Setting Up Foundation Tables

To set up foundation tables, use the Governing Body Rules (ST_GOVERN_BODY), Exchange Table (ST_EXCHANGE), Transfer/Escrow Agency (ST_AGENT), Brokerage Table (ST_BROKERAGE), Brokerage/Branch Table (ST_BRKR_BRANCH), and the FMV Method Table (ST_FMV_MTHD_TBL) components.

This topic provides an overview of the reports that you can generate for foundation tables, lists prerequisites, and discusses how to set up foundation tables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_GOVERN_BODY1 |

Specify the governing body for your stock plans and add comments. |

|

|

ST_GOVERN_BODY2 |

Define ISO Section 422 rules and Section 83B filing days for your stock option system. |

|

|

ST_GOVERN_BODY3 |

Define Section 423 rules for your stock purchase system. |

|

|

ST_EXCHANGE_TBL1 |

Define the stock exchanges where the stocks administered in your system are traded. |

|

|

Exchange Table - Address Page |

ST_EXCHANGE_TBL2 |

Specify contact information for the stock exchange. |

|

ST_AGENT1 |

Define the agencies that provide escrow or transfer agent service for stocks administered in your system. |

|

|

Transfer/Escrow Agency - Address Page |

ST_AGENT2 |

Define the address of the agencies that provide transfer or escrow service. |

|

Brokerage Table Page |

ST_BROKERAGE |

Define the brokerage firms that your company has approved for stock plan participants. |

|

ST_BRKR_BRANCH |

Define the branches of the brokerage firms your participants use. |

|

|

ST_FMV_MTHD_TBL |

Define the different fair market value (FMV) methods you use for stock transactions. |

You can generate the following reports to review information in the foundation tables:

Governing Body Rules report (STUSU001)

Exchange Table report (STSU002)

Transfer/Escrow Agency report (STSU003)

Brokerage Table report (STSU004)

FMV Method Table report (STSU006)

Before you define the stock exchanges on which your stock trades, set up a unique holiday schedule for each exchange.

Use the Governing Body Rules - General page (ST_GOVERN_BODY1) to specify the governing body for your stock plans and add comments.

Navigation:

This example illustrates the Governing Body Rules - General page.

Only IRS (USA) regulations are supported and the system displays amounts that comply with IRS requirements. You can enter other governing bodies, but they are not supported.

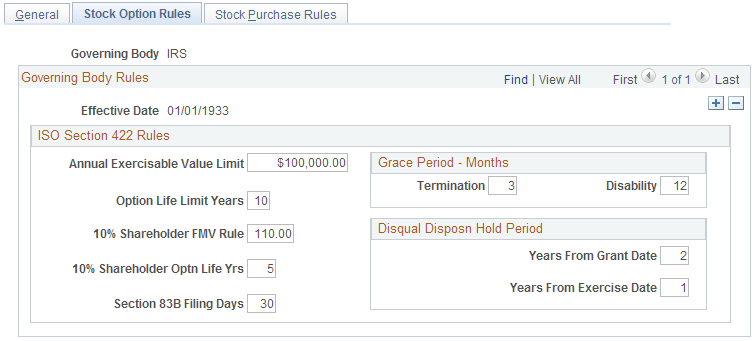

Use the Governing Body Rules - Stock Option Rules page (ST_GOVERN_BODY2) to define ISO Section 422 rules and Section 83B filing days for your stock option system.

Navigation:

This example illustrates the Governing Body Rules - Stock Option Rules page.

ISO Section 422 Rules

The system displays default amounts defined by the IRS for qualified stock option plans and employee stock purchase plans as of 1/1/1933, the date that IRS Section 422 regulations became effective. You can change the default amounts if, for example, you want to make all your equity plans more restrictive. If you make the amounts more generous, your plans may not comply with regulatory agency rules and securities laws.

Field or Control |

Description |

|---|---|

Annual Exercisable Value Limit |

The annual ISO exercisable value limit, determined as of the grant date, as defined by the IRS. |

Option Life Limit Years |

The number of years between an option's grant date and its expiration date. |

10% Shareholder FMV Rule |

The percentage of FMV that the price of an option that is granted to a 10% shareholder must equal or exceed. |

10% Shareholder Optn Life Yrs (option life years) |

The number of years between the grant date and the expiration date for options that are granted to 10% shareholders. |

Section 83B Filing Days |

The number of days allowed for an individual to file a Section 83B election after being awarded a restricted stock award. |

Grace Period - Months

Field or Control |

Description |

|---|---|

Termination |

The number of months following a termination to exercise a vested ISO option, after which it is treated as a non-qualifying option. |

Disability |

The number of months following a termination due to disability to exercise a vested ISO option, after which it is treated as a non-qualifying option. |

Disqual Disposn Hold Period (disqualifying disposition hold period)

An ISO grant must be held a minimum number of years from the grant date to be considered a qualifying disposition when it is sold.

