Setting Up Loan Origination

To set up a default loan agency, use the Reassign Loan Agencies component (LN_AGENCY_DFLT) and Define Loan Institutions component (LOAN_INST_TABLE).

This section provides an overview of loan origination and discusses how to:

Specify a default loan agency.

Set up loan destination defaults.

Because CommonLine 4 process levels only require a guarantor to originate a loan, the loan destination that you use to originate the loan might not be the same loan destination that you use to guarantee the loan.

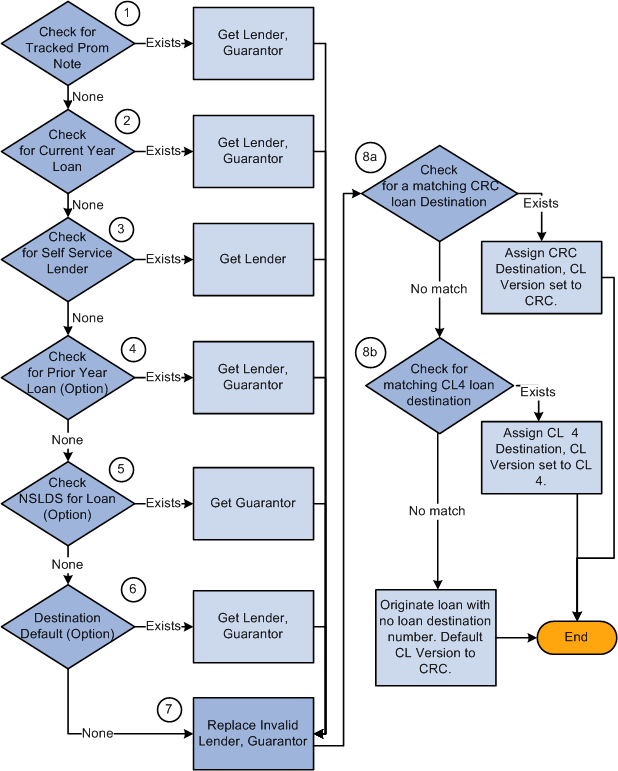

Loan origination follows a seven-step process to determine the lender and guarantor and then determine the loan destination. You determine which steps to follow when you set destination defaults.

|

Step |

What Happens |

Possible Information Selected |

|---|---|---|

|

1 |

If an active, unused promissory note is tracked, the process selects the designated lender and guarantor from the form used for origination. The process skips steps 2 through 6. |

Lender only Guarantor only Lender and guarantor No information |

|

2 |

If a matching loan is originated and guaranteed in the current aid year for the borrower, the system uses lender and guarantor from the earlier origination record, and the process skips steps 4 through 6. |

Lender and guarantor No information |

|

3 |

If the student has entered a lender from the self-service lender selection pages, the process uses the selected lender and skips steps 4 through 6. |

Lender No information |

|

4 |

The origination process searches back one year for a prior year originated loan of the same loan type; if a prior loan is found, the process skips steps 5 and 6. |

Lender and guarantor No information |

|

5 |

The origination process searches the current NSLDS history to find a previously originated loan of the same loan type. A new NSLDS loan type cross reference section is available in the Loan Type Table component to facilitate this step. If a prior loan is found, the process skips step 6. Note: Only the guarantor is used from the NSLDS loan history. |

Guarantor only No information |

|

7 |

The process assigns a default destination |

Lender only Guarantor only Lender and guarantor No information |

|

6 |

The process checks the validity of the selected lender and guarantor values and reassigns lender and guarantor IDs as defined in the Agency Default page. |

Lender only Guarantor only Lender and guarantor No information |

|

8 |

Based on the lender and guarantor information selected in the prior steps, the loan origination process searches for a matching loan destination profile record. If one is not found, the loan is still originated, but it cannot be transmitted until a loan destination is assigned. |

Loan destination No destination |

The following chart illustrates the process:

