Collecting Data for the Valuation Process

To collect data for the valuation process, use the Estimate Table (ST_ESTIMATE) and Valuation (ST_VALUATION) components.

This topic provides overviews of the data that is required to run the Valuation process and the steps for collecting and entering valuation data, and discusses how to collect data for the valuation process.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_RUNCTL_STFS001 |

Run the Expected Life Years Analysis report. |

|

|

ST_RUNCTL_STFS002 |

Run the Expected Volatility report. |

|

|

ST_ESTIMATE |

Enter variables for valuing stock options. |

The Valuation process, which uses the Black-Scholes Option Pricing model, requires six variables. Two of the variables are already stored in the system, two you can derive from system-generated reports, and the remaining two you acquire from outside sources. The variables and their sources are as follows:

|

Variable |

Source |

|---|---|

|

Grant fair market value (FMV) |

Stock Administration |

|

Grant price |

Stock Administration |

|

Expected life of the option |

Derived from the Expected Life report |

|

Expected volatility of the stock price |

Derived from the Expected Volatility report |

|

Expected dividend yield |

Acquired outside the system |

|

Risk-free interest rate |

Acquired outside the system |

To collect and enter report data for the Valuation process:

Run the Expected Life Years Analysis report.

This report helps you determine the expected life years for the Black-Scholes model. The expected remaining life of an option is the length of time before the optionee is expected to exercise the option in full. The report calculates the weighted average expected remaining life for the outstanding shares of the option. The system uses prior exercise information for a designated group of options plus other parameters that you enter to produce the Expected Life Years Analysis report.

Run the Expected Volatility report.

The Expected Volatility report helps you estimate the future volatility of a stock by calculating volatility based on historical stock prices entered through the Maintain Daily Prices page. It analyzes price movements over periods of months, weeks, days, or some other frequency that you choose and can serve as a benchmark from which you can project the expected stock volatility.

Enter variables on the Estimate Table page.

Use the Estimate Table page to create an Estimate ID and to record the expected volatility rates, risk-free interest rates, and expected dividend rates that you want the Black-Scholes Pricing Model to use when it values your stock options.

Use the Expected Life Years Analysis page (ST_RUNCTL_STFS001) to run the Expected Life Years Analysis report.

Navigation:

Note: The Expected Life Years Analysis report does not include stock options that are cancelled or that allow exercise before vesting. Additionally, options included in the report must have at least one active exercise.

Field or Control |

Description |

|---|---|

Valuation Method |

The valuation method that you select determines how the system estimates the expected life of the grant. You can select one of two valuation methods: Single Method measures and calculates the expected life from the grant date. Multiple Method measures and calculates the expected life from each of its vesting dates. |

Include Grants

Enter selection criteria in the Include Grants group box and click the Refresh Group button. The grants that meet your selection criteria appear in the Grant(s) to be Processed group box. You can add or remove individual grants from this list.

To be included in the report calculation, a grant must be active and have at least one active exercise record.

Field or Control |

Description |

|---|---|

Percentage Exercised |

If applicable, enter the minimum percentage of a grant that must be already exercised in order to be included in the report. |

View SQL |

Click this link if you want to see the WHERE clause of the SQL statement that represents your selection criteria. |

Use the Expected Volatility Report page (ST_RUNCTL_STFS002) to run the Expected Volatility report.

Navigation:

Field or Control |

Description |

|---|---|

Frequency Type |

The value that you select in this field determines the number of days the system uses to calculate the annualized volatility. Valid values are Annual, Biweekly, Daily, Monthly, Quarterly, Semimonthly, or Weekly. For example, if you calculate volatility for the date range, 01/01/2001 to 12/31/2001, and select Weekly in this field, the system retrieves the fair market value of the stock (based on the FMV method selected for the stock during set up) for every seventh day of the period defined by the from date and the end date. It then determines the annualized volatility by averaging the 52 periods in a year. If you select Daily, the system bases the annualized volatility on 250 trading days in a year. Note: The FASB recommends using at least 20 to 30 periods to compute a statistically valid measure (preferably more for long-term options). Ideally, this measurement should be based on a historical period equal to the expected life of the options. |

Use the Estimate Table page (ST_ESTIMATE) to enter variables for valuing stock options.

Navigation:

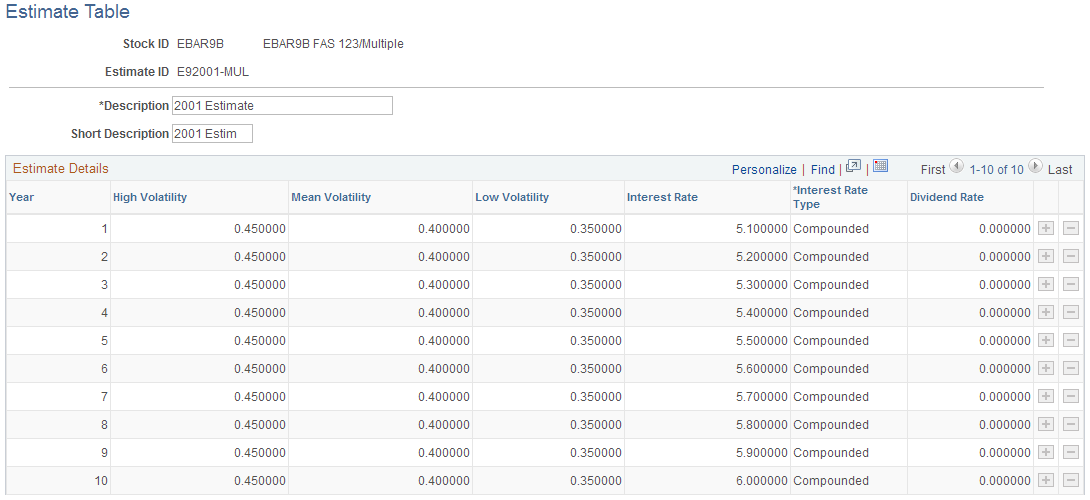

This example illustrates the Estimate Table page.

Enter a separate row of variables for each year up to the maximum expected life years of the options. For example, if the maximum expected life years for any option is 8.5, enter nine rows of data in the estimate table.

Important! Once an Estimate ID is used in a confirmed valuation, you cannot modify data in that estimate.

Field or Control |

Description |

|---|---|

High Volatility, Mean Volatility, Low Volatility |

Enter the high, mean and low volatility rates that you think are appropriate for the stock. Use the Expected Volatility report to help you determine these rates. |

Interest Rate |

For U.S. employers, the risk-free interest rate must be the rate currently available for zero-coupon U.S. government issues with a remaining term equal to the expected life of the options. |

Interest Rate Type |

Identify whether the interest rate represents a Compounded or Simple rate. |

Dividend Rate |

Enter the expected dividend rate for the year. |

Note: To value a group of restricted stock options or options that can be exercised before they are vested, create an Estimate ID and enter zeros for all of the estimated values. Enter zero for the expected life years when you launch the valuation process.