Setting Up and Maintaining Optional Payroll Data

To set up and maintain optional payroll data, use the Payroll Options (PAYROLL_DATA) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PAYROLL_DATA1 |

Set up paycheck delivery and distribution options. |

|

|

PAYROLL_DATA2 |

Set up paycheck location and payroll deduction subset options. |

Optional payroll processing information, such as check distribution and deduction subset options, is often necessary when employees have multiple jobs or have multiple jobs and need to be paid through more than one payroll system.

If you are setting up multiple jobs:

Calculate Deductions — Follow guidelines in your PeopleSoft Benefits Administration product documentation.

Benefit Deductions — Follow guidelines in your PeopleSoft Benefits Administration product documentation.

General Deductions — Set up and maintain the Payroll Options component, Payroll Options 2 page.

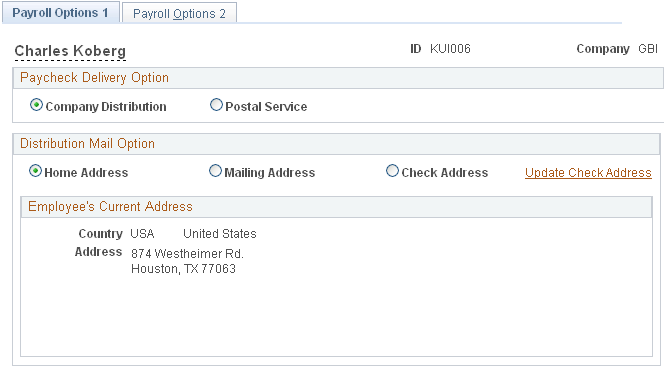

Use the Payroll Options 1 page (PAYROLL_DATA1) to set up paycheck delivery and distribution options.

Navigation:

This example illustrates the fields and controls on the Payroll Options 1 page.

Paycheck Delivery Option

Field or Control |

Description |

|---|---|

Company Distribution |

Select to indicate that the check should be handed out as part of a regular company distribution. |

Postal Service |

Select to indicate that the check should be mailed using the Postal Service. |

Distribution Mail Option

Use the options in the Distribution Mail Option group box to indicate how an employee's check should be distributed.

Field or Control |

Description |

|---|---|

Home Address |

Select to send checks to the employee's home address. The system automatically displays the home address from the employee's personal data in PeopleSoft HCM. |

Mailing Address |

Select to send checks to the employee's mailing address. The system automatically displays the mailing address from the employee's personal data in PeopleSoft HCM. |

Check Address |

Select to send checks to the employee's check address. The system automatically displays the check address from the employee's personal data in PeopleSoft HCM. |

Update Check Address |

Select to update the employee's check address here, rather than on the Personal Data component. |

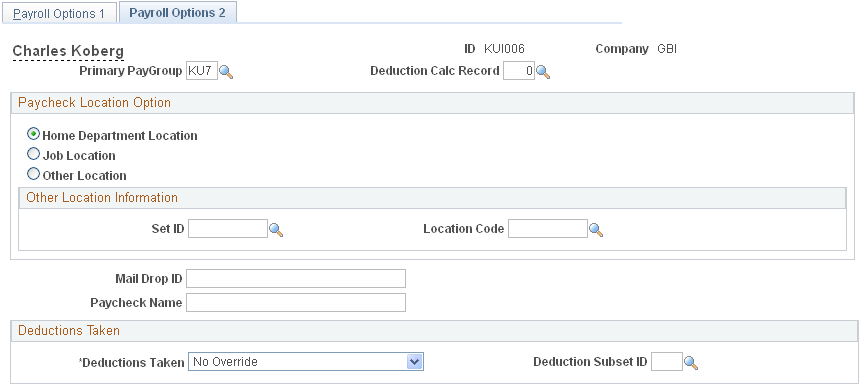

Use the Payroll Options 2 page (PAYROLL_DATA2) to set up paycheck location and payroll deduction subset options.

Navigation:

This example illustrates the fields and controls on the Payroll Options 2 page.

Field or Control |

Description |

|---|---|

Primary PayGroup |

Select to identify the pay group for which a consolidated paysheet will be created when an employee is being paid in different pay groups during the same pay run. The primary pay group also controls whether deductions or additional pay should be taken for the pay period. For employees with multiple jobs, PeopleSoft recommends that you select, as the primary pay group, the one in which the employee is paid most often. If you leave this field blank, the system uses the default pay group that is associated with the first job into which the employee was hired. Note: You are responsible for verifying that this value is correct for each employee. |

Paycheck Location Option

Use the options in the Paycheck Location Option group box to specify which location code to use as a sort option for printing paychecks for this pay group. These options are used only if:

The Company Distribution Order option is selected as the paycheck sequence option on the Pay Group Table - Check Distribution page.

The Select on Payroll Data Panel option is selected as the paycheck location option on the Pay Group Table - Check Distribution page.

The location is entered as a check print sequence on the Pay Group Table - Check Sequencing page.

See Understanding Payroll Schedules.

Note: You must create location codes in the Location table before you can use them here or elsewhere in the system.

Field or Control |

Description |

|---|---|

Home Department Location |

Select the location code (in the Department table) that is associated with the department ID on the employee's Job record that is used as a sort option for printing checks. |

Job Location |

Select the location on the employee's Job record that is used as a sort option for printing checks. |

Other Location |

Select to enter a different location code to use as a sort option for printing checks. In this case, the system uses the designated agent address and transmits the check for office delivery. If you select the Other Location option, you also must select a setID and a location code. |

SetID |

Select the setID for the location code. |

Location CD (location code) |

Select a location code to indicate this location as a sort option for printing checks. Use this option only if the Select on Payroll Data Panel option is selected as the paycheck location option on the Pay Group Table - Check Distribution page. |

Mail Drop ID |

Select to enter the employee's mail drop ID. |

Paycheck Name |

Select to enter a name, other than the employee name that is entered on the Personal Data record, to whom the paycheck should be made out. This field is not formatted, so enter the name exactly as you want it to appear on the paycheck. |

Deductions Taken

Use the options in the Deductions Taken group box to indicate how to take deductions for an employee. Selections made on this page override the values that are entered for the pay run in the General Deductions Taken field on the Pay Calendar table. Values include:

Field or Control |

Description |

|---|---|

Deductions Taken |

|

Deduction Subset ID |

You must specify the subset ID if you select Subset in theDeductions Taken field. |