Overview of Payroll Integration

Time and Labor transmits the payable time created by the Time Administration process to a payroll application, such as Payroll for North America or Global Payroll. The payroll application compensates time reporters for their payable time and—at the end of the pay run—sends labor-related costs back to Time and Labor, where they are distributed across payable time and made available to Project Costing and other applications.

Before using your payroll system to pay employees for time reported in Time and Labor, you must integrate your systems. This entails:

Mapping time reporting codes (TRCs) to your payroll system's earnings codes.

Selecting settings on various pages within Time and Labor, your payroll system, and PeopleSoft Human Resources.

Configuration requirements vary by payroll system and are described later in this section.

After the setup is complete, payroll personnel can include payable time, created by the Time Administration process, in pay runs. Depending on how you configure Time and Labor, payroll personnel can distribute the resulting costs back to payable time for other products to use. This section discusses the relationship between payable time created in Time and Labor, your payroll application, and other applications that can use cost data.

Note: Payable time is available to third-party applications; however, PeopleSoft does not deliver a process for publishing to third-party applications.

See also: Understanding Payable Time

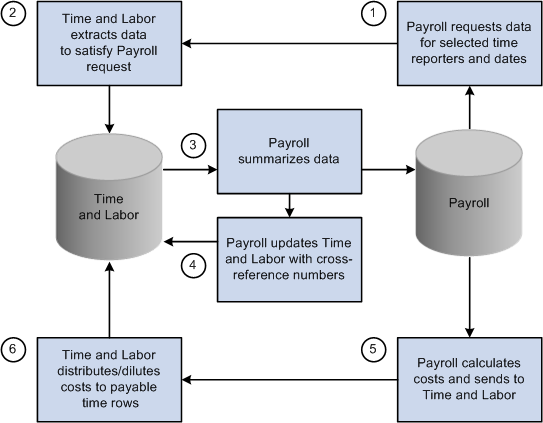

Procedures for including payable time in pay runs vary by payroll system; however, the general steps that apply to both Payroll for North America and Global Payroll are as follows:

In Time and Labor, a user runs the Time Administration process to create payable time for the workgroups with time reporters to pay.

In the payroll system, a user sets up the calendars and run IDs for the payroll process.

The payroll system defines who is to be paid and for what period of time. This information is used to select employees in the pay group who have been active at any time during the pay period.

Payable time entries are selected from Time and Labor and sent to the payroll system.

The first time this occurs, all payable time that meets the selection criteria is sent. After that, only payable time that has been added or changed is selected, including adjustments to the current period and prior periods.

The payroll system summarizes the payable time entries.

Summarization consists primarily of totaling reported hours, units, or amounts at the earnings code or task code level. Each payroll system has its own rules for summarizing data. Pay calculations are run and the payroll cycle is completed.

The payroll system sends cost data generated by the pay run back to Time and Labor.

The Labor Distribution and Dilution processes are invoked in Time and Labor if you have selected these features.

The Labor Distribution process attaches the costs calculated by your payroll system to the corresponding payable time entries in Time and Labor.

The Labor Dilution process averages the calculated costs and evenly distributes them across the payable time entries.

The payable status associated with each entry of payable time is updated throughout the various stages of processing. You can view payable status on the View Payable Time Detail page of the Time and Labor self-service component.

This diagram illustrates the process flow when Time and Labor is integrated with a payroll application

After a pay run is complete, payroll costs associated with time that originated in Time and Labor can be extracted from the payroll system and distributed across payable time entries. The updated time detail can then be published to other applications for additional processing.

Allocating costs back to payable time is labor distribution. Labor distribution is an optional feature of Time and Labor that you can select on the Pay System page. Select one of two options.

Labor distribution only.

This option enables you to allocate payroll costs back to the tasks for which payable time was originally reported, provided you defined the TRC as eligible for distribution. If you are not tracking time at the task level, costs are allocated to the TRCs to which time was reported.

Labor distribution and dilution.

