Setting Up Earnings Consolidations

To set up earnings consolidation, use the Earnings Consolidation (EARNINGS) component.

This topic provides an overview of earnings consolidations and discusses how to set up earnings consolidation rules.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_CONS_EARN_PARMS |

Establish the accumulation period, and identify the earnings data to include in the periodic totals. |

|

|

PA_CONS_EARN_ACCUM |

Set limits and adjustments. |

|

|

PA_CONS_EARN_GEN |

Establish generation conditions and methods. |

|

|

PA_CONS_EARN_BRK |

|

You use the Consolidated Earnings component to set up the rules for earnings consolidations.

To process an earnings consolidation:

Determine the accumulation period and the actual earnings for the period.

Generate earnings if necessary.

Adjust hire periods if necessary.

Adjust any termination periods preceding a rehire.

Add any additional earnings.

Apply any minimums or maximums.

Calculate the partial period fraction.

Note: The consolidation process adjusts termination periods only if an employee has been rehired. It does not adjust final termination periods; functions using consolidated data have other parameters for handling final periods. Earnings are generated for complete periods only.

The core functions that need consolidated earnings use the final adjusted earnings amount produced by step six. However, the system also stores the intermediate amounts produced by steps one and two and the fraction produced by step seven. These intermediate amounts are informational only; they display on the Earnings History page but are not used in the calculation.

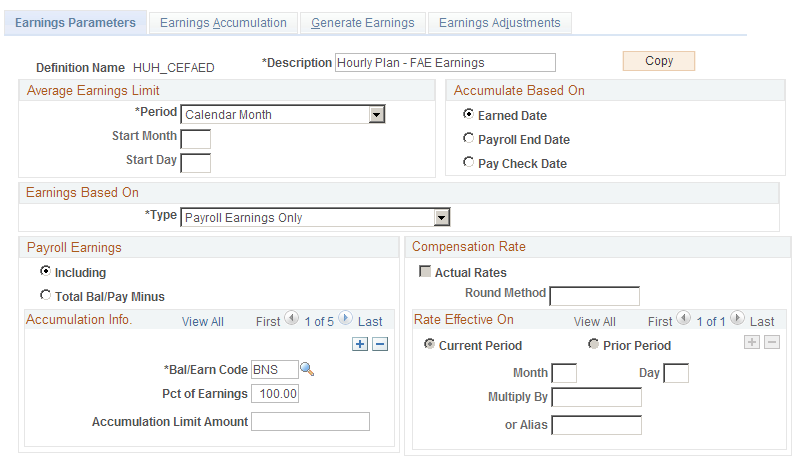

Use the Earnings Parameters page (PA_CONS_EARN_PARMS) to establish the accumulation period, and identify the earnings data to include in the periodic totals.

Navigation:

This example illustrates the fields and controls on the Earnings Parameters page.

Field or Control |

Description |

|---|---|

Copy |

Consolidated earnings definitions can be quite complex. This is a shortcut you can use to copy a similar definition. Establish the first definition, click the Copy button, enter a new name and description, and the system clones the original definition using the new name. Then make whatever minor adjustments you need to the new definition. If you have to make major adjustments, consider creating the new definition from scratch instead of copying an existing definition. |

Setting Up the Accumulation Period

Field or Control |

Description |

|---|---|

Period |

The consolidation process produces periodic earnings totals to provide a period-by-period earnings history. Enter the appropriate period, selecting from the following options: Calendar Month, Calendar Year, Plan Year, Employee's Anniversary Year, and Other Year. If you select Other Year, specify the start month and start day of that year. Use a number (1-12) to represent the month. The day is usually the first of the month. Depending on the function that uses this definition, there are certain restrictions:

|

Allocating Earnings to Periods

Field or Control |

Description |

|---|---|

Accumulate Based On |

If you base earnings on either of the following, your earnings data is already aligned with your consolidation period: Earnings Balance Table or Payroll W2 Accumulator (you select these options in the Earnings Based On field, described below). If you base earnings on compensation rate, there are no earnings periods to align. In these cases, you can ignore the Accumulate Based On group box. If you base earnings on pay period data, you need to align your payroll dates with your consolidation dates. Specify the period into which earnings fall by selecting an Accumulate Based On option:

|

Indicating the Earnings Basis

Consolidated earnings are based on either actual earnings as recorded in your Payroll system or compensation rate as recorded in your PeopleSoft Human Resources system.

