated deferred-vested employee, beneficiary, or QDRO alternate payee. PeopleSoft's effective dating enables you to set up payment instructions as far in advance as you need. For example, if Meredith selects a ten year certain form of payment, you can enter an active row effective as of the benefit commencement date and a stopped row effective ten years later. If Luis selects a level income option, you can set up one row with the pre-SSRA payment amounts and another row, future dated to the date when Luis attains social security retirement age, with the post-SSRA amount. Note: You can also use this page to stop payments in the event of a retiree's death. This is discussed in "Administering Pension Payees." |

Payment Reason |

When you schedule payments on the Payee Payment Schedule page, retirees, terminated vested employees, and QDRO alternate payees, automatically have a payment reason of System Calculated. For beneficiaries, the system automatically sets the payment reason to Benef. When you schedule payments from the Payee Manual Schedule page, you have additional options for this field. The payment reason is informational only; it does not affect payment processing. |

Payment Choice |

Specify which of the payment types to use by entering the number of your choice in the Payment Choice field. For example, if Yolanda selects a joint and survivor option with a spouse beneficiary, there are two choices: choice one is the retiree amount and choice two is the plan beneficiary amount. When Yolanda retires, you schedule payments for choice one. When she dies and you set up survivor benefits for her husband, you select choice two. Similarly, if Luis selects a level income option, you can set up one row with the pre-SSRA payment amounts and another row, future dated to the date when Luis attains social security retirement age, with the post-SSRA amount. |

Form |

This field describes the optional form of payment. |

Payment Frequency |

This field indicates the payment frequency. This is usually 12, since most pension payments are monthly. |

Percent Continued |

This field indicates what percentage of a retiree's benefit will continue to the surviving spouse when the retiree dies. |

Guaranteed Payments |

This field indicates how many years of payments are guaranteed for term certain forms of payment. |

Payment Type <#>

Field or Control |

Description |

|---|---|

Total |

The amount is the gross amount of the pension check. If a portion of the amount is attributed to employee after-tax contributions, then that portion is considered nontaxable. |

Non Taxable |

The nontaxable amount tells you how much of each pension check should be considered nontaxable. Note: The amount is the total payable amount; the nontaxable amount is the nontaxable portion of the total amount. The taxable amount is the difference between the two. |

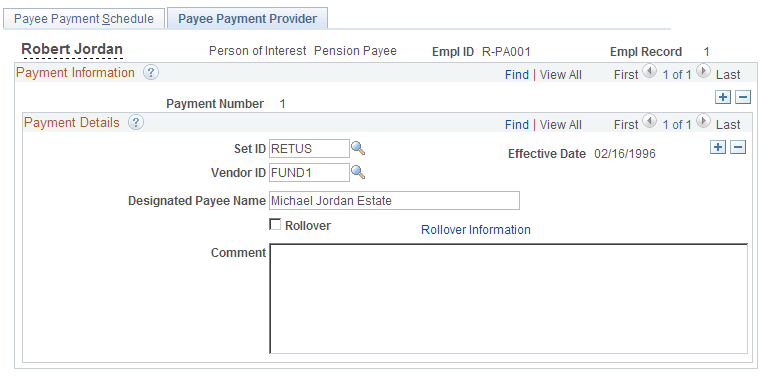

Use the Payee Payment Provider page (PA_RT_PAY_SCHED3) to enter descriptive information about a payment.

Navigation:

This example illustrates the fields and controls on the Payee Payment Provider page.

Field or Control |

Description |

|---|---|

Vendor ID |

Use the Vendor ID field to specify a funding source for the payments. This information goes into the trustee extract. You can only specify one funding source for the payment stream. If you need to specify more than one funding source, you have to create multiple payment streams. You enter providers and vendors into the system from the Provider table. This table is effective-dated, so the provider must be valid for the effective date of the payment. If you specify valid funding providers for your plan on the Plan Administration page, only those providers are available. |

Designated Payee Name |

Use the Designated Payee Name field if a pension check should be made out to someone besides a retiree. For example, if a retiree has been declared incompetent and a legal guardian has control of the retiree's finances, use this field. |

Comment |

Use this text field for any additional comments about the payment. |

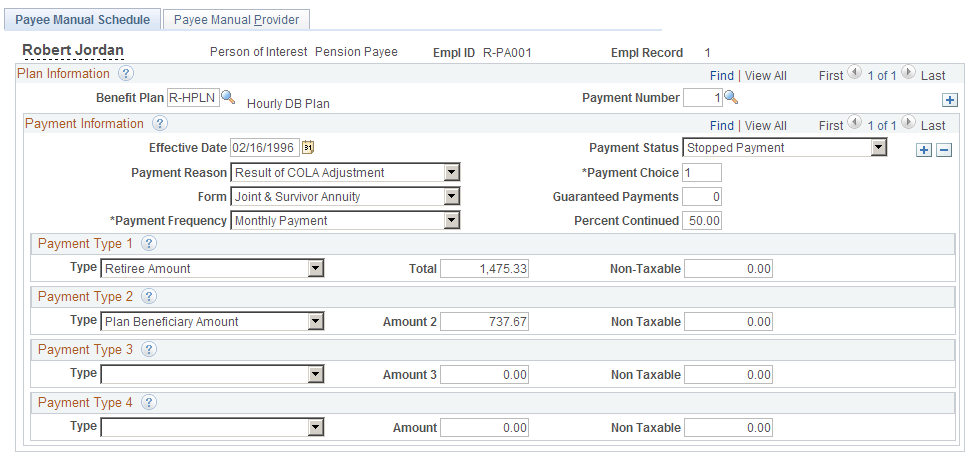

Use the Payee Manual Schedule page (PA_RT_PAY_SCHED4) to set up the schedule when you schedule payments for payees who do not have payment amounts already in the system, either in a system calculation or, for beneficiaries, in a retiree's payment schedule.

