(AUS) Using PeopleSoft Asset Management Options to Meet Australian Requirements

This topic discusses how to use PeopleSoft Asset Management Options to meet Australian requirements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BU_AGG_RD |

Calculate research and development tax deductions for R&D plant assets. |

|

|

Asset Profile Page |

PROFILE_DEFN |

Define asset profiles. |

|

ASSET_GENERAL_01 |

Add asset basic information manually, or add or change existing asset information. Also access the Set R&D Info page. |

|

|

ASSET_ENTRY_00 |

Enter information about how this asset will be capitalized. Also access the Set R and D Info page. |

|

|

ASSET_RD_SP |

Enter information about R&D assets. For Australian customers, use this page for tax reporting purposes. For others, this page is informational only. |

|

|

Tax Information Page |

ASSET_ENTRY_02 |

Specify property type and tax depreciation criteria to identify which investment credits are taken for the current asset. If the fields on this page are unavailable, you are working with a book that was not set up as a tax book. |

|

RD Deductions - AUS (research and development deductions - Australia) |

RUN_AMTX10AU |

Run a report to view the number of R&D concessions that can be claimed. |

|

Tax Credits - AUS |

RUN_AMTX20AU |

Run the Tax Credit Allowance Structured Query Report (SQR) to produce a report of total tax credits by business units. |

|

Australia CCP Report (Australia changes in creditable purpose report) |

RUN_AMTX30AU |

Report the apportionment of recoverable versus nonrecoverable VAT on invoices. |

Enable R&D calculations and define assets as R&D eligible assets from the following pages:

Asset Unit Aggregate RD page.

Asset Profiles - Definition page.

Set R and D Info page.

Asset Unit Aggregate Research and Development – Australia Page

Use the Asset Unit Aggregate RD - AUS (asset unit aggregate research and development - Australia) page (BU_AGG_RD) to calculate research and development tax deductions for R&D plant assets.

Navigation:

To calculate the amount of deductions that it is possible to claim, enter the aggregate R&D amount for each fiscal year. Enter the fiscal year, expenditure, and description for the business unit.

Asset Profile Page

Use the Asset Profile page (PROFILE_DEFN) to define asset profiles.

Navigation:

Asset profiles that are defined with R&D options that are selected indicate that all assets that are added to your system by using this profile are used for R&D and are entitled to R&D tax concessions.

Field or Control |

Description |

|---|---|

R and D Plant Asset (research and development plant asset) |

Select if this asset is used for R&D and is entitled to R&D tax concessions. |

R and D Start Date (research and development start date) |

Enter the date on which the asset was first used exclusively for R&D. If you leave this field blank, the in-service date from the business unit's tax book is used as the start date. The start date determines the first year in which you can claim R&D concessions. |

Use NBV for R and D (use net book value for research and development) |

Select if you want to base the R&D concessions calculation on the net book value of the asset (at the R&D start date) instead of the book cost. This is useful when an asset previously being depreciated as a non-R&D asset subsequently becomes eligible for R&D concessions. |

Asset R&D Information Page

Use the Asset R&D Information (asset research and development information) page (ASSET_RD_SP) to enter information about R&D assets.

For Australian customers, use this page for tax reporting purposes. For others, this page is informational only.

Navigation:

Click the Set R and D Info link from the General Information page or from the Asset Additional Information section on the Cost/Asset Information page in ExpressAdd.

Field or Control |

Description |

|---|---|

R and D Plant (research and development plant) |

Select if you want to identify the asset as specifically allocated for R&D. |

R and D Start Date (research and development start date) |

Enter the R&D start date for this asset. |

Use NBV (use net book value) |

Select if appropriate for your tax reporting purposes. Click the OK button to return to the Asset Information or Cost/Asset Information page. |

Australia tax law provides certain tax credit allowances related to capital investment projects that include provisions for rebates (often referred to as credits). Unlike allowable deductions, the tax credits are not part of the calculation of taxable income.

The tax credit allowance is calculated in this way:

To use this feature:

Set up your own credit tables or modify the existing tables on the Tax Credits page.

Assign a status to the defined tax credits.

The status enables you to classify assets when reporting credits. Use the Tax Credit Status page to enter or modify a tax credit status.

Enter tax credits against assets.

Use the Asset Profiles, Asset Book Definition, or Asset ExpressAdd component.

See Defining Tax Credits.