Field or Control |

Description |

|---|---|

Earnings Based On |

In the Earnings Based On group box, choose one of the following types:

Note: When you use Earnings Balance Tables or Payroll W2 Accumulator, you must allocate earnings based on Earned Date. |

Multiple Jobs Considerations for the Earnings Based On Group Box

If you use the multiple jobs functionality, the system selects the jobs used for earnings consolidations in one of two ways: If you select Payroll W2 Accumulator as the method of accumulation, consolidations use the W-2 amounts without regard to the job. In all other cases, consolidation only includes the jobs that make an employee eligible for the plan.

Selecting and Adjusting Earnings Amounts

Field or Control |

Description |

|---|---|

Payroll Earnings |

If your consolidated earnings use any of the payroll-based earnings types, use the Payroll Earnings group box to specify the earnings or balance types to use:

Build the list of earnings or balance types in the scrolling region of the Earnings Based On group box. |

Bal/Earn Code |

Specify a code for the plan you select. |

Pct of Earnings |

For each Bal/Earn Code you specify, you can adjust the earnings by a specified percentage. For example, you can use 100 percent of regular earnings and 50 percent of overtime earnings. If you exclude earnings, you can exclude 50 percent of overtime earnings. |

Accumulation Limit Amount |

You can limit the amount of earnings for an earnings code by entering the limit here. Do not use this field to implement 401(a)(17) limits. Set up those limits on a separate 401(a)(17) Parameters Page, and apply them in the Final Average Earnings or Cash Balance Accounts function. |

Setting Up Compensation Rate Options

If you base your earnings data wholly or partially on compensation rate, you need to specify how to use the rate. Rate information comes from the employees' job records.

Field or Control |

Description |

|---|---|

Actual Rates |

If you select this option, each compensation rate in effect during a period is prorated for the portion of the period it was effective. All these prorated rates are added to calculate the earnings for the period. For example, if Lewis's annual rate is 40,000 USD on January 1 and 44,000 USD starting April 1, the system takes three months at the first rate (10,000 USD) and nine months at the second rate (33,000 USD), for a final amount of 43,000 USD. |

Round Method |

You can round the effective dates of rate changes by specifying a round method, which you define. |

Rate Effective On

If you do not use the actual rates, complete the Rate Effective On options. Use the scrolling region in this box to list one or more dates when the compensation rates are in effect.

Field or Control |

Description |

|---|---|

Current Period and Prior Period |

Select an option: Current Period to check the compensation rate during the current period or Prior Period to check it during the prior period. |

Month |

Enter the month that the compensation rate becomes effective. |

Day |

Enter the day that the compensation rate becomes effective. |

Multiply By |

Especially if you incorporate rates from multiple dates, you need to indicate how to weigh each rate. Enter a factor for each rate in the Multiplied By field. For example, you could use half of an employee's January 1 rate and half of the employee's July 1 rate. You can set up a factor as a constant value or an alias that you create. If you leave this field blank, the system uses a factor of 1.0. |

Example of Setting Up Compensation Rates

When you consolidate earnings that are based on both payroll and earnings and the compensation rate, the system adds the earnings data (as specified in the Payroll Earnings group box) and the compensation data (as specified in the Compensation Rate Effective On group box).

Suppose you consolidate monthly but pay employees every two weeks. Let's see what happens when you use a 50/50 blend of payroll earnings and compensation rate for an employee earning 60,000 USD per year.

For the compensation rate portion, the employee's earnings are 5,000 USD per month. Take 50 percent of that and each consolidation period has 2,500 USD from the compensation rate source.

For the payroll portion, there are ten months when the employee gets 4,600 USD and two months when the employee gets 6,800 USD (these numbers are rounded rather than exact). Take 50 percent of these numbers and you get ten months at 2,300 USD and two months at 3,400 USD.

Add the 2,500 USD (from the 50 percent of the rate portion) to each of these amounts, and you end up with ten months at 4,800 USD and two months at 5,900 USD.