Navigation:

This example illustrates the fields and controls on the Payee Manual Schedule page.

Plan Information

Field or Control |

Description |

|---|---|

Benefit Plan |

Enter the benefit plan for the payment. |

Payment Number |

Enter the payment number for the payment. |

Note: There is no calculation name unless you're viewing payments originally entered through the Payee Payment Schedule page. After all, the reason you're using the manual scheduling is that you're not using a system calculation.

Payment Information

Field or Control |

Description |

|---|---|

Effective Date and Payment Status |

As on the Payee Schedule Payments page, the effective date and payment status control the actual payments. |

Payment Reason |

The payment reason, which was always set to System Calculated or Benef when you used a system calculation, now has other available values: Override, Manual, and COLA. When you run Pension Administration COLA processing, the system inserts effective-dated rows with the adjusted amounts; these rows use the COLA payment reason. |

Payment Choice and Choice |

Specify which of the payment amounts to use by entering a number in the Payment Choice field. Use the number in the Choice field to the left of the payment amount to identify the correct row. |

Form, Guaranteed Payments, Payment Frequency, and Percent Continued |

With manual scheduling, you have to enter the payment form by hand using these fields. |

Payment Type <#>

Enter payment information for each type of payment for the selected form.

If the form of payment includes a survivor benefit, be sure to enter a row for the beneficiary, as well as the retiree. This row is necessary for automated scheduling of beneficiary payments. Similarly, use additional rows for other optional forms of payment that have more than one pension benefit amount: level income options and pop-up options. It is best to schedule these amounts up front so that cost of living adjustments are properly applied to all of the amounts.

Field or Control |

Description |

|---|---|

Type , Amount , and Non-Taxable |

Enter payment amounts manually using these fields. |

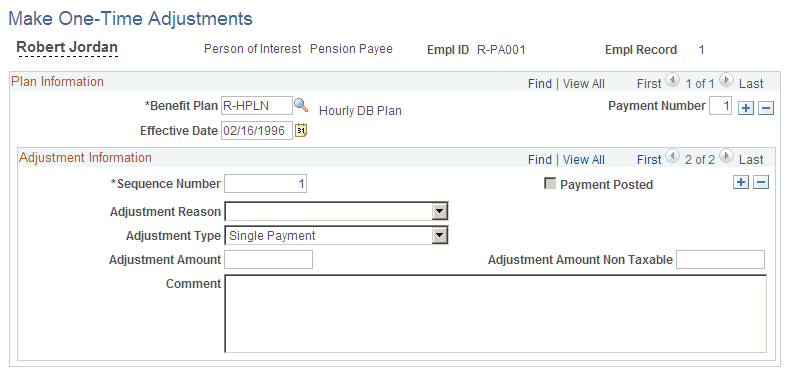

Use the Make One-Time Adjustments page (PA_RT_ADJ_SCHED) to schedule one-time payments.

Navigation:

This example illustrates the fields and controls on the Make One-Time Adjustments page.

Field or Control |

Description |

|---|---|

Benefit Plan and Payment Number |

Enter the benefit plan and payment number that identify the regular payments associated with this adjustment. If a person is receiving benefits from two plans, you set up adjustments for each plan separately. The same rule applies when you set up separate payment streams within a single plan. Note: Adjustments are only processed for payees who have a payment schedule established. Payments from the schedule can be stopped, but the schedule itself must be present. |

Effective Date |

The effective date indicates when to make an adjustment. The adjustment is made during the first pay run for a pay period concurrent with or later than the effective date. There is no stop date for the adjustment. Instead, the adjustment record is internally flagged as paid after the payment is made; this prevents the system from making the same payment twice. |

Sequence Number |

The sequence number enables you to make multiple adjustment with the same plan, payment number, and effective date. By separating the adjustments rather than scheduling one adjustment with the net amount, you add detail to your audit trail. |

Adjustment Reason |

Select an adjustment reason to explain why you're making the adjustment: Recalc indicates a recalculation, typically introducing additional earnings data unavailable at the time of the initial calculation. Retro Adj is for retroactive adjustments, such as those made after the administrative delay preceding a payee's first pension check. Interest is for interest paid on late payments. For example, use this for the payments associated with recalculations or retroactive calculations. (Alternatively, you can include the interest component in the initial adjustment.) Mid Period indicates reduced payments made when a pension check is prorated for a partial month. For example, a retiree dies in the middle of a month. You can either make a negative adjustment to the regularly scheduled payment or you can stop the regular payment and schedule a positive one-time payment. Other applies to a variety of possible reasons. |

Adjustment Type |

You can use one-time adjustment to adjust balances, for example, for a retiree's estate refunds payments made after the retiree's death, or if you need to reallocate post-death payments from a retiree's balance to a beneficiary's balance. To do this, select Balance Adjustment. For regular adjustment, select Single Payment. Note: The Review Payment Results page does not adjust running totals based on balance adjustments. When you schedule a balance-only adjustment, you should manually update the payment summary information. |

Adjustment Amount |

You can enter either a positive or negative adjustment amount. Negative adjustments amounts should only be scheduled for pay periods where there is a regular payment. Be careful to ensure that the reduction does not exceed the regular payment amount; Pension Administration does not support arrears processing. |

Adjustable Amount Non Taxable |

If a portion of the adjustment is nontaxable, enter that amount in the Adjustable Amount Non Taxable field. For negative adjustments, entering a nontaxable amount ensures that the reduction offsets the nontaxable amount in the regularly scheduled payment. Do not try to reduce the nontaxable amount beyond the regularly scheduled amount. |