Entering Tax Credits Against an Asset

Tax credits are entered against an asset in the Asset Book Definition or Asset ExpressAdd component, or at the asset profile level by using the Asset Profile Tax Credits page. You can enter tax credits against leased assets by using the Asset Book Definition page after the asset has been entered through Leased Asset Entry.

Entering Tax Credits in the Asset Book Definition Component

The Tax Credit Options region on the Tax page (PROFILE_BK_03) of the Asset Profiles component provides you with the options to identify which investment credits are taken for a selected asset. You must specify the tax criteria before you can enter tax credits.

After you enter the tax credit code, PeopleSoft Asset Management retrieves the percentage figures that are specified for the tax credit and calculates the computation amount using the following formula:

The sum of all tax credits that are defined in the current book appears in the Tax Credit field. The total tax credit amount is updated each time that you change tax credit information.

Entering Tax Credits in the Asset ExpressAdd Component

The Asset ExpressAdd component enables you to identify which investment credits are taken for a selected asset from the Tax Credit Options region on the Tax Information page (ASSET_ENTRY_02). You must specify the tax criteria before you can enter tax credits.

Access the Tax Credit Options group box on the Tax Information page.

Enter the tax credit code. You can optionally enter a tax credit status.

After you enter the tax credit code, PeopleSoft Asset Management retrieves the percentage figures that are specified for the tax credit and calculates the computation amount by using the following formula:

The sum of all tax credits that are defined in the current book appears in the Tax Credit field. The total tax credit amount is updated each time that you change tax credit information.

If you change the cost information on the Cost/Asset Information page of the Asset ExpressAdd component after you have entered tax credits, click the Calculate Credit button to recalculate the amount of the credits. This reloads the percentage figures from the Tax Credit table and then recalculates the amounts for all tax credits that are defined for the current asset.

Australian financial services organizations are required to track the usage of fixed assets that are used in making input tax supply. Input tax that is not creditable is capitalized in the value of the asset and depreciated accordingly. Creditable tax is eligible for refund and is not included in the value of the asset. Because a single asset can be used by a business entity in multiple activities, some of which may be taxable or GST-free and some of which may be input taxed, the full amount of GST that is paid must be recorded and apportioned creditable and noncreditable based upon usage. Over the life of an asset, this apportionment must be reviewed annually and adjusted to reflect the asset's current usage. The time period during which an asset is subject to this review is determined by the cost of the asset. Review periods are maintained in the Asset Threshold-VAT table referenced when assigning the last date of mandatory review.

Recording GST in Payables and Passing GST on to Asset Management

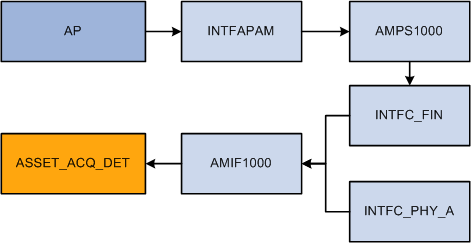

To track the apportionment of GST that is relevant to an asset, four fields are passed to Asset Management from Payables using the Run Load Assets process (INTFAPAM):

Asset ID

Merchandise Amount

Non Recoverable VAT

Total VAT

Payables validates the information that you entered on the invoice before passing it to Asset Management.

Note: The invoice information must be validated in PeopleSoft Payables before it is passed to PeopleSoft Asset Management. Invoice information cannot be rejected once it has reached PeopleSoft Asset Management.

This diagram illustrates the interface process:

PeopleSoft Payables to PeopleSoft Asset Management GST process

Adding GST Online in Asset Management

You can enter GST information directly into Asset Management when entering an asset online through the Asset Basic Information component. Use the Tax link on the Asset Acquisition Detail page to enter tax amounts that are charged to the asset.

Changes in CCP are recorded on the same page that you use to enter an asset's GST amounts manually and to designate recoverable and nonrecoverable amounts. When changing the usage percentage of an existing asset, select the transaction type Adjustment rather than Addition; otherwise, the entry process is the same.

When working in a business unit that is identified for Australia, the Calculate Last Date of Review button appears on the Asset Information page. Select a schedule type code, and click the Calculate Last Date of Review button to generate the last date of mandatory review for the asset. The last date of mandatory review is stored on the Asset Basic Information page.

Some organizations must track fixed assets that are used in making input tax supply. You can track the change in the extent to which a fixed asset is used to make taxable supply from reporting period to reporting period, and you can make adjustments for any change. For instance, in Australia, Australian financial services organizations require a solution to record the apportionment of recoverable versus nonrecoverable VAT on invoices. This information is then sent to PeopleSoft Asset Management for capital assets.

