Check

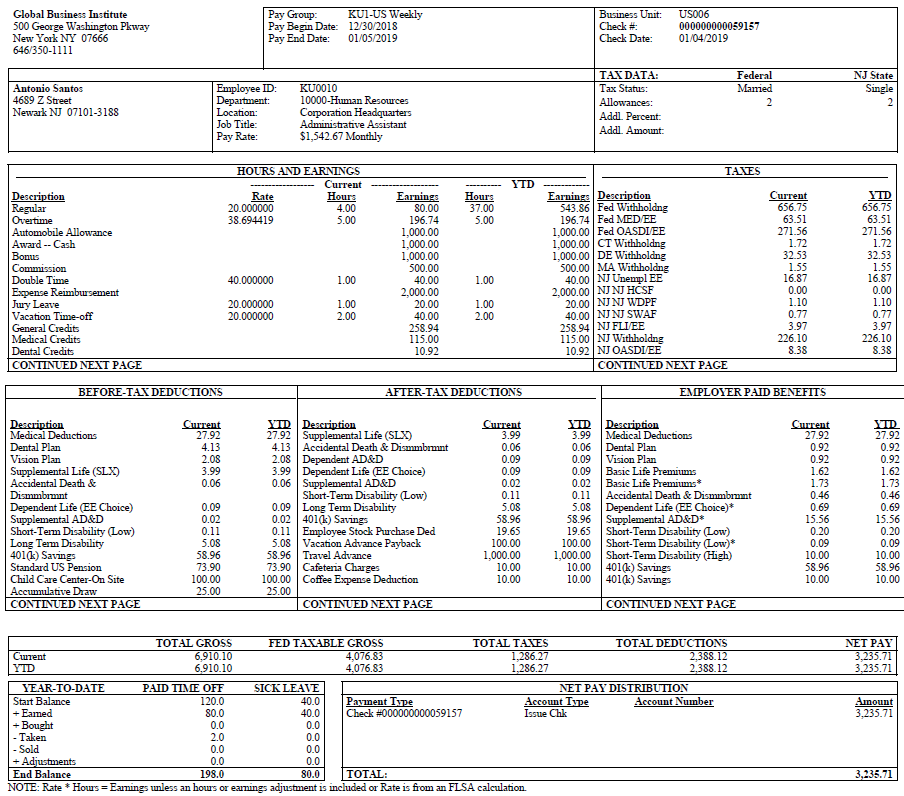

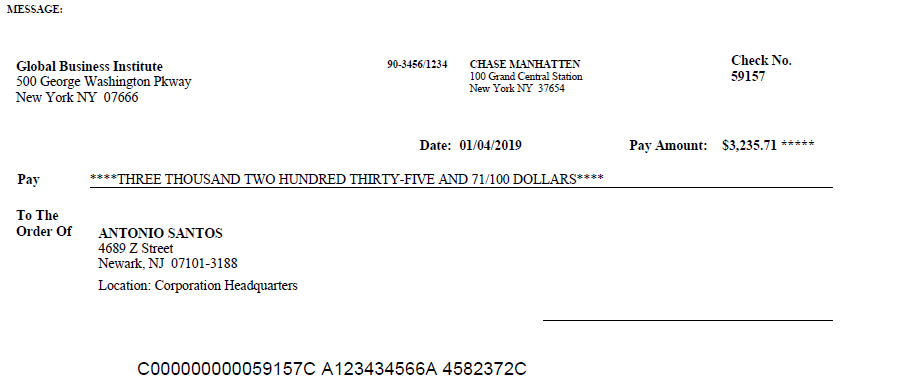

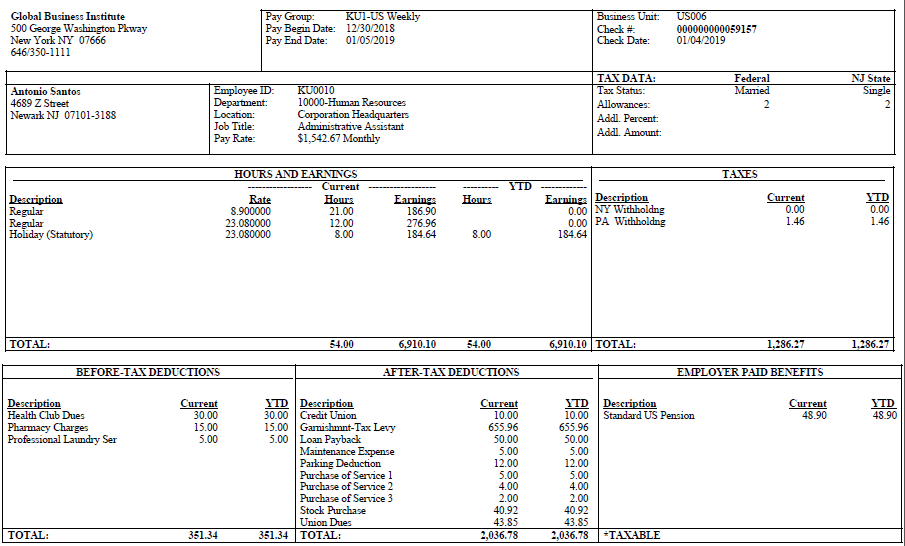

This is an example of a check (PRTOFCHK template) for an employee whose wage statement includes 16 lines of earnings details, 15 lines of tax details, 16 lines of before-tax deduction details, 23 lines of after-tax deduction details, and 14 lines of employer paid benefits details.

This example illustrates a sample check (PRTOFCHK) page 1 (1 of 2).

This example illustrates a sample check (PRTOFCHK) page 1 (2 of 2).

This example illustrates a sample check (PRTOFCHK) page 2 (1 of 2).

This example illustrates a sample check (PRTOFCHK) page 2 (2 of 2).

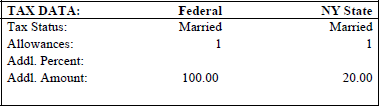

Tax Data Display

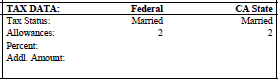

The display of the TAX DATA section changes depending on the Form W-4 version selected for the employee on the Federal Tax Data Page. This screenshot displays how the TAX DATA section looks when the employee’s federal taxes are calculated with the federal form version of W-4 - 2020 or Later:

This example illustrates the TAX DATA section when the employee’s federal form version is W-4 - 2020 or Later.

This screenshot displays how the TAX DATA section looks when the employee’s federal taxes are calculated with the federal form version of W-4 - 2019 or Earlier:

This example illustrates the TAX DATA section when the employee’s federal form version is W-4 - 2019 or Earlier.