Setting Up and Maintaining Additional Pay

To set up and maintain additional pay, use the Additional Pay (ADDITIONAL_PAY) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ADDITIONAL_PAY1 |

Set up and assign additional pay earnings to an employee. Specify a different department to charge for the additional pay. Change employee tax data for additional pay. |

Additional pay refers to earnings that an employee is paid on a regular basis in addition to regular earnings, for example, a vehicle allowance, variable compensation, or benefit credits. (Do not confuse additional pay with one-time payments, such as overtime or an expense reimbursement.)

To set up and maintain additional pay:

Use the Earnings Table component to set up an earnings code for the additional pay.

Use the Earnings Program Table component to add the earnings code to the earnings program.

Use the Additional Pay component to set up and assign the additional pay to an employee.

Use the Additional Pay page (ADDITIONAL_PAY1) to set up and assign additional pay earnings to an employee.

Navigation:

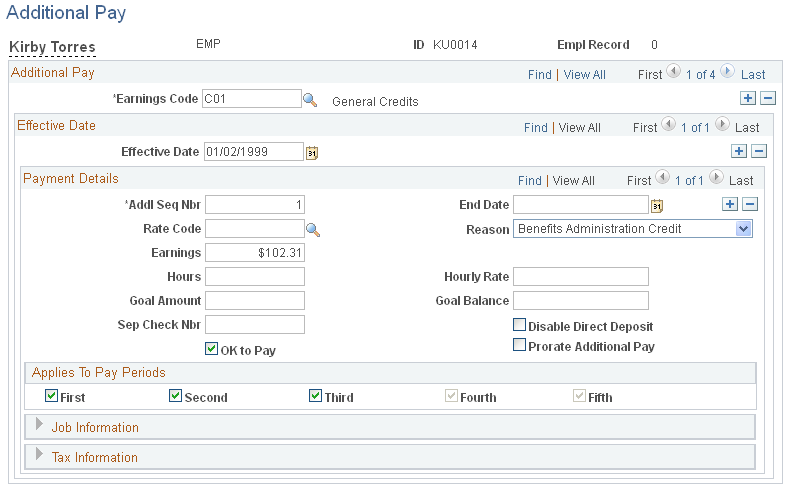

This example illustrates the fields and controls on the Additional Pay page (1 of 3).

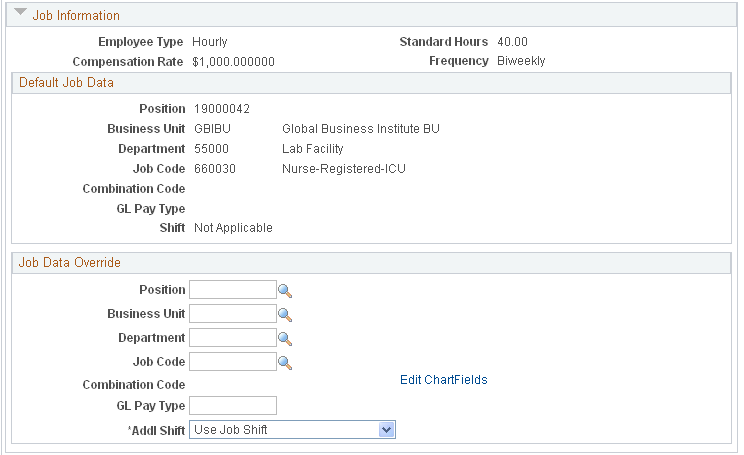

This example illustrates the fields and controls on the Additional Pay page (2 of 3).

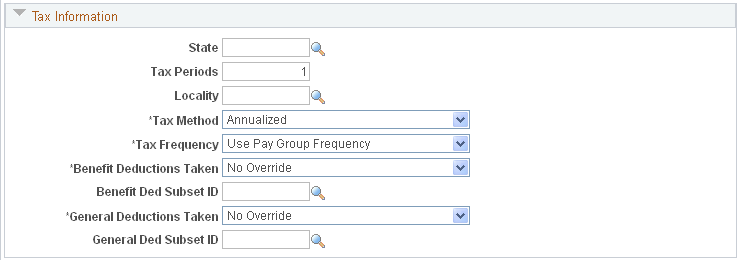

This example illustrates the fields and controls on the Additional Pay page (3 of 3).

Specify a different department to charge for the additional pay. Change employee tax data for additional pay.

Field or Control |

Description |

|---|---|

Addl Seq Nbr (additional sequence number) |

Select 1 unless there are multiple additional pay records. |

Earnings, Hours, andHourly Rate |

Select to indicate whether additional pay is hours multiplied by an hourly rate or a fixed amount, but not both. If an hourly rate is indicated, but the field is left blank, information is automatically populated from the employee's job record. |

Goal Amount |

Select to have your payroll system stop issuing this additional pay when the amount has been reached. |

Applies to Pay Periods

Field or Control |

Description |

|---|---|

First, Second, Third, Fourth, andFifth |

Select the appropriate options to indicate the pay periods in which this additional pay should be identified in your payroll system. For example, if an employee were paid twice a month, but received a monthly car allowance, you would select either First or Second, but not both. |

Job Data Override

Use the Job Data Override group box to change the department that is charged for the additional pay.

Field or Control |

Description |

|---|---|

Position, Business Unit, Department, Job Code, Combination Code, andGL Pay Type |

Enter data in any of these fields to override the default value. |

Addl Shift (additional pay shift) |

Select Use Job to use the shift that is specified on the employee's Job record. |

Tax Information

Use the Tax Information group box to modify the employee's state and local tax data.

Field or Control |

Description |

|---|---|

State |

Select to enter the state that the employee worked in, if different from the employee's regular pay. This field is validated against the employee's state and local tax data. |

Locality |

Select to enter the locality that the employee worked in, if different from the employee's regular pay. This field is validated against the employee's state and local tax data. |