Valuing Stock Options

This topic provides an overview of the procedure for running the Process Grant Valuation process (STFS003) and discusses how to value stock options.

Note: The system must have a valuation for all grants issued after the Original Fair Value date that is noted on the Stock Table page. Any grants that do not have a valuation record, are reported on the Valuation Audit report.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ST_RUNCTL_VALUE |

Run the Process Grant Valuation (Black Scholes) process. |

|

|

ST_GRANT_VALUE |

View grant valuation information including the shares valued, the grant FMV, and expected life years for a selected employee and grant. |

|

|

Grant Valuation Page |

ST_GRANT_VAL_SEC |

For grants valued with the multiple valuation method, display detailed information for each valuation period. |

|

ST_RUNCTL_UNVALUE |

Deletes specific grant valuations. |

The Process Grant Valuation process executes the Black-Scholes Pricing model for the grants that you select. You can run the process in preview or confirmation mode.

To run the process:

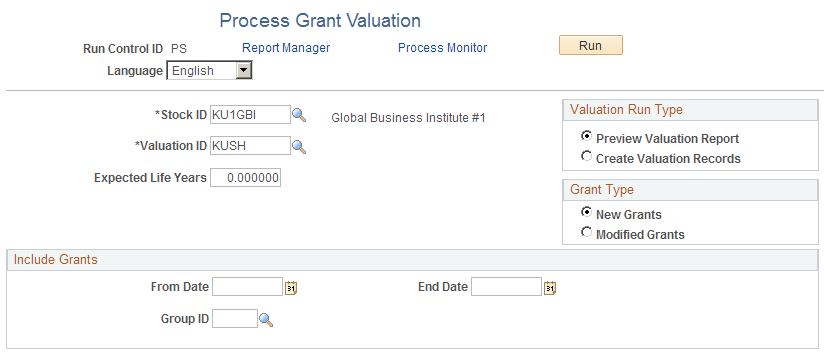

Access the Process Grant Valuation page.

Specify the stock ID, valuation ID, and expected life years for the grants to be valued.

Indicate whether you want to preview or confirm a valuation.

Select the grants to include in the process.

Run the process.

Use the Process Grant Valuation page (ST_RUNCTL_VALUE) to run the Process Grant Valuation (Black Scholes) process.

Navigation:

This example illustrates the Process Grant Valuation page.

Field or Control |

Description |

|---|---|

Expected Life Years |

Enter the expected remaining life that you deem appropriate for the group of options you're valuing. (You can use the Expected Life Year Analysis report to help determine this number.) The figure you enter determines which set of variables the system retrieves from the Estimate Table for use in the Black-Scholes Model. The system rounds up if you enter a number with a decimal that equals or exceeds .50. For example, 3.5 and 3.6 are rounded up to 4. If the Valuation ID represents the multiple valuation method, the Valuation process automatically adds the number you enter in this field to the length of each vesting period. The expected life must extend beyond the first vesting date but cannot extend beyond the last expiration date. For example, assume today is 07/01/2001, the first vesting date is 07/01/2003, and the last expiration date is 07/01/2011. In this case, the expected life years can be between 2 and 10. |

Valuation Run Type

Field or Control |

Description |

|---|---|

Preview Valuation Report and Create Valuation Records |

You can preview the valuation for a group of grants before you create it. Previewing prints the Valuation Detail report without saving the valuation records to the database. This report details the valuation calculation results for each grant processed. You can preview a valuation, change the values on the Valuation Table and run the preview process again. When you create a valuation record for each grant processed, the system also prints the Valuation Detail report. Once you create a Valuation ID for a given run, you cannot modify it unless you first reverse all valuation records for that Valuation ID. |

GrantType

Field or Control |

Description |

|---|---|

New Grants and Modified Grants |

Select the grants to include in the process. |

Include Grants

Enter selection criteria in the Include Grants group box.

Specify the Stock ID, Valuation ID, and expected life years for the grants you want to value and whether you want to preview or confirm a valuation.

Use the Maintain Grants - Valuation page (ST_GRANT_VALUE) to view grant valuation information including the shares valued, the grant FMV, and expected life years for a selected employee and grant.

Navigation:

This example illustrates the Maintain Grants - Valuation page.

Note: When you use the multiple valuation method to value grants, the values on this page reflect the weighted averages for the grant.

Field or Control |

Description |

|---|---|

Valuation Reason |

When a grant valuation is first confirmed, the valuation reason is set to Initial Valuation. Reprice appears in this field if this grant has been revalued after repricing. |

Value Per Share |

This field displays the fair value per share and appears as a hyperlink if the multiple valuation method was used. Click the link to open the Grant Valuation page, where you can see detailed information for each valuation period. |

You can revalue grants after the initial valuation; but only if the revaluation is due to repricing, that is, the original grant has been cancelled and reissued. (A reprice grant number must appear for the new grant on the Maintain Grants - Miscellaneous page.)

You must use the same valuation method (single or multiple) to value the repriced grants; however you do not need to use the same Valuation ID.

To revalue the options, run the Process Grant Valuation process for the new grants. The system automatically revalues the cancelled grant, if the new grant is linked to the cancelled grant via the reprice grant number.

Use the Reverse Grant Valuation page (ST_RUNCTL_UNVALUE) to deletes specific grant valuations.

Navigation:

To unconfirm valuations for grants that have been previously valued:

Specify the Stock ID.

Select the grants for which you want to reverse the valuation process by entering selection criteria in the Include Grant Valuations group box.

Click the Refresh Group button.

The grants that meet your selection criteria appear in the Grant(s) to be Processed group box. You can add or remove individual grants from this list.

Click Run.