Defining Stock Option Plan Rules

To define stock option plan rules, use the Stock Option Plan Rules (ST_OPTION_PLAN) component.

After you create vesting schedules, you can define your option plans. Plans can include the following option types: NQ, ISO, RSA, NQ/SAR, and ISO/SAR (non qualified, incentive stock options, restricted stock awards, non qualified/stock appreciation right, and incentive stock options/stock appreciation right).

Generate the Stock Option Plan Rules report (STSU020) to view rules for your stock option plans.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_OPTION_PLAN1 |

Define general rules for a stock option plan, including allowed option types, governing body, transferability, exercise before vest, and repurchase alternatives. |

|

|

Stock Option Plan Rules - General: Comments Page |

ST_OPTION_PLAN5 |

Add comments about the stock option plan, such as a list of amendments made by the Board of Directors or shareholders. |

|

ST_OPTION_PLAN2 |

Select all payment and income methods allowed within a stock option plan. Also define how to calculate income for the option types that are allowed under your plan. |

|

|

ST_OPTION_PLAN3 |

Define rules for accounting for shares that are never issued or that are reacquired. |

|

|

ST_OPTION_PLAN4 |

Define the FMV methods and nontrading day rules for stock option plans. |

|

|

ST_OPTION_PARMS |

Define by Parameter ID various combinations of option features that you may use when granting options for a particular stock plan. |

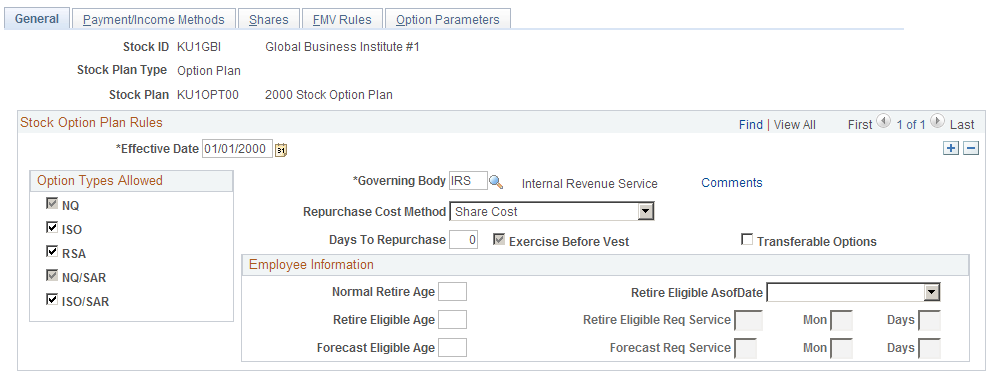

Use the Stock Option Plan Rules - General page (ST_OPTION_PLAN1) to define general rules for a stock option plan, including allowed option types, governing body, transferability, exercise before vest, and repurchase alternatives.

Navigation:

This example illustrates the Stock Option Plan Rules - General page.

Field or Control |

Description |

|---|---|

Option Types Allowed |

Select the option types the stock plan allows. You must select at least one option type. Values are NQ (non qualified), ISO (incentive stock options), RSA (restricted stock awards), NQ/SAR (non qualified/stock appreciation right), and ISO/SAR (incentive stock options/stock appreciation right). You can grant options and define option parameters for only those option types you select here. If you select ISO, NQ is automatically selected. If you select ISO/SAR, NQ/SAR is automatically selected. When RSA is selected, Exercise Before Vest is automatically selected. |

Governing Body |

Select from available options. Define governing bodies with the Governing Body Rules component (ST_GOVERN_BODY). |

Repurchase Cost Method |

If you select Exercise Before Vest, this option is available. It determines what your company pays for shares repurchased from an optionee. Select Share Cost to pay the cost the optionee originally paid for the stock. Select Fair Market Value to pay the Fair Market Value as defined on the FMV Rules page. |

Days to Repurchase |

If you select Exercise Before Vest, this option is available. Enter the number of days the company has to repurchase from optionees' shares exercised but unvested. |

Exercise Before Vest |

If you select NQ or ISO option types, this choice is available. If you select the RSA option type, this option is automatically selected. |

Transferable Options |

Select to allow options to be transferred to another individual. This is informational only. |

Employee Information

Use this group box to define employee retirement eligibility. The Stock – Retirement Eligibility (ST_RET_ELIG) Application Engine process updates the retirement eligibility indicators on the Maintain Grants - General page based on the eligibility rules you define here.

See Maintain Grants - General Page, Processing Retirement Eligibility.