Field or Control |

Description |

|---|---|

Years From Grant Date |

The minimum number of years from grant date to sale date for an ISO sale to be considered a qualified disposition. The system displays 2 years. |

Years From Exercise Date |

The minimum number of years from exercise date to sale date for an ISO sale to be considered a qualified disposition. |

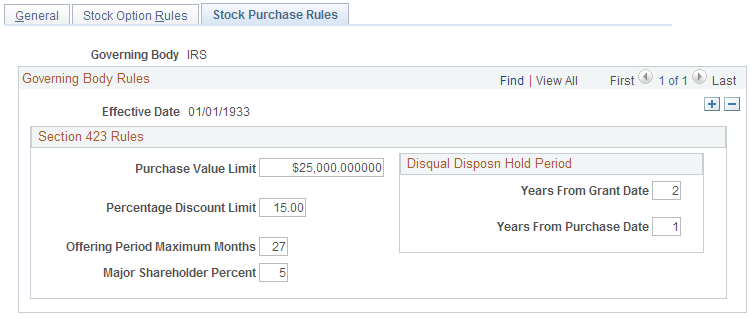

Use the Governing Body Rules - Stock Purchase Rules page (ST_GOVERN_BODY3) to define Section 423 rules for your stock purchase system.

Navigation:

This example illustrates the Governing Body Rules - Stock Purchase Rules page.

The system displays default amounts defined by the IRS for qualified stock option plans and employee stock purchase plans as of 1/1/1933, the date that IRS Section 423 regulations became effective. You can change the default amounts if, for example, you want to make all your equity plans more restrictive. If you make the amounts more generous, your plans may not comply with regulatory agency rules and securities laws.

Field or Control |

Description |

|---|---|

Purchase Value Limit |

The calendar year stock purchase limit for an individual determined at the beginning of an offering period. |

Percentage Discount Limit |

The maximum discount of FMV that can be defined for a stock purchase. |

Offering Period Maximum Months |

The maximum number of months in an offering period. |

Major Shareholder Percent |

The percentage of company stock owned by an employee that disqualifies that individual from participating in a stock purchase plan. |

Years From Grant Date |

The minimum number of years from the grant date to the purchase date for a stock purchase to be considered a qualified disposition. |

Years From Purchase Date |

The minimum number of years from the purchase date to the sale date for a stock purchase sale to be considered a qualified disposition. |

Use the Exchange Table - General page (ST_EXCHANGE_TBL1) to define the stock exchanges where the stocks administered in your system are traded.

Navigation:

Enter a description of the exchange, the currency code, and holiday schedule.

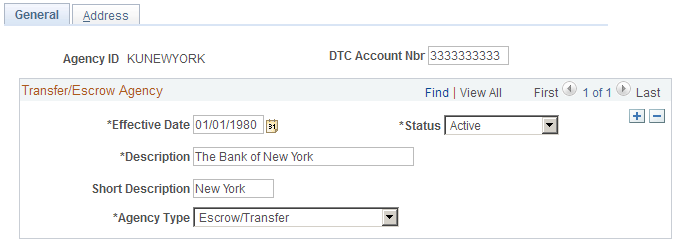

Use the Transfer/Escrow Agency - General page (ST_AGENT1) to define the agencies that provide escrow or transfer agent service for stocks administered in your system.

Navigation:

This example illustrates the Transfer/Escrow Agency - General page.

Field or Control |

Description |

|---|---|

DTC Account Nbr (Depository Trust Company account number) |

Enter the electronic ID of the transfer agent, escrow agent, or institution for electronically issued shares. This ID can be alphanumeric. |

Agency Type |

Select the type of service that the agency provides. Values are Escrow, Transfer, and Escrow/Transfer. |

Use the Brokerage/Branch Table page (ST_BRKR_BRANCH) to define the branches of the brokerage firms your participants use.

Navigation:

Enter the branch's address information.

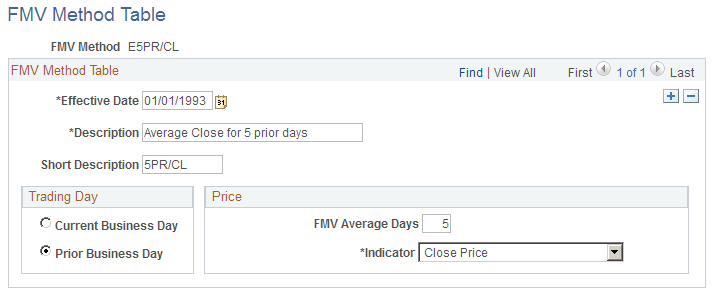

Use the FMV Method Table page (ST_FMV_MTHD_TBL) to define the different fair market value (FMV) methods you use for stock transactions.

Navigation:

This example illustrates the FMV Method Table page.

Stock Administration enables you to select the same or different FMV methods for your various stock plans.

Trading Day

Select which day's stock price to use for the FMV calculation.

Price

Field or Control |

Description |

|---|---|

FMV Average Days |

Enter the number of days to use when calculating an average. If you enter 0, the system uses the default of one day. If no averaging is needed, leave the default of one day |

Indicator |

Select which stock price to use in the FMV calculation. Values are: Ask Price, Average Bid/Ask, Average High/Low, Average Open/Close, Bid Price, Close Price, High Price, Low Price, Open Price, and Private. Select Private if your company is privately held. Enter the FMV price determined by your Board of Directors on the Daily Prices Tracking page. Note: You can override the FMV method at the transaction level, and you can have different FMVs for different transactions within your stock administration system. |