Compare the blended method to using just payroll earnings or just the compensation rate:

Using only payroll earnings, there are 10 months at 4,600 USD and two months at 6,800 USD.

Using only the compensation rate, there are 12 months at 5,000 USD.

Using a 50/50 blend of the two, there are 10 months at 4,800 USD and 2 months at 5,900 USD.

By blending the payroll earnings and the compensation rate, you can reduce the discrepancy between the months when the employee receives two paychecks and the months when the employee receives three paychecks.

Note that in this example we assume that payroll data is allocated by either paycheck date or payroll end date. Allocating based on earned date is somewhat different. That method spreads earnings more evenly among consolidation periods. It does not necessarily make sense to blend payroll earnings and compensation rate when you allocate the payroll data by earned date. This could make sense, however, if employee earnings vary substantially from period to period due to bonuses or commissions.

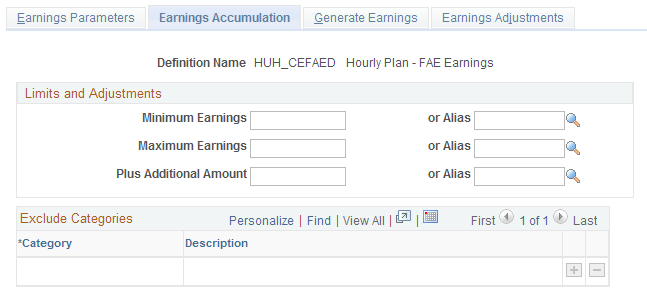

Use the Earnings Accumulation page (PA_CONS_EARN_ACCUM) to set limits and adjustments.

Navigation:

This example illustrates the fields and controls on the Earnings Accumulation page.

Limits and Adjustments

The limits and adjustments apply to all complete consolidation periods, whether full or partial. The system does not apply limits and adjustments before the period end date, so you do not specify this information for most final periods. If you consolidate based on compensation rate, you can also specify statuses for which an employee should not be credited with earnings.

Field or Control |

Description |

|---|---|

Minimum Earnings |

To limit the total earnings per period, enter a minimum earnings amount. |

Maximum Earnings |

To limit the total earnings per period, enter a maximum earnings amount. |

Plus Additional Amount |

If you want to add earnings to the period total (subject to a maximum that you set), enter that amount in the Plus Additional Amount field. To subtract earnings, enter a negative number in this field. You can set up all of these fields as either constants or aliases that you create. |

Exclude Categories

If your consolidation is based on the annual compensation rate rather than actual earnings, you need a way to recognize periods of time when an employee should not receive any earnings credit. For example, if an employee who earns 36,000 USD per year goes on leave for a month, you need to exclude one month's worth of earnings to reduce the consolidated earnings for the period to 33,000 USD. Use the Exclude Categories group box to enter codes for which you ignore earnings.

Note: The Exclude Categories information only applies when you base the earnings consolidation at least partially on compensation rate.

Field or Control |

Description |

|---|---|

Category |

Enter each category of action and reason codes for which you ignore earnings. Use the categories you set up on the Job Event Categories page. The system does not credit an employee with earnings until the next relevant action and reason event in the employee's job record—in this case, a return from leave. However, the system only recognizes this action as "relevant" if you reference it elsewhere in the consolidated earnings definition. To ensure that the system recognizes the return from leave action (and thus stops excluding earnings), include that action in the Include Category on the Consolidate Earnings - Earnings Adjustments page. |

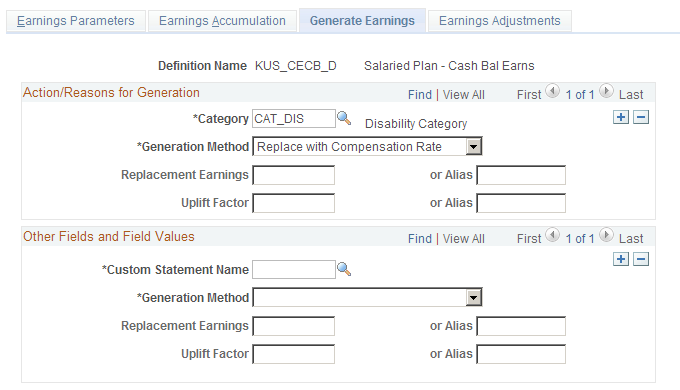

Use the Generate Earnings page (PA_CONS_EARN_GEN) to establish generation conditions and methods.

