Defining Investment Property

This topic provides an overview of investment property and lists the pages used to identify investment property for proper accounting entry processing in PeopleSoft Asset Management.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CATEGORY_DEFN |

Establish categories as Investment Property or Property Interest, as necessary. |

|

|

INSTALLATION_AM |

Enable the Revaluation Process feature to be able to select investment property options on the Business Unit/Book Feature page and the Accounting Entry Template. |

|

|

BU_BOOK_FEATURE |

Select the investment property options within the Impairment/Revaluation Options group box (if applicable), as well as the revaluation method and the investment property transaction code. |

|

|

DIST_TEMPLATE_DEFN |

Select an investment property asset category in order to display the proper investment property accounting entries. |

|

|

AM_REVALUATION |

Select the investment property revaluation method to retrieve the assets that should receive investment property accounting treatment. |

|

|

AMREVAL_RQST |

Select the investment property revaluation method to process the assets that should receive investment property accounting treatment. |

In accordance with International Accounting Standards (IAS) 40, PeopleSoft Asset Management facilitates the administration of investment properties that are stored in the Asset Repository. To help organizations more easily comply with IAS 40, PeopleSoft provides:

Ease of identification of investment property as distinguished from other assets.

Accounting entry templates for investment property - accounting entry template and distribution type, IX, is used for investment property accumulated adjustments for non depreciable categories.

Reporting capabilities - investment property fields appear on the Asset Management Units/Books report (AMBU1000) and Asset Categories report (AMAS1100). Information for required disclosure of investment property fair values is provided within the Fair Value Activity Report and Fair Value Detail Report.

During the addition of property or later, you can identify the asset as investment property. This attribute can be applied at the asset level or at the asset profile or category. Identification at the category level is necessary for handling batch transactions where there is no human intervention. Investment property can be owned assets and capital leases. Property interest is an operating lease that meets the conditions to be deemed as an Investment Property. Operating leases that fall under this category are not ruled by the ordinary lease accounting rules but are treated as capital leases for accounting purposes. In other words, they are considered capital leases even if they are technically considered operating leases per FAS 13.

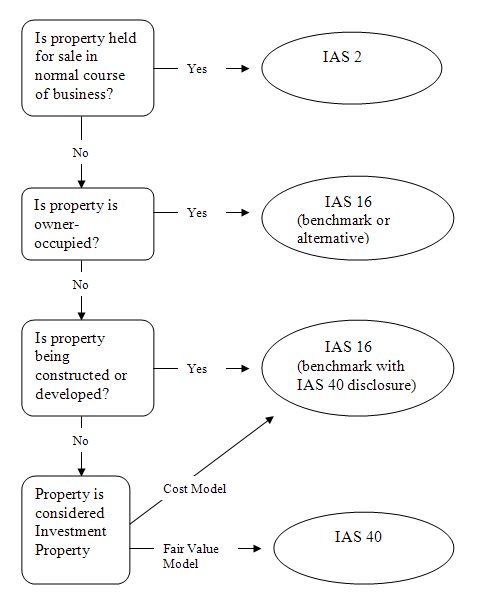

The following diagram summarizes the classification process and treatment of investment property for International Accounting Standards (IAS):

Classification process and treatment of investment property for International Accounting Standards (IAS):

Before you can begin identifying investment property and make use of the delivered functionality for proper accounting treatment of investment property, you must:

Review IAS 40 to determine the assets that must be accounted for and reported as investment property or property interest. Determine whether they are leased assets as well and whether they require revaluation.

Establish categories as Investment Property or Property Interest as necessary on the Categories page.

Enable the Revaluation Process feature on the Installation Options - Asset Management page.

Once you enable the revaluation process at the installation level, the Investment Property option appears on the Business Unit/Book Feature page within the Impairment/Revaluation Options group box. The distribution type for investment property also appears on the Accounting Entry Template.

Select the investment property options within the Impairment/Revaluation Options group box (if applicable) on the Business Unit/Book Feature page. These include options for the revaluation method and the investment property transaction code.

Use the Categories page (CATEGORY_DEFN) to establish categories as Investment Property or Property Interest, as necessary.

Navigation:

The Categories page provides investment property indicators that enable proper accounting treatment and generate investment property reporting detail for required disclosure.

Selection of the depreciable status and investment property options on this page dictates which accounting entries to display in the accounting entry template.

The Asset Management accounting entry templates accommodate accounting entries that are required for investment property. When selecting an asset category (for the accounting entry template) that has investment property options selected, the Investment Property distribution type (IP) directs related accounting entries for all processes to the investment property account. This is applicable for all of the templates where a fixed asset account appears.

If you decide to measure investment properties using the fair value model, PeopleSoft Asset Management provides a calculation to reflect the gain or loss that is generated by the fair value fluctuation over time. To enable revaluation for investment properties, the following setup is required:

Enable the Revaluation Process feature within the Installation Options - Asset Management page.

Enable the specific investment property options for Impairment and Revaluation processes on the Business Unit/Book Feature page.

Enable Revaluation Installation Option

Select the Revaluation Process check box. The selection of this check box makes investment property options visible on the Business Unit/Book Feature page for impairment and revaluation processing.

Enable Investment Property Impairment and Revaluation Options

Enable the Impairment/Revaluation Options that deal with the investment property treatment: The enhancement here consists in two new fields, the first to check if the book will enable the Investment Property revaluation and the second to assign the corresponding Transaction Code associated to that kind of transaction

Investment Property - select to enable investment property revaluation for a book within the business unit.

Revaluation Method - select the Inv Prop (investment property) field.

Inv. Property Trans. Code - select the investment property transaction code.

See Creating PeopleSoft Asset Management Business Units and see Business Unit/Book Feature Page.

Enable Revaluation Worksheet for Investment Property

As with other assets, use the Revaluation Worksheet to revalue investment properties. Select the Inv Prop revaluation method on the Revaluation Worksheet to retrieve all of the investment property assets. When making this selection, these assets are retrieved even if the Asset Category field is left blank.