(CAN) Setting Up and Maintaining Source Deductions

To set up and maintain source deductions, use the Update Source Deductions CAN (RUN_TAX103CN) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_TAX103CN |

Run the Update Source Deductions SQR Report process (TAX103CN). |

Use the Update Source Deductions SQR Report process (TAX103CN) to calculate and update federal, Quebec, and provincial basic source deductions for employees by generating a new Canadian Income Tax Data record for each employee who is active as of the effective date specified.

Set up and run this process at predefined intervals in preparation for the new year's payroll processing. The corresponding report (TAX103CN) provides a list of all records created.

Use the Update Source Deductions page (RUN_TAX103CN) to run the Update Source Deductions SQR Report process (TAX103CN).

Navigation:

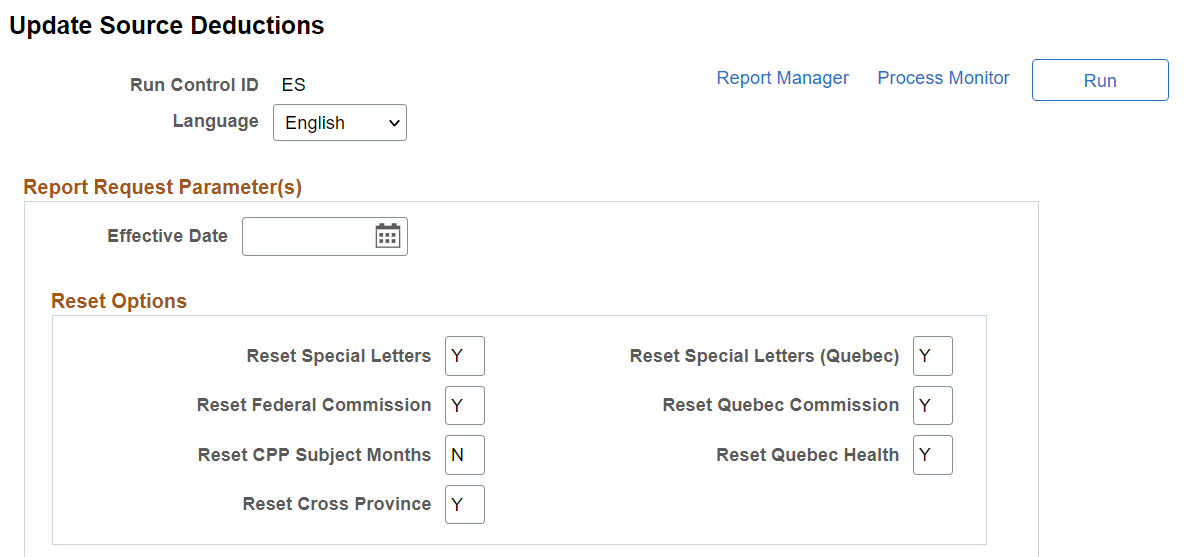

This example illustrates the fields and controls on the Update Source Deductions page (1 of 2).

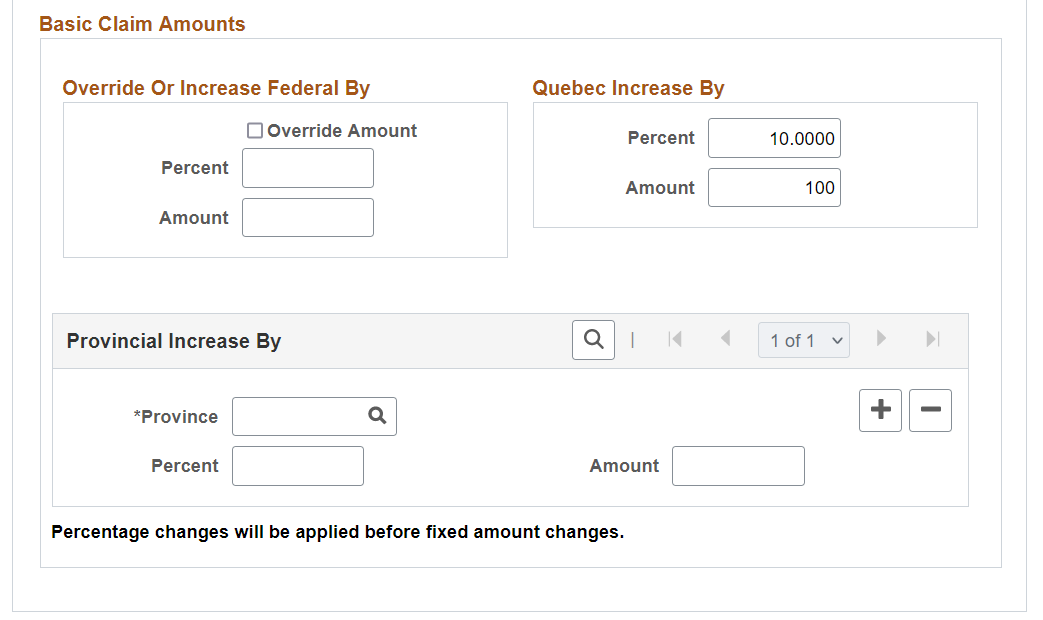

This example illustrates the fields and controls on the Update Source Deductions page (2 of 2).

|

Field or Control |

Description |

|---|---|

|

Reset Special Letters |

Enter Y (yes) to reset the special letters amount to zero. |

|

Reset Federal Commission |

Enter Y to reset the federal commission amounts to zero. |

|

Reset CPP Subject Months (reset Canada Pension Plan subject months) |

Y (yes): Reset the employee's CPP subject months to 12. N (no): Reset the employee's CPP subject months to zero when the employee's original CPP subject months are fewer than 12 (for example, to reset CPP subject months to zero for employees who no longer contribute to CPP). If the employee's original CPP subject months are 12, they remain 12. |

|

Reset Cross Province |

Y (yes): The Cross Province check box on the Canadian Income Tax Data 2 page is deselected when the new record is created. N (no): The Reset Cross Province check box and associated field values are copied to the newly created record. |

|

Reset Special Letters (Quebec) |

Enter Y (yes) to reset the Quebec special letters amount to zero. |

|

Reset Quebec Commission |

Enter Y (yes) to reset the Quebec commission amounts to zero. |

|

Reset Quebec Health |

Enter Y (yes) to deselect the Exempt from Quebec Health check box on the Quebec Income Tax Data page for all employees for whom Exempt from Quebec Health is currently selected. Resetting in this way makes no employee exempt from Quebec Health. |

|

Field or Control |

Description |

|---|---|

|

Override Or Increase Federal By |

Use this group box to perform updates to employees' federal basic claim amounts. Use percent, amount, or both to specify the value of the increase when the Override Amount check box is not selected. Use amount to specify the override amount when the Override Amount check box is selected. The amount will default to the Federal Basic Personal Amount from the Canadian Tax Table if amount is zero or blank. |

|

Quebec Increase By |

Use this group box to perform updates to employees' Quebec basic claim amounts. Use either percent or amount to specify the value of the increase. |

|

Provincial Increase By |

Use this group box to perform updates to employees' provincial basic personal amounts. Add rows to enter multiple provinces. Use either percent or amount to specify the value of the increase. |