(IND) Setting Up Tax Asset Blocks

Use the Asset Block (ASSET_BLOCK) component to define asset blocks.

This topic provides an overview of asset blocks and discusses how to define asset blocks.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ASSET_BLOCK |

Define assets blocks. This is equivalent to the tax block for India. |

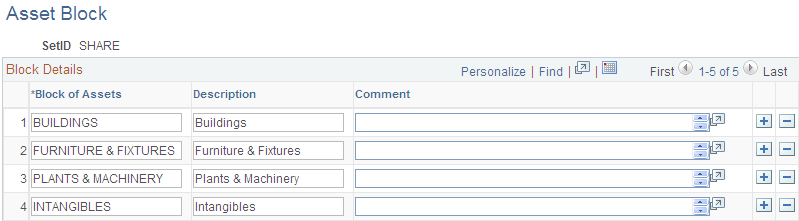

Asset blocks are required for India tax reporting. According to the Indian Tax Depreciation Act (Indian Income Tax Act 1961), does not recognize depreciation on individual assets. Instead, it groups similar pools of assets under the concept of a tax block. There are only four blocks of assets prescribed under the act:

Buildings.

Furniture and fixtures.

Machinery and plants.

Intangibles.

Annual tax depreciation is reported to the India tax authority per tax block, per fiscal year. The PeopleSoft system uses the asset block to maintain tax block definitions for India.

Use the Asset Block page (ASSET_BLOCK) to define assets blocks.

This is equivalent to the tax block for India.

Navigation:

This example illustrates the fields and controls on the Asset Block Page. You can find definitions for the fields and controls later on this page.