Navigation:

This example illustrates the fields and controls on the Generate Earnings page.

Establishing Conditions for Earnings Generation

Field or Control |

Description |

|---|---|

Action/Reasons for Generation |

You use the fields in this group box to generate earnings based on employee status or other criteria. |

Category |

You can generate earnings based on employee status or on other criteria. Use the Category field to identify the HR action and reason code categories that require generated earnings. You can insert additional rows if necessary. |

Custom Statement Name |

To indicate other conditions for earnings generation, you have to first set up a custom statement outlining those conditions. Enter the name of the custom statement in the Custom Statement Name field. If the custom statement conditions are met, the system generates earnings for all periods being processed. This means that during a delete-and-rebuild consolidation, which processes several periods at once, the system might generate earnings for all periods. Warning! Do not generate based on custom statements unless you permanently disable the delete-and-rebuild consolidation mode. If an employee has multiple action-and-reason events that generate earnings for a single period—for example, a military leave and then a disability leave—the events are processed in chronological order. If your generation method replaces earnings for the entire period, earnings generated for the final event replace earnings generated for earlier events. |

Ending Earnings Generation

If you generate earnings based on an HR action and reason category, the system uses an employee's action and reason history to determine when to stop the generation. The system continues to generate earnings for the employee until the next relevant action and reason event in the employee's job record. For example, if Belinda goes on leave at the end of 2002 and returns from leave at the beginning of 2004, the system generates earnings for three years: 2002, 2003, and 2004.

The system only recognizes a return from leave action as "relevant" if you reference it elsewhere in the consolidated earnings definition. To ensure that the system recognizes the return from leave action (and thus stops generating earnings), include that action in the Include Category on the Earnings Adjustments page.

If you generate earnings based on custom statement criteria, the system generates earnings for all the periods that are processed. If the statement is no longer true during the next processing period, the system does not generate earnings at that time.

Multiple Jobs Considerations for Earnings Consolidations

When you process multiple jobs, the system generates earnings for each job as needed, then adds the results to create a total generated earnings amount for each computation period.

Field or Control |

Description |

|---|---|

Generation Method |

For each earnings generation condition that you set up, select a generation method:

Most of the methods replace all the earnings for the period. Only the Replace with Compensation Rate method can generate earnings for the period of time during which an employee actually meets the generation conditions. For example, Belinda went on leave at the end of 2002 and returned at the beginning of 2004. If you select Replace with Compensation Rate, the system generates earnings for the time she was on leave and adds those earnings to her actual 2002 and 2004 earnings. With any other method, the system overwrites the actual earnings from early 2002 and late 2004 with the generated earnings for those periods. |

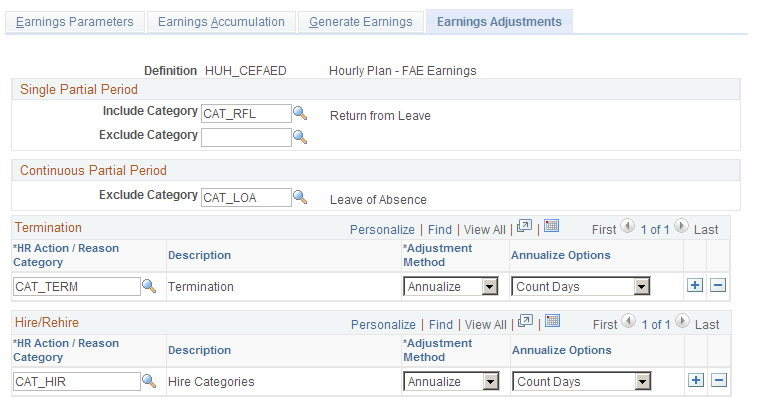

Use the Earnings Adjustments page (PA_CONS_EARN_BRK) to:

Establish the criteria for calculating the partial period fraction.

Annualize or otherwise adjust hire and termination periods.

Indicate "include" categories of action and reason codes that signal the end of a generated earnings period.

