Understanding 415 Limits Processing

This section provides an overview of 415 Limits Processing and discusses:

Finding the amounts subject to limits.

Determining the limits.

Applying the limits.

PeopleSoft's 415 limits processing can be broken into three parts:

Finding the amounts subject to the limits.

Finding the limits themselves.

Applying the limits.

The first part happened during optional forms processing: your optional forms definitions have a flag where you mark whether the benefit is subject to the limits. The 415 definition controls the other two parts.

When benefits are reduced for 415 limits, you see the reduced amounts in the associated optional forms function result. These are the only results that change due to 415 limits processing.

Note: The benefit amount—that is, the benefit formula function result—is not updated. It still shows the pre-415 limits amount.

You indicate that benefits are subject to 415 limits by selecting the Use Formset in 415 Processing check box on the Optional Forms pages.

If you have multiple benefit formulas and optional formsets representing the same benefit (for example, an early retirement benefit and a normal retirement benefit), include only one.

In a contributory plan, only the employer-paid portion of a benefit is subject to 415 limits.

Section 415 limits are always applied to the single life annuity value of a benefit. If the normal form of a benefit is not a single life annuity, be sure to include single life annuity in the optional formset. If the single life annuity is only for 415 purposes and is not an actual option for your employees, you can select the For 415 Only check box in the optional forms definition. This prevents the option from appearing in the calculation results.

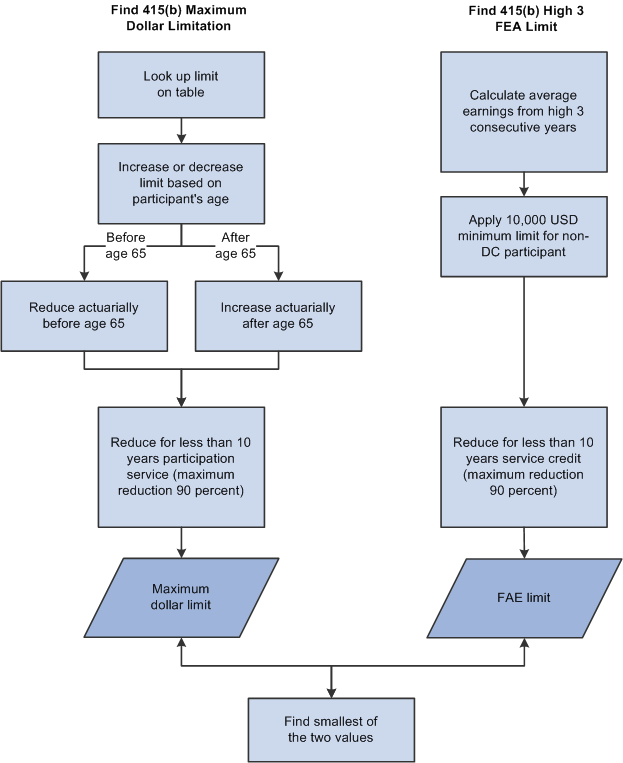

This is the most complex part of the process. You can look at the 415 pages to go through all the parameters used during this stage. The following diagram summarizes the process for determining limits. It includes steps for increasing or decreasing limits based on age, calculating average earnings, and reducing limits for service length:

This diagram shows how the system calculates 415 limits, including how the system increases or decreases limits based on age, calculates average earnings, and reduces limits for service length

This calculation reflects amendments to IRC section 415 by the Small Business Job Protection Act of 1996 (SBJPA) and the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA).

Note: The acronym GUST refers to several legislative acts, including SBJPA.

Pre-amendment methodology will be applied, however, when a calculation involves a benefit commencement date occurring in a plan year that ended before January 1, 2002. For subsequent dates, ages used for actuarial increases and decreases to the 415(b) maximum dollar limit were changed by EGTRRA.

Also, SBJPA removed the 415(e) test for defined benefit plans that are secondary to defined contribution plans. Pension Administration still performs this historical calculation if both of the following are true:

The benefit commencement date occurs in a plan year that ended before December 31, 2000, the effective date of the SBJPA change.

You provide historical 415(e) information for the plan and the employee.

In this case, the final 415 limit is the smallest of the historical 415(e) limit, the 415(b) maximum dollar limit, and the 415(b) high 3 FAE limit.

If the benefit (still expressed as a single life annuity) is over the limit, the system subtracts the benefit from the limit to find how much the benefit needs to be reduced. If there are multiple plans providing the benefit, you have two options for distributing the reduction: proportionately or by precedence order.

After benefits are reduced, the system converts each plan's limited benefit back to its normal form using the same optional forms rules used to convert to the single life annuity.

Limited optional forms are calculated using the same factors used by the unlimited benefit with one exception: To convert to any forms flagged "QJSA" (qualified joint and survivor annuity), the system puts the regular conversion rules aside and applies the final 415 limit directly to the unreduced QJSA amounts. If the original QJSA value is less than the 415 limit, it is retained.