Integrating with PeopleSoft Billing

This topic provides an overview of how to integrate PeopleSoft Asset Management with PeopleSoft Billing and discusses how to enable the integration.

PeopleSoft Asset Management integration with PeopleSoft Billing enables you to complete asset lifecycle processes, bill retire with sale transactions, and generate accounting entries in PeopleSoft Billing and PeopleSoft Asset Management. Using the AM/BI Interface process, you can pass asset Retire With Sale transactions from PeopleSoft Asset Management to PeopleSoft Billing to generate appropriate accounting entries to relieve fixed assets, calculate VAT as necessary, debit Receivables, and post to PeopleSoft General Ledger. You can also send asset reinstatements to PeopleSoft Billing as credit lines.

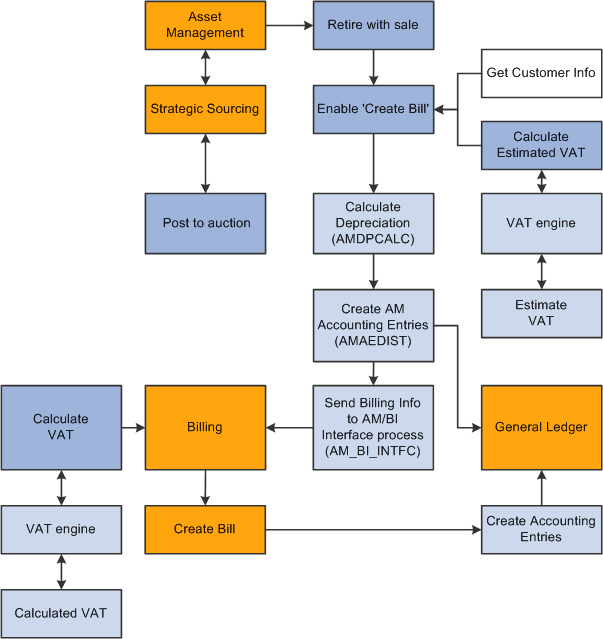

This diagram displays the data and process flow that occurs when you integrate PeopleSoft Asset Management with PeopleSoft Billing:

Data and process flow for integration between PeopleSoft Asset Management and PeopleSoft Billing:

When an asset is retired by sale in PeopleSoft Asset Management:

Retire the asset with a sale in PeopleSoft Asset Management and collect the appropriate customer information within PeopleSoft Asset Management.

Send the transaction information and billing information to the Billing Interface using the AM/BI process (AM_BI_INFTC).

When PeopleSoft Strategic Sourcing puts an asset on an auction site for sale:

If the auction bid is awarded, PeopleSoft Strategic Sourcing sends the customer information and asset sold proceeds to PeopleSoft Asset Management to initiate and complete the retirement transaction with proceeds from bid price.

PeopleSoft Asset Management retires the asset and creates the appropriate accounting entries for sale.

You run the AM BI Interface process to send the retirement sales transaction and billing information to Billing.

Note: You must collect customer information at the time of sale and send this information to PeopleSoft Billing with the retirement transactions, because assets can be purchased by an individual or entity not currently in the Customer Master table.

If the auction bid is not awarded, PeopleSoft Strategic Sourcing returns the asset to PeopleSoft Asset Management and changes the auction status to enable PeopleSoft Asset Management to realize any asset activity as a cost adjustment, transfer, or retirement.

PeopleSoft Asset Management interfaces with PeopleSoft Billing if you installed PeopleSoft Billing and if you:

Select the Billing Interface Processing option on the Asset Management Interface Options page, and set up a default billing business unit, bill type, bill source, and bill by identifier.

Select the Create Bill option on the Retire Assets page.

If PeopleSoft Asset Management interfaces with PeopleSoft Billing, PeopleSoft Asset Management sends the proceeds to the billing clearing account. PeopleSoft Asset Management sends to PeopleSoft Billing the proceeds clearing account to reflect both sides of the customer's debt. When PeopleSoft Billing receives the PeopleSoft Asset Management data, PeopleSoft Billing reverses the clearing account and generates the receivable account.

