(CAN, IND, and USA) Defining and Maintaining Tax Classes

Use the Tax Class Definition (TAX_CLASS_DEFN) component to set up tax classes.

This topic provides an overview of how to use tax classes and discusses how to define tax classes.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_CLASS_DEFN |

Set up or review tax classes. Tax Class determines the period over which you expense tax depreciation. The Tax Class table for the SHARE tableset is shipped with guideline class lives for property. Tax Class is informational only and is not used in any calculations. You can set up your own tax classes or use those already set up in the SHARE Tax Class table. Define class and block rate for the tax class. This is equivalent to the tax group for India. |

Tax class is a classification system established by the U.S. Internal Revenue Service (IRS) to determine the period over which you can expense tax depreciation. The IRS has assigned classes to particular types of depreciable property, and there are assigned rates for each class. The classifications delivered with PeopleSoft Asset Management list the available IRS-defined tax classes.

Tax class rates are used in Canada to calculate depreciation as allowed by the Capital Cost Allowance (CCA). Asset pools or classes and CCA rates are set by governmental regulations. In the year that assets are acquired, 50 percent of the normal rate should be used (Half-Year Rule). The value that you enter for an asset tax class for the CCA rate percent is used later when you run a process to calculate the CCA rate. However, the Canadian Accelerated Investment Incentive enables enhanced first year write-offs. The incentive suspends the CCA Half-Year Rule. Eligible property must be acquired after November 20, 2018, and become available for use before 2028.

Tax class is also used to define tax rates by group for processing tax and depreciation in India. The tax group is a subcategory of the tax block in India. PeopleSoft Asset Management defines tax blocks in the Asset Block component. Therefore, tax class is a subgroup of the asset block in PeopleSoft Asset Management. The tax class is associated with assets in the Profile component and the Express Add component as Guideline Class.

Use the Classes page (TAX_CLASS_DEFN) to set up or review tax classes.

Tax Class determines the period over which you expense tax depreciation. The Tax Class table for the SHARE tableset is shipped with guideline class lives for property. Tax Class is informational only and is not used in any calculations. You can set up your own tax classes or use those already set up in the SHARE Tax Class table. Define class and block rate for the tax class. This is equivalent to the tax group for India.

Navigation:

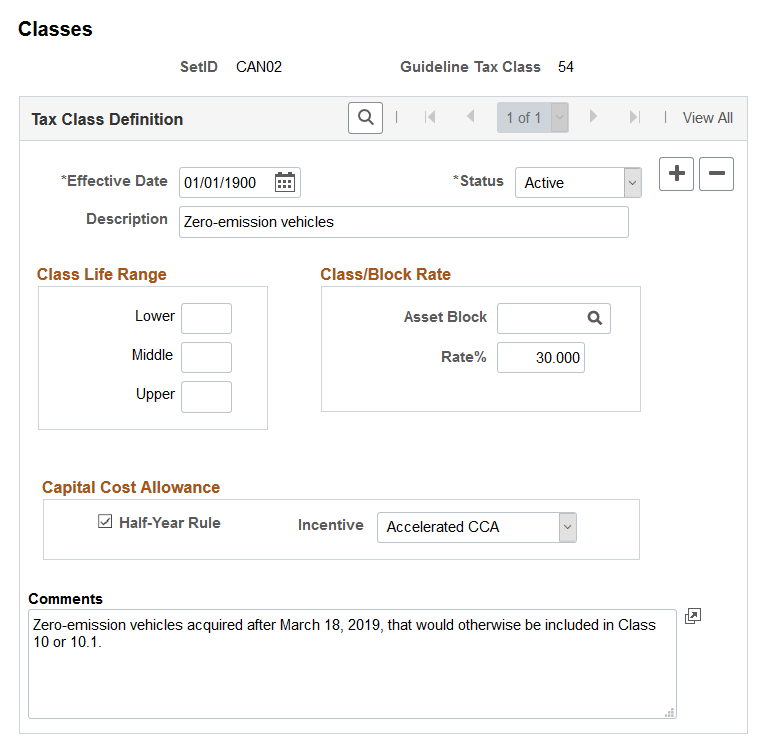

This example illustrates the fields and controls on the Classes page. You can find definitions for the fields and controls later on this page.

Class Life Range

Field or Control |

Description |

|---|---|

Lower |

Enter the asset lifetime expectancy minimum in a range. |

Middle |

Enter the asset lifetime expectancy average or middle or range. |

Upper |

Enter the asset lifetime expectancy maximum in a range. |

Class/Block Rate

Field or Control |

Description |

|---|---|

Asset Block |

Enter the asset block with which this tax class should be associated for depreciation and tax reporting in India. Asset tax blocks are defined by the Indian Tax Depreciation Act (Indian Income Tax Act 1961). |

Rate % (rate percentage) |

(CAN) Canada: Enter the appropriate CCA rate percentage for this tax class to calculate the CCA for Canada. The Capital Cost Allowance (CCA) is "a tax deduction that Canadian tax laws allow a business to claim for the loss in value of capital assets due to wear and tear or obsolescence" (Canada Customs and Revenue Agency). If you buy a property or a piece of equipment to use in your business, you don't deduct the entire cost of it against your income for that particular year. Instead, you deduct a calculated portion of the expense over a period of years as the property or the equipment depreciates. The Canada Customs and Revenue Agency has assigned classes to particular types of depreciable property, and there are assigned rates for each class. (IND) India: Enter the tax group rate percentage that will be associated with the asset block and tax entity used to process depreciation and tax reporting for India. |

Capital Cost Allowance (CAN)

Use this section to enable enhanced write-off methods for eligible property that is subject to the Capital Cost Allowance (CCA) rules.

Field or Control |

Description |

|---|---|

Half-Year Rule |

Select this option to indicate the guideline tax class is subject to the Half-Year Rule. |

Incentive |

Select an incentive for the guidance tax class when it is subject to Accelerated Investment Incentives. Values include:

|