Use the Australia CCP Report (Australia changes in creditable purpose report) page (RUN_AMTX30AU) to report the apportionment of recoverable versus nonrecoverable VAT on invoices.

Navigation:

CGT legislation in Australia requires payment of tax on certain capital gains that are realized at the time of an asset's sale, net of inflation, of all components of the cost basis. Tax deductions can also be realized in certain circumstances for losses. PeopleSoft Asset Management provides pages on which you designate the applicability of a gain or loss calculation for specific assets or for all of the assets in a book. When an asset on which gain or loss has been designated as applicable is retired, the system calculates the gain or loss and stores the results for later reporting. The gain or loss calculation is split into an assessable gain or loss and a capital gain or loss amount.

Specifying Capital Gain or Loss Options for an Asset

There are multiple components where you can indicate that an asset is CGT-applicable if you want the capital gain or loss calculated for an asset upon retirement:

Asset Book Definition - Book Tax page (if the CGT calculation is applicable for assets on a book level).

Asset Profile.

ExpressAdd.

To be prompted to identify an asset as CGT-applicable, you must associate the book for the asset with the country (Australia) on the Asset Book Definition page.

If CGT is applicable for this asset, select the CGT Applicable check box on any of these pages.

Run the Australian Retirements reports to view the results of CGT-applicable assets. Use these calculations:

These calculations use existing indexing tables containing local consumer price indexes (CPI). A logical extension of this calculation is to determine the actual amount of tax to be paid, or in the case of a loss, the tax credit that you can later net against a future capital gain.

Here are the elements that are used in the calculation of a capital gain or capital loss on the disposal of an asset:

The cost base of the asset, which is used to determine the amount of a capital gain if the disposal of the asset occurs within 12 months of the taxpayer's acquisition of the asset.

The indexed cost base of the asset, which is used to calculate the amount of a capital gain if the taxpayer disposes of the asset 12 months or more after the date of its acquisition.

The reduced cost base of the asset, which is used to calculate the amount of a capital loss that arises on the disposal of the asset.

Using the Asset Retirements page, you can view the CGT that is calculated upon retirement for each asset by book.

The Retirement reports also contain CGT information.

In compliance with accounting standards, many companies must carry assets at fair value. As a result, frequent revaluation of assets may be necessary, depending on requirements. PeopleSoft Asset Management supports asset revaluations in accordance with Australian accounting standards, which require crediting to related asset accounts a balance of accumulated depreciation at the date on which an asset is revalued.

Steps to Generate Asset Revaluation (Net Method)

To process asset revaluations per Australian accounting standards:

Select the Net Method option on the Accounting Entry Template IDs page.

To prevent the generation of Provision for Revaluation Contra (RC) accounting lines as a result of revaluation—accounting lines which are invalid for Australian net method revaluation purposes—use the Net Method option on the Accounting Entry Template IDs page.

(Optional) If necessary to your business process, you can use the Revaluation Worksheet page to revalue an asset downwards (per the Australian Accounting Standard AASB 116), so that fair market value is less than net book value.

Run Revaluation en Masse (AMAUSCAL):

Select the net method as the revaluation method, define the run control parameters and click the Run button on the Process request page.

If you select the Include Current Period Depr (include current period depreciation) option, the process includes the depreciation in the revaluation accounting entries.

Select the Australian Revaluation check box.

The process updates the Financial Loader table (PS_INTFC_FIN) with four rows for each asset included in the process request: one for retirement (RET) with the total cost, one for reinstatement (REI) with the total cost, one for an adjustment (ADJ) reflecting the difference between the original cost and the cost calculated with revaluation parameters, and one for book change (BKS).

(Optional) Preview the data in the Asset Management loader table (INTFC_FIN).

Run the Load Transactions into AM process (AMIF1000) to load the RET, REI, ADJ, and BKS transactions that are created by the revaluation.

Note: Unlike previous methods for generating asset revaluation, you only need to run the Load Transactions into AM process once.

Use the Depreciation Calculation page (RUN_AMDPCALC) to run the Depreciation Calculation process (AM_DEPR_CALC).

Run the Accounting Entry Creation process (AM_AMAEDIST) to generate the appropriate accounting entries.

Run the Detail Net Book Value Report by Category (AMDP2110).