Indicate "include" categories to balance the compensation rate "exclude" categories if your consolidation is based on compensation rate.

Navigation:

This example illustrates the fields and controls on the Earnings Adjustments page.

Using the Partial Period Fraction

The partial period fraction indicates what portion of a consolidation period an employee actually works. For example, if you consolidate using calendar years and an employee terminates on October 1, 2000, the employee has a partial period fraction of .75 for the 2000 consolidation period. If the employee is rehired the following May 1, the 2001 period has a partial period fraction of .66.

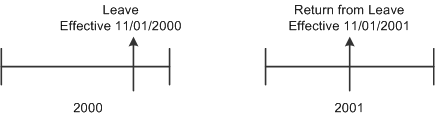

The system determines the partial period fraction by breaking the period into included and excluded segments. These segments are, in turn, based on the employee's action and reason history. For example, assume that leaves of absence are in your exclude category and returns from leave are in your include category. Jasmine has the following action and reason history:

This diagram provides an example action and reason history. In the example, the employee went on leave from November 1, 2000 and returned from leave on November 1, 2001.

The system always determines the partial period fraction by counting the included days, not the included months. Because 305 days of the 366 days in 2000 are included, the 2000 fraction is 305/366, or .8330. In 2001, 184 days out of the 365 days are included, and the fraction is .50414.

This example assumes that the leave status continues into the next period. The rules can instead be set up so that the exclude status stops when the consolidation period ends. In that case, Jasmine's 2001 partial period fraction is 1.0, even though she is still on leave for the first part of the period.

Configuring Include and Exclude Categories

The two types of exclude segments already discussed, generation action and reason codes and "exclude category" action and reason codes (for excluding earnings when you consolidate based on compensation rate), can continue beyond the end of a consolidation period until the next include segment starts.

Field or Control |

Description |

|---|---|

Single Partial Period |

In the Single Partial Period group box, enter the Include Category and Exclude Category. |

Include Category |

Enter an Include Category with all the action and reason codes that start an include period, including those that end the generated earnings exclude segments and the compensation rate exclude segments. |

Exclude Category |

Enter an Exclude Category for other action and reason codes that start an exclude segment that stops no later than the end of the consolidation period. |

Continuous Partial Period |

In the Continuous Partial Period group box, enter an Exclude Category for action and reason codes that start an exclude segment that continues until the next "include" action and reason. Note: Make sure that no action and reason code combination appears in more than one consolidated earnings category. For example, if you generate earnings during maternity leaves and military leaves, do not include either of those leave types in either of the partial period exclude categories. |

Multiple Jobs Considerations for Continuous Partial Period

A partial period for an employee with multiple jobs is calculated by subtracting the number of days the employee is inactive in the specified accumulation period from the total number of days in an accumulation period. The difference is then divided by the total number of days in the accumulation period.

Adjusting Hire and Termination Periods

Field or Control |

Description |

|---|---|

Termination and Hire/Rehire |

Use the Termination and Hire/Rehire group boxes to set up adjustments for hire and termination periods. In calculating the partial period fraction, hire actions are treated as "include" actions, and termination actions are treated as "exclude" actions. The consolidation process adjusts a termination period only after a subsequent rehire. For example, if Quentin terminates in 2004, the 2004 consolidation period is his last. If he is rehired in 2006, the system adjusts the 2004 period, creates a zero-earnings 2005 period, and creates a 2006 period. Because the 2006 period includes the rehire action, it incorporates the hire period adjustment method you specify. |

HR Action/Reason Category |

Before you set up adjustments for hire and termination periods, you first must indicate how to recognize these periods. Enter the HR action and reason categories that indicate hire termination periods in the HR Action/Reason Category fields in the Termination and Hire/Rehire group boxes. |

Adjustment Method |

For each action and reason category that you set up, select an adjustment method for adjusting the earnings for the resulting partial period:

|

Multiple Jobs Considerations for Adjustment Method

Multiple jobs are generally consolidated one job at a time. Rates and earnings are computed by job, so there is no confusion about the earnings and rates that are used.

Note: When you use the multiple jobs functionality, the system applies minimum and maximum adjustments to the total consolidated earnings of all jobs.