Field or Control |

Description |

|---|---|

Normal Retire Age |

Enter the age at which an optionee can retire without a service requirement. |

Retire Eligible As Of Date |

Select Grant Date or Agreement Date to indicate the date on which the optionee's retirement eligibility is evaluated. |

Retire Eligible Age and Retire Eligible Req Service (retire eligible required service) |

Enter the age at which an optionee who meets specific service requirements can retire (an early retirement age), and specify the years, months, and days of service that are required for early retirement. |

Forecast Eligible Age and Forecast Req Service (forecast required service) |

Enter the age and service requirements for optionees that you want to include in your forecasting. Enter service requirements as years, months, and days. Use these fields to identify optionees that are nearing retirement eligibility. |

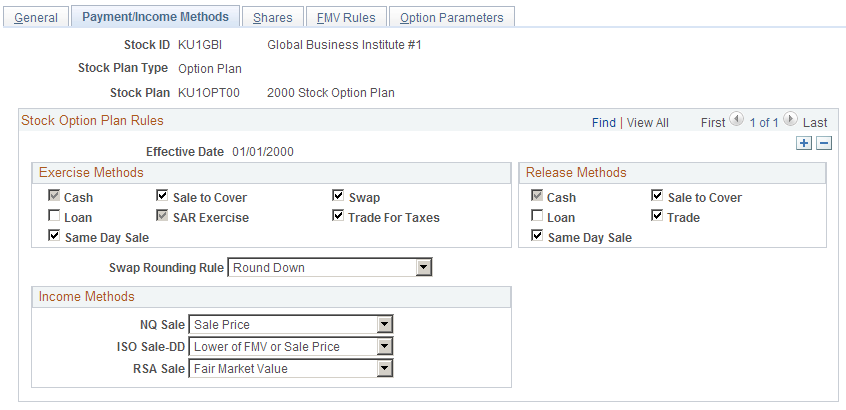

Use the Stock Option Plan Rules - Payment/Income Methods page (ST_OPTION_PLAN2) to select all payment and income methods allowed within a stock option plan.

Also define how to calculate income for the option types that are allowed under your plan.

Navigation:

This example illustrates the Stock Option Plan Rules - Payment/Income Methods page.

Field or Control |

Description |

|---|---|

Exercise Methods |

Select the exercise methods allowed by your stock plan. Values are: Cash: The optionee pays cash for the cost of the shares exercised and taxes. Loan: The optionee obtains a loan from the company to pay for the cost of the shares exercised and/or taxes. Same Day Sale: The optionee pays for the cost of the shares exercised and taxes by having the broker immediately sell 100% of the shares exercised, and deduct the amount due from the proceeds. This is sometimes known as a cashless exercise. Sale to Cover: The broker sells enough shares to cover the exercise cost and taxes. SAR Exercise: The optionee uses the appreciation on the shares exercised to pay for the cost of the taxes. This is available only for NQ/SARs and ISO/SARs option types. If you selected a SAR option type on the Stock Option Plan Rules - General page, SAR Exercise is automatically selected. Swap: The optionee surrenders already-owned shares to pay for the cost of shares exercised. Trade for Taxes: The optionee surrenders already-owned shares to pay for the cost of the taxes. |

Release Methods |

Select the release methods allowed by the stock plan. Values are Cash, Loan, Same Day Sale, Sale to Cover, and Trade. |

Swap Rounding Rule |

If you selected Swap for Shares or Trade for Taxes, this option is available. This rule determines how fractional shares are calculated during swap exercises. Select Round Up, Round Down, Standard Rounding, or Keep Fractions. Keep Fractions is available only if fractional shares are allowed at the Stock Details level. The Rounding Rule defined on the Stock Details - Common Rules page is the default. |

Income Methods |

Depending on the option type selected, use these methods to calculate income on same day sales, sell to cover exercises, and disqualifying dispositions. Valid values for the NQ Sale, ISO Sale − DD, and RSA Sale fields are: Sale Price, Lower of FMV or Sale Price, or Fair Market Value (the default value). |

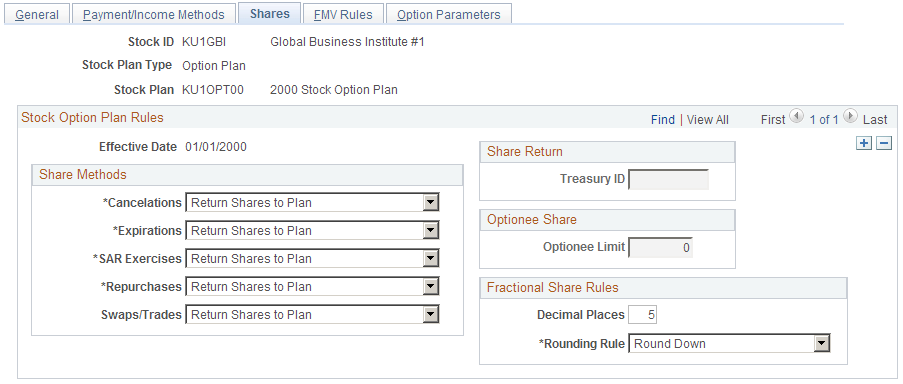

Use the Stock Option Plan Rules - Shares page (ST_OPTION_PLAN3) to define rules for accounting for shares that are never issued or that are reacquired.

Navigation:

This example illustrates the Stock Option Plan Rules - Shares page.

Share Methods

Indicate what happens to shares related to each of the events listed in the Share Methods group box. Options are:

Return Shares to Plan: Shares return to the plan pool where they are available for grant. This is the default share method.

Retire Shares to Treasury: Once returned to the treasury, shares are not available for grant unless allocated to a plan by the Board of Directors or the shareholders.