If you select this option, the Dilution process is triggered automatically at the end of the Labor Distribution process. The system reallocates labor-distributed costs for a given day, so that payroll costs are evenly distributed over payable time entries for hourly TRCs flagged as eligible for dilution. If a time reporter is paid at different rates or—in the case of salaried workers—is not explicitly paid for overtime, Time and Labor can calculate an average hourly (diluted) amount and apply it evenly across all hours reported for the day.

Example: Effect of Labor Distribution With and Without Dilution

Assume the following time entries:

|

Date |

Hours |

TRC |

Project |

|---|---|---|---|

|

1 Feb |

5 |

REG |

A |

|

1 Feb |

4 |

REG |

B |

|

1 Feb |

3 |

REG |

C |

Suppose the Time Administration process applies a rule that converts hours in excess of 8 per day to overtime. The results of the rule are shown as follows.

|

Date |

Hours |

TRC |

Project |

|---|---|---|---|

|

1 Feb |

5 |

REG |

A |

|

1 Feb |

3 |

REG |

B |

|

1 Feb |

1 |

OT |

B |

|

1 Feb |

3 |

OT |

C |

When you run the payroll process, it consolidates the entries resulting in 8 hours of regular time and 4 hours of overtime. Regular time is paid a rate of 10.00 USD per hour; overtime is paid a rate of 19.00 USD per hour. Payroll sends the costs back to Time and Labor, which distributes the costs across the payable time entries as follows:

|

Date |

Hours |

Rate |

TRC |

Project |

Cost |

|---|---|---|---|---|---|

|

1 Feb |

5 |

10 |

REG |

A |

50 |

|

1 Feb |

3 |

10 |

REG |

B |

30 |

|

1 Feb |

1 |

19 |

OT |

B |

19 |

|

1 Feb |

3 |

19 |

OT |

C |

57 |

|

TOTAL |

12 |

|

|

|

156 |

The cost for project A is lower than the cost for project C, even though more hours were worked for project A. This is not equitable, given that the time reporter could have worked on the projects in any order.

The Labor Dilution process distributes costs more evenly. It divides the total cost of 156 by 12 (the total number of reported hours) to come up with a rate of 13. It then applies the same rate to all entries, as shown in the following table.

|

Date |

Hours |

Rate |

TRC |

Project |

Diluted Cost |

|---|---|---|---|---|---|

|

1 Feb |

5 |

13 |

REG |

A |

65 |

|

1 Feb |

3 |

13 |

REG |

B |

39 |

|

1 Feb |

1 |

13 |

OT |

B |

13 |

|

1 Feb |

3 |

13 |

OT |

C |

39 |

|

TOTAL |

12 |

|

|

|

156 |

Now project A reflects a diluted cost that is proportionate to the number of hours worked.

Labor Distribution Rules

Labor distribution rules are:

The Labor Distribution process allocates costs back to payable time entries according to the level of detail supported by the payroll system.

The criteria that the payroll system uses to consolidate payable time entries determines the level of detail.

When all TRCs participating in labor distribution are of the same type (amount, units, or hours), costs are allocated evenly, based on the reported values.

When one or more TRCs are defined with an amount type, the Labor Distribution process:

Allocates the amounts that were originally reported back to TRCs with an amount type.

Allocates the remaining costs across TRCs with a type of hours or units.

When payable time status is set to Closed and the associated reason code is Not Distributed (NDS), (that is, it will not be sent to a payroll system or will not participate in labor distribution), the estimated gross amount (Est_Gross) populates both the labor distribution amount field (Lbr_Dist_Amt) and the diluted labor distribution amount field (Diluted_Gross).

In addition, the currency code (Currency_Cd) used to calculate estimated gross populates the currency code used for the labor-distributed and labor-diluted amounts (Currency_Cd2).

Record-only adjustments are not sent to payroll for processing, thus they are not included in the Labor Distribution process.

You can manually update the labor distribution and labor dilution amount through the Adjust Paid Time page.