PeopleSoft Asset Management calculates an estimated VAT amount (if necessary), generates retirement and sales accounting entries, and posts the entries to PeopleSoft General Ledger. If PeopleSoft Asset Management interfaces with PeopleSoft Billing, you run the AM/BI Interface process to send the transactions to Billing to book the sale, create accounting entries, generate the invoice, and post the debt to PeopleSoft Receivables. If retirement is originated from PeopleSoft Strategic Sourcing, Asset Management does not send VAT information to Billing (Strategic Sourcing does not process VAT). If retirement is originated from Assets Management, Asset Management calculates VAT estimates only.

Note: PeopleSoft Asset Management VAT is estimated, and PeopleSoft Billing VAT is the actual calculated VAT taking customer and bill-by information into account.

If a country allows the Domestic Reverse Charge VAT treatment and the corresponding VAT Asset Class and Customer are set to 'Domestic Reverse Charge, the Domestic Reverse Charge Sales Code will be carried to PeopleSoft Billing along with the calculated Domestic Reverse Customer Amount.

See Understanding VAT.

To establish processing between PeopleSoft Asset Management and PeopleSoft Billing, you must select the Billing Interface Processing option from the Billing Interface group box on the AM Business Unit Definition page. This activates integration between the two applications and enables the Create Bill option on the Asset Management Retirement page. PeopleSoft Billing is the only billing interface that is supported by this feature.

When you activate the Billing interface, you must also enter values for the BI Unit, Bill Source, Bill Type, and Bill By Identifier fields. If Billing business units and other Billing information to complete the business unit definitions on this page have not yet been defined, you must do so before beginning transaction processing.

You must define the default book in the AM Business Unit Definition component. This is the default book for the AM/BI Interface. This should also be established as the primary book in your PeopleSoft General Ledger setup.

Also, establish the accounting entry template to be used in retirement transactions in which the asset is retired with the disposal code Retire w/Sale. You must designate the account for the Billing clearing account, Proceeds to Billing, in the accounting entry template. This maintains balanced accounting entries between PeopleSoft Asset Management and PeopleSoft Billing accounts.

PeopleSoft Asset Management and PeopleSoft Billing Business Unit Mapping

To accommodate interunit and noninterunit scenarios for PeopleSoft Asset Management asset retirement integration, the AM BI Interface process writes the BUSINESS_UNIT_AM and BUSINESS_UNIT_AMTO values to the INTFC_BI table, writes the BUSINESS_UNIT_AM value to the BI_HDR table, and writes the BUSINESS_UNIT_AMTO value to BI_LINE table. Writing these values to Billing tables enables you to track the entity retiring the assets, as well as the entity receiving the asset. Billing supports one General Ledger To business unit (BUSINESS_UNIT_TO) per invoice. Therefore, PeopleSoft Asset Management To business units must share the same corresponding PeopleSoft General Ledger business unit. Billing supports multiple Asset Management To business units at the line level, but each business unit to must be booked to the same General Ledger To business unit.

PeopleSoft Asset Management is not required to populate the INTFC_BI.INTERUNIT_FLG. If PeopleSoft Asset Management passes an interunit customer, the PeopleSoft Billing Interface populates this field with Y (yes).

The Billing Interface also populates the INTFC_BI.BUSINESS_UNIT_GL field, based on the billing business unit (INTFC_BI.business_unit) that Asset Management passes.

If the Billing Interface is creating an interunit bill (INTFC_BI.InterUnit_flg = Y), it populates the INTFC_BI.BUSINESS_UNIT_TO field (when Asset Management passes no value) with the BUSINESS_UNIT_GL value, which the interface obtains from the CUST_OPTION table, based on the customer ID. If the Billing Interface is not able to determine a value for the INTFC_BI.BUSINESS_UNIT_TO field using customer defaulting, it stops the transaction and marks it in error.