Process flow to determine loan destination

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Agency Default Setup |

LN_AGENCY_DFLT |

|

Identify a default agency if the borrower does not select a lender, guarantor, or servicer. Identify lenders, guarantors, or servicers that are no longer in service and have them replaced automatically with a new agency when a loan is originated. |

|

Loan Destination Default |

LOAN_INST_TABLE2 |

|

Set up default parameters for loan destination. |

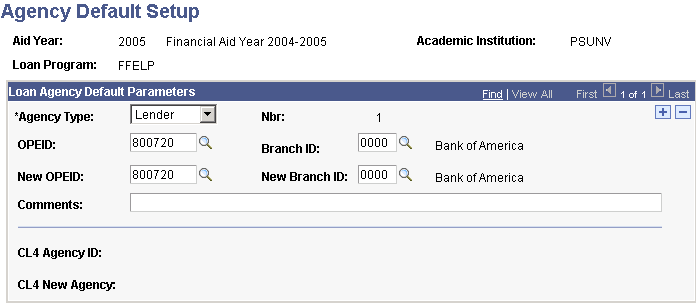

Access the Agency Default Setup page ().

This example illustrates the fields and controls on the Agency Default Setup page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Agency Type |

Select from: Guar/Ins (guarantor/insurer), Lender, and Servicer. |

OPEID (office of postsecondary education identifier) |

Select the office of postsecondary education identifier. To assign a default loan agency, leave this field blank. |

New OPEID |

Enter the agency to replace the previous agency, or the default agency if you left the OPEID field blank. Note: The source of values for the OPEID and New OPEID field are defined in the Create CRC Loan Participant component. |

CL4 Agency ID |

Displays the ID and agency name. |

CL4 New Agency |

Displays the ID and name for the new agency. |

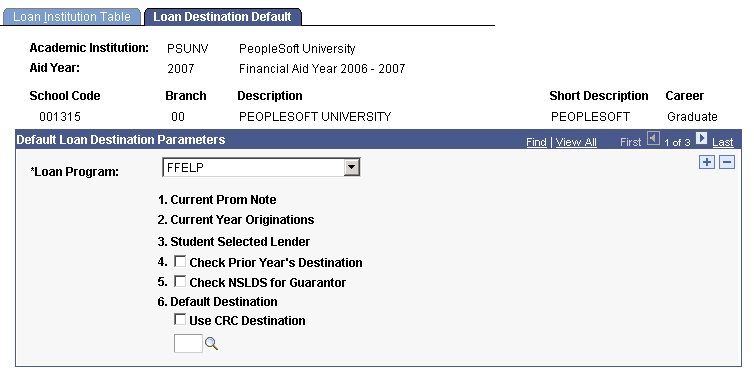

Access the Loan Destination Default page ().

This example illustrates the fields and controls on the Loan Destination Default page. You can find definitions for the fields and controls later on this page.

The order in which the system chooses the loan destination for the student is as follows: Current Promissory Note, Current Year Originations, Check Prior Year Originations, Check NSLDS for Guarantor, Default Destination.

Field or Control |

Description |

|---|---|

Loan Program |

Select from Alternative, Direct, FFELP, Health, Perkins, State, or University. |

Current Prom Note (current promissory note), Current Year Originations, and Student Selected Lender |

The loan origination process always performs these steps. |

Check Prior Year's Origination and Check NSLDS for Guarantor |

Select to have the system perform these steps. |

Default Destination |

If nothing results from the first four search methods, the system uses this default destination. The field allows you to select from the CommonLine 4 loan destination profile numbers. Select the Use CRC Destination (common record commonline destination) check box to allow the selection of CRC loan destination profile numbers. |

Use CRC Destination |

Select to use CRC destination. This controls the dynamic prompting of either CL4 or CRC loan destinations in the edit box on the page.

Note that a default loan destination number is not required to activate this behavior. The current rule used by the origination process to determine the CL version and loan destination number has not been changed. |