Field or Control |

Description |

|---|---|

Cancellations |

Cancelled shares are no longer available for exercise. |

Expirations |

Unexercised shares cease to be exercisable at the end of the option term. |

SAR Exercises |

When a SAR is exercised for cash rights the individual receives the cash amount of appreciation that has occurred on the option shares rather than receiving the option shares. This field determines how the unused SAR shares are handled during an exercise. |

Repurchases |

A company typically repurchases shares from an individual who exercises an option before it's vested and then terminates before the vest date. |

Swaps/Trades |

When individuals exercise options with a stock swap, they surrender the already-owned shares of stock to pay the total required option price or taxes for the option they are purchasing. |

Share Return

Field or Control |

Description |

|---|---|

Treasury ID |

If you selected Retire Shares to Treasury for any share method, indicate to what treasury they are to be returned. |

Optionee Share

Field or Control |

Description |

|---|---|

Optionee Limit |

In this optional field, enter the maximum number of shares that can be granted to an optionee from the stock option plan. If an optionee limit is defined on the Stock Details - Stock Options page, the value defaults and this field is unavailable. |

Fractional Share Rules

If you allowed fractional shares on the Stock Details - Common Rules page you can further restrict the number of decimal places here. Your selections on the Stock Details - Common Rules page determine the default values shown here; you can make the values more restrictive.

Field or Control |

Description |

|---|---|

Decimal Places |

Enter a number, between 0 and 6, to round. The number must be less than or equal to the decimal places defined on the Stock Details - Common Rules page. |

Rounding Rule |

Select a rounding rule to use after a conversion. Values are Standard, Up, and Down. |

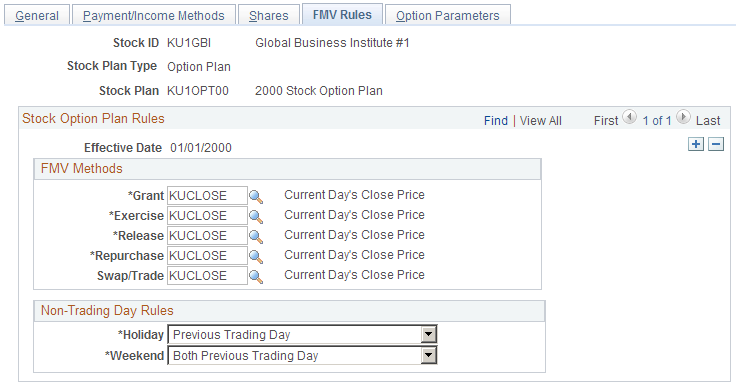

Use the Stock Option Plan Rules - FMV Rules page (ST_OPTION_PLAN4) to define the FMV methods and nontrading day rules for stock option plans.

Navigation:

This example illustrates the Stock Option Plan Rules - FMV Rules page.

FMV Methods

Define the FMV methods to use for various types of transactions.

The method defined on the Stock Details - Common Rules page determines the default value. You can use different methods for different types of transactions.

Non-Trading Day Rules

The method defined on the Stock Details - Common Rules page determines the default value.

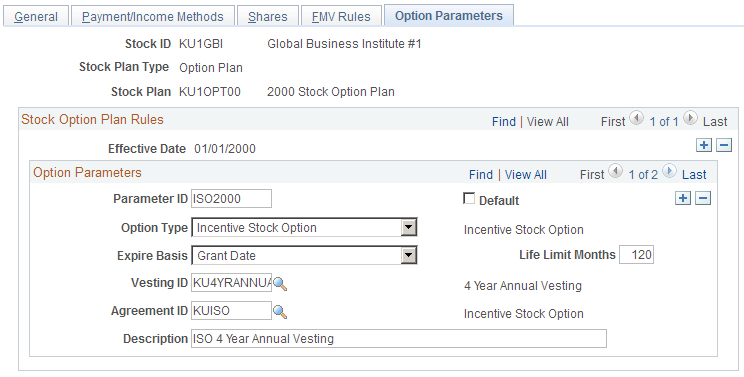

Use the Stock Option Plan Rules - Option Parameters page (ST_OPTION_PARMS) to define by Parameter ID various combinations of option features that you may use when granting options for a particular stock plan.

Navigation:

This example illustrates the Stock Option Plan Rules - Option Parameters page.

This page is optional, but can help with data entry when you are administering grants.

Field or Control |

Description |

|---|---|

Parameter ID |

Enter an ID to identify the various combinations of option features that you may use when granting options. |

Default |

Select to make this parameter ID the default. There can be only one default for each option plan. You'll use the default parameter ID when using the Administer Grants page. |

Expire Basis |

Select a date rule to use when calculating the expiration date on the vesting schedule. Values are Grant Date, Grant Dt + 1 (grant date + 1), Vest Date, and Vest Dt + 1 (vest date + 1). |

Life Limit Months |

Enter the number of months before the option expires. If the plan allows ISO or ISO/SAR option types, this number must not exceed the option life limit years under the ISO Section 422 rules defined with the Governing Body Rules - Stock Option Rules page. |