Using Optional Forms of Payment Results

Optional forms of payment results include quite a bit of information. Each form set includes several forms, each of which has:

Identifying information about the nature of the form.

One or several associated payment types. For example, a joint and survivor form includes both retiree and beneficiary amounts, while a level income option includes one amount to use until the retiree's social security retirement age and another amount to use after the retiree reaches social security retirement age.

Four dollar amounts for each payment type:

Total amount before applying 415 limits.

Nontaxable portion of the pre-415 limits amount.

Total amount after applying 415 limits.

Nontaxable portion of the post-415 limits amount.

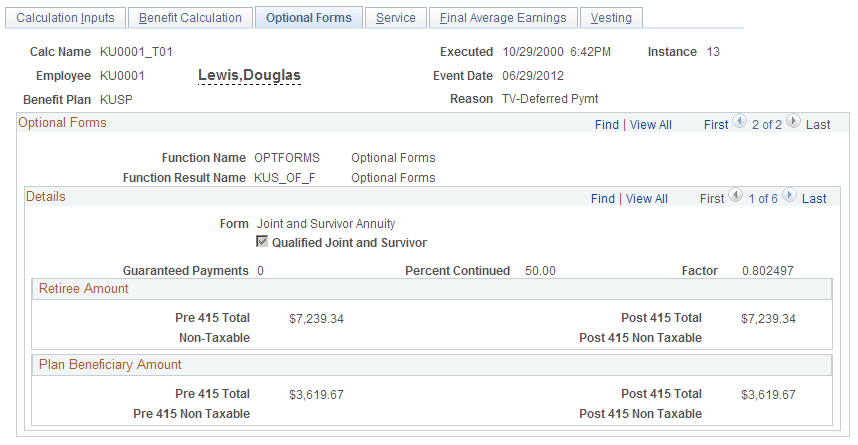

The following page (access this page under ) shows results for a single form in an optional form set:

This example illustrates calculation results for optional forms.

Each form is identified by the form type, the number of years of guaranteed payments, and the percentage of the benefit that is continued to a surviving beneficiary.

Forms can have multiple payment options. A joint and survivor form includes payments for the retiree and beneficiary payments for after the retiree dies.

The system provides four values for each payment option: the total amount and any nontaxable portion of that amount, both before and